1040ez Tax Form 2008

What is the 1040ez Tax Form

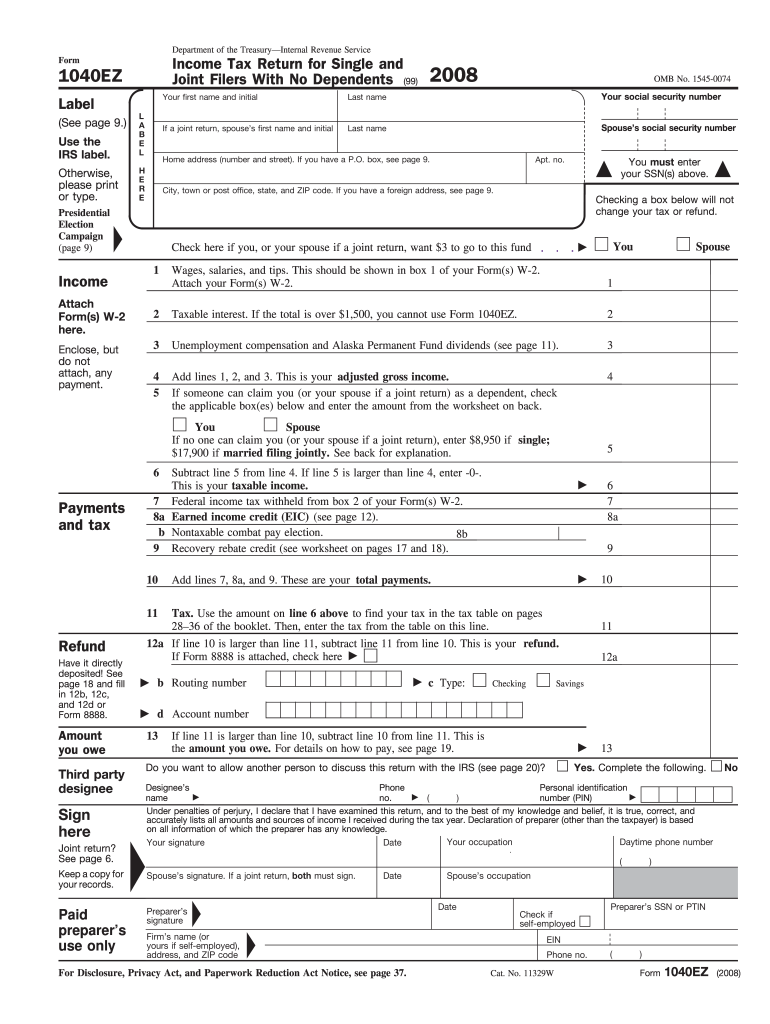

The 1040ez Tax Form is a simplified version of the standard IRS Form 1040, designed for taxpayers with straightforward financial situations. This form is primarily used by individuals who are filing their taxes and meet specific criteria, such as having a taxable income below a certain threshold, claiming no dependents, and not itemizing deductions. The 1040ez allows for a quicker and easier filing process, making it an ideal choice for many taxpayers.

How to use the 1040ez Tax Form

Using the 1040ez Tax Form involves a few straightforward steps. First, gather all necessary financial documents, including W-2 forms and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your total income and any applicable tax credits. Finally, review the completed form for accuracy before submitting it to the IRS. The 1040ez can be filed electronically or by mail, depending on your preference.

Steps to complete the 1040ez Tax Form

Completing the 1040ez Tax Form involves several key steps:

- Gather all necessary documents, including W-2s and other income statements.

- Provide your personal information, such as name, address, and Social Security number.

- Enter your total income from all sources.

- Claim any applicable tax credits that you qualify for.

- Calculate your total tax owed or refund due.

- Sign and date the form before submitting it to the IRS.

Legal use of the 1040ez Tax Form

The 1040ez Tax Form is legally binding when completed accurately and submitted in compliance with IRS regulations. To ensure its legal validity, taxpayers must provide truthful information and sign the form. Electronic submissions are accepted, provided they meet the requirements set forth by the IRS. It is essential to keep a copy of the submitted form and any supporting documents for your records, as they may be needed for future reference or audits.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when filing the 1040ez Tax Form. Typically, the deadline for filing individual tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should consider any extensions available if they need more time to complete their filings. Staying informed about these dates helps avoid penalties and ensures compliance with tax obligations.

Eligibility Criteria

To qualify for using the 1040ez Tax Form, taxpayers must meet specific eligibility criteria. These include:

- Filing as single or married filing jointly.

- Having a taxable income below a specified limit.

- Claiming no dependents.

- Not itemizing deductions.

- Being under age sixty-five.

Meeting these criteria allows individuals to take advantage of the simplified filing process offered by the 1040ez.

Quick guide on how to complete 2008 1040ez tax form

Effortlessly Prepare 1040ez Tax Form on Any Device

Managing documents online has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and electronically sign your documents without any hiccups. Handle 1040ez Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric operations today.

How to Modify and Electronically Sign 1040ez Tax Form with Ease

- Obtain 1040ez Tax Form and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or redact confidential information using the specific tools that airSlate SignNow offers for this purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misdirected documents, tedious form searches, or mistakes requiring new document prints. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign 1040ez Tax Form to ensure clear communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 1040ez tax form

Create this form in 5 minutes!

How to create an eSignature for the 2008 1040ez tax form

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the 1040ez Tax Form and who should use it?

The 1040ez Tax Form is a simplified income tax return designed for individuals with uncomplicated tax situations. It's ideal for single or joint filers with no dependents, and whose taxable income is below certain limits. If you qualify, using the 1040ez Tax Form can streamline your filing process.

-

How can airSlate SignNow assist with the 1040ez Tax Form?

airSlate SignNow provides a user-friendly platform for electronically signing and managing your 1040ez Tax Form. With our easy-to-use features, you can prepare your tax documents and eSign them securely, ensuring you meet your tax deadlines without hassle.

-

Are there any costs associated with using airSlate SignNow for the 1040ez Tax Form?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our cost-effective solutions allow you to manage your 1040ez Tax Form and other documents without breaking the bank, providing you with value for your investment.

-

What features does airSlate SignNow offer for managing tax forms like the 1040ez?

airSlate SignNow includes features like customizable templates, secure eSigning, and document storage, making it easy to handle your 1040ez Tax Form. Our platform also offers real-time tracking and reminders, ensuring you stay organized and on schedule.

-

Can I integrate airSlate SignNow with other tax preparation software for my 1040ez Tax Form?

Absolutely! airSlate SignNow seamlessly integrates with various tax preparation software, enhancing your experience when filing your 1040ez Tax Form. By integrating our solution, you can streamline your workflow and ensure all your documents are synchronized.

-

What are the benefits of eSigning my 1040ez Tax Form with airSlate SignNow?

Using airSlate SignNow to eSign your 1040ez Tax Form provides numerous benefits. You gain the convenience of signing documents from anywhere, faster processing times, and enhanced security features, ensuring your sensitive information is protected.

-

Is customer support available for help with the 1040ez Tax Form?

Yes, airSlate SignNow offers dedicated customer support to assist you with any questions related to your 1040ez Tax Form. Our knowledgeable team is available through various channels to provide guidance and support throughout your document management journey.

Get more for 1040ez Tax Form

- Property tax forms home comptrollertexasgov

- Register your business nm taxation and revenue department form

- Individual e file declaration for electronic filing form va 8453

- Commissioner of the revenuehanover county va form

- Form st 9 virginia retail sales and use tax form st 9 virginia retail sales and use tax

- N 20 11 prepaid sales tax rate change for cigarettes form

- Subdomains of s3amazonawscom are untrusted in firefox 360 form

- Tenants personal and credi t i nformati on

Find out other 1040ez Tax Form

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online