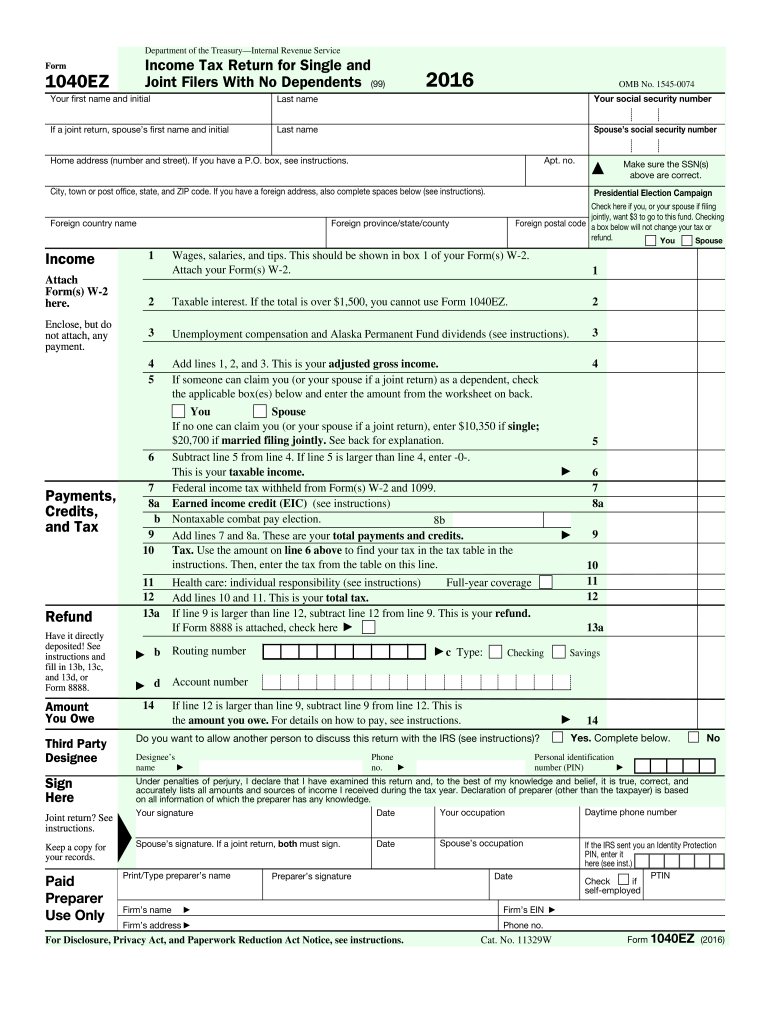

1040ez Forms 2016

What is the 1040EZ Form?

The 1040EZ Form is a simplified version of the standard IRS Form 1040, designed for taxpayers with straightforward tax situations. This form is specifically intended for individuals who meet certain criteria, such as having a taxable income below a specified limit, claiming no dependents, and taking the standard deduction. The 1040EZ Form streamlines the filing process, making it easier for eligible taxpayers to report their income and calculate their tax liability. It is primarily used by single or married individuals filing jointly who do not have complex tax situations, such as itemized deductions or certain types of income.

How to Use the 1040EZ Form

Using the 1040EZ Form involves several straightforward steps. First, ensure that you meet the eligibility criteria, which include being under the income threshold and having no dependents. Next, gather all necessary documentation, such as W-2 forms from employers and any other income statements. Fill out the form by entering personal information, income details, and calculating your tax owed or refund due. After completing the form, review it for accuracy before submitting it to the IRS. You can file the 1040EZ electronically or by mailing a paper copy, depending on your preference.

Steps to Complete the 1040EZ Form

Completing the 1040EZ Form involves a series of clear steps:

- Gather all required documents, including W-2 forms and any other income information.

- Enter your personal information, such as your name, address, and Social Security number.

- Report your total income, including wages and interest.

- Calculate your adjusted gross income and determine your tax liability using the provided tax tables.

- Indicate whether you are owed a refund or if you owe additional taxes.

- Sign and date the form before submitting it.

Legal Use of the 1040EZ Form

The 1040EZ Form is legally recognized by the IRS for filing income taxes. To ensure its legal validity, it must be completed accurately and submitted by the designated deadline. Taxpayers must also adhere to all IRS guidelines regarding eligibility and income reporting. Failure to comply with these regulations can result in penalties or audits. Using an electronic signature through a trusted platform can further enhance the form's legal standing, ensuring that all necessary signatures and certifications are properly documented.

Filing Deadlines / Important Dates

Filing deadlines for the 1040EZ Form align with the standard tax filing schedule. Typically, the deadline for submitting your tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers seeking an extension can file Form 4868 to request additional time, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the 1040EZ Form, specific documents are required. These include:

- W-2 forms from all employers.

- Any 1099 forms for additional income.

- Records of any interest income.

- Social Security numbers for yourself and your spouse, if applicable.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete 1040ez 2016 forms

Effortlessly Prepare 1040ez Forms on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can access the right format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without delays. Manage 1040ez Forms on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to Modify and Electrically Sign 1040ez Forms with Ease

- Find 1040ez Forms and then click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all information and then click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign 1040ez Forms while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040ez 2016 forms

Create this form in 5 minutes!

How to create an eSignature for the 1040ez 2016 forms

How to create an electronic signature for the 1040ez 2016 Forms in the online mode

How to generate an electronic signature for the 1040ez 2016 Forms in Google Chrome

How to make an electronic signature for putting it on the 1040ez 2016 Forms in Gmail

How to create an eSignature for the 1040ez 2016 Forms straight from your smartphone

How to make an electronic signature for the 1040ez 2016 Forms on iOS

How to generate an eSignature for the 1040ez 2016 Forms on Android

People also ask

-

What are 1040ez Forms and who should use them?

1040ez Forms are simplified tax forms designed for individuals with straightforward tax situations, such as single filers or married couples without dependents. If your income is below a certain threshold and you take the standard deduction, using the 1040ez Forms can streamline your tax filing process.

-

How can airSlate SignNow help with 1040ez Forms?

airSlate SignNow provides an efficient platform for electronically signing and sending 1040ez Forms. Our user-friendly interface ensures that you can quickly complete and submit your tax forms securely, saving you time and reducing the hassle associated with traditional paper filing.

-

What features does airSlate SignNow offer for managing 1040ez Forms?

With airSlate SignNow, you can effortlessly eSign, store, and manage your 1040ez Forms all in one place. Our platform includes features like customizable templates, document tracking, and secure storage, making it easier than ever to handle your tax documents.

-

Are there any costs associated with using airSlate SignNow for 1040ez Forms?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses looking to manage 1040ez Forms. You can choose a plan that fits your budget while enjoying the benefits of our powerful eSignature tools.

-

Can I integrate airSlate SignNow with my accounting software for 1040ez Forms?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and tax software, allowing you to easily manage and eSign your 1040ez Forms within your existing workflow. This integration enhances efficiency and helps keep your documents organized.

-

What security measures does airSlate SignNow implement for 1040ez Forms?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols and secure cloud storage to protect your 1040ez Forms and sensitive information, ensuring that your documents are safe and accessible only to authorized users.

-

How do I get started with airSlate SignNow for my 1040ez Forms?

Getting started with airSlate SignNow is simple! Sign up for an account, and you can begin uploading and eSigning your 1040ez Forms immediately. Our easy-to-follow guides and customer support are available to assist you throughout the process.

Get more for 1040ez Forms

- Power of attorney form utah

- Michigan certificate that no foreclosure proceedings have been commenced individual form

- Montana residential rental lease agreement form

- Last will texas form

- Texas quitclaim deed for two individuals to individual form

- Massachusetts certificate of formation for domestic limited liability company llc

- Understanding the executors deed form

- Notice to owner georgia form

Find out other 1040ez Forms

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile