1040ez Tax Form 2008

What is the 1040ez Tax Form

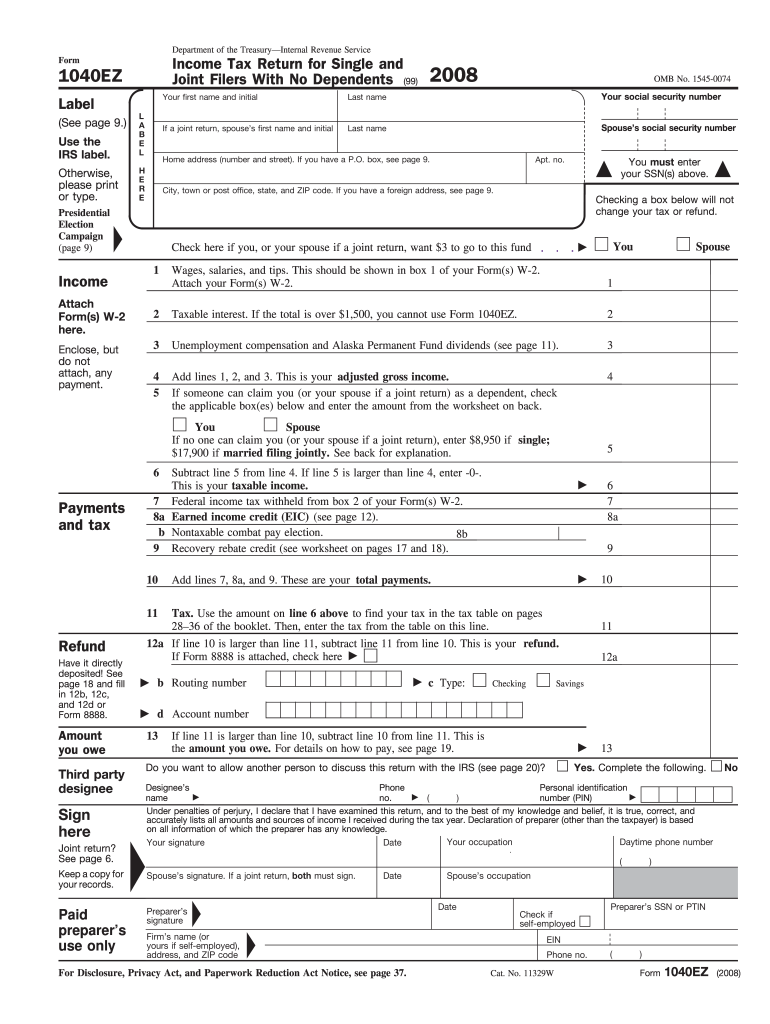

The 1040ez Tax Form is a simplified version of the standard IRS Form 1040, designed for taxpayers with straightforward financial situations. This form is primarily used by individuals who are filing their taxes and meet specific criteria, such as having a taxable income below a certain threshold, claiming no dependents, and not itemizing deductions. The 1040ez allows for a quicker and easier filing process, making it an ideal choice for many taxpayers.

How to use the 1040ez Tax Form

Using the 1040ez Tax Form involves a few straightforward steps. First, gather all necessary financial documents, including W-2 forms and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your total income and any applicable tax credits. Finally, review the completed form for accuracy before submitting it to the IRS. The 1040ez can be filed electronically or by mail, depending on your preference.

Steps to complete the 1040ez Tax Form

Completing the 1040ez Tax Form involves several key steps:

- Gather all necessary documents, including W-2s and other income statements.

- Provide your personal information, such as name, address, and Social Security number.

- Enter your total income from all sources.

- Claim any applicable tax credits that you qualify for.

- Calculate your total tax owed or refund due.

- Sign and date the form before submitting it to the IRS.

Legal use of the 1040ez Tax Form

The 1040ez Tax Form is legally binding when completed accurately and submitted in compliance with IRS regulations. To ensure its legal validity, taxpayers must provide truthful information and sign the form. Electronic submissions are accepted, provided they meet the requirements set forth by the IRS. It is essential to keep a copy of the submitted form and any supporting documents for your records, as they may be needed for future reference or audits.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when filing the 1040ez Tax Form. Typically, the deadline for filing individual tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should consider any extensions available if they need more time to complete their filings. Staying informed about these dates helps avoid penalties and ensures compliance with tax obligations.

Eligibility Criteria

To qualify for using the 1040ez Tax Form, taxpayers must meet specific eligibility criteria. These include:

- Filing as single or married filing jointly.

- Having a taxable income below a specified limit.

- Claiming no dependents.

- Not itemizing deductions.

- Being under age sixty-five.

Meeting these criteria allows individuals to take advantage of the simplified filing process offered by the 1040ez.

Quick guide on how to complete 2008 1040ez tax form

Effortlessly Prepare 1040ez Tax Form on Any Device

Managing documents online has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and electronically sign your documents without any hiccups. Handle 1040ez Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric operations today.

How to Modify and Electronically Sign 1040ez Tax Form with Ease

- Obtain 1040ez Tax Form and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or redact confidential information using the specific tools that airSlate SignNow offers for this purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misdirected documents, tedious form searches, or mistakes requiring new document prints. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign 1040ez Tax Form to ensure clear communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 1040ez tax form

Create this form in 5 minutes!

How to create an eSignature for the 2008 1040ez tax form

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the 1040ez Tax Form and who can use it?

The 1040ez Tax Form is a simplified tax return option designed for individuals with straightforward tax situations. It is beneficial for single filers or married couples with no dependents, allowing for quicker processing and easier preparation.

-

How does airSlate SignNow help with the 1040ez Tax Form?

AirSlate SignNow offers a seamless eSigning solution for the 1040ez Tax Form, enabling users to sign and send documents securely. This streamlines the filing process, ensuring quick turnaround and reducing the hassle typically associated with tax submissions.

-

What are the costs associated with using airSlate SignNow for the 1040ez Tax Form?

AirSlate SignNow provides a cost-effective solution for handling the 1040ez Tax Form with flexible pricing plans. Whether you are an individual or a business, you can choose a plan that suits your needs, ensuring you get the most value for your investment.

-

Can I integrate airSlate SignNow with other tax software for filing the 1040ez Tax Form?

Yes, airSlate SignNow can be integrated with a variety of tax software solutions, facilitating an efficient workflow when filing the 1040ez Tax Form. This allows users to leverage their preferred tools and maintain consistency in their tax preparation processes.

-

What features does airSlate SignNow offer for efficiently completing the 1040ez Tax Form?

AirSlate SignNow boasts features like template creation, advanced security, and real-time tracking to enhance the process of completing the 1040ez Tax Form. These tools ensure users can manage their documents easily, reducing time spent on paperwork.

-

Is it easy to collaborate with others when filling out the 1040ez Tax Form using airSlate SignNow?

Absolutely! AirSlate SignNow enables easy collaboration with team members or tax professionals while filling out the 1040ez Tax Form. Users can share documents for review and annotation, making teamwork more efficient and effective.

-

What are the advantages of using airSlate SignNow over traditional methods for the 1040ez Tax Form?

Using airSlate SignNow for the 1040ez Tax Form offers convenience, speed, and enhanced security compared to traditional methods. It eliminates the need for physical paperwork, allowing users to complete and sign documents from anywhere at any time.

Get more for 1040ez Tax Form

- Professional references form

- Appointment of short term guardian by a parent form

- Killearn kloverleaf ad reservation form to place an ad fax this completed form to kha at 850 6680530 email printready ad or ad

- Aeon credit application form

- Waec ghana form

- Tax residency certificate form

- Certificat de vie pdf form

- Rx order check list fax cover sheet form

Find out other 1040ez Tax Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors