1040ez Form 2012

What is the 1040EZ Form

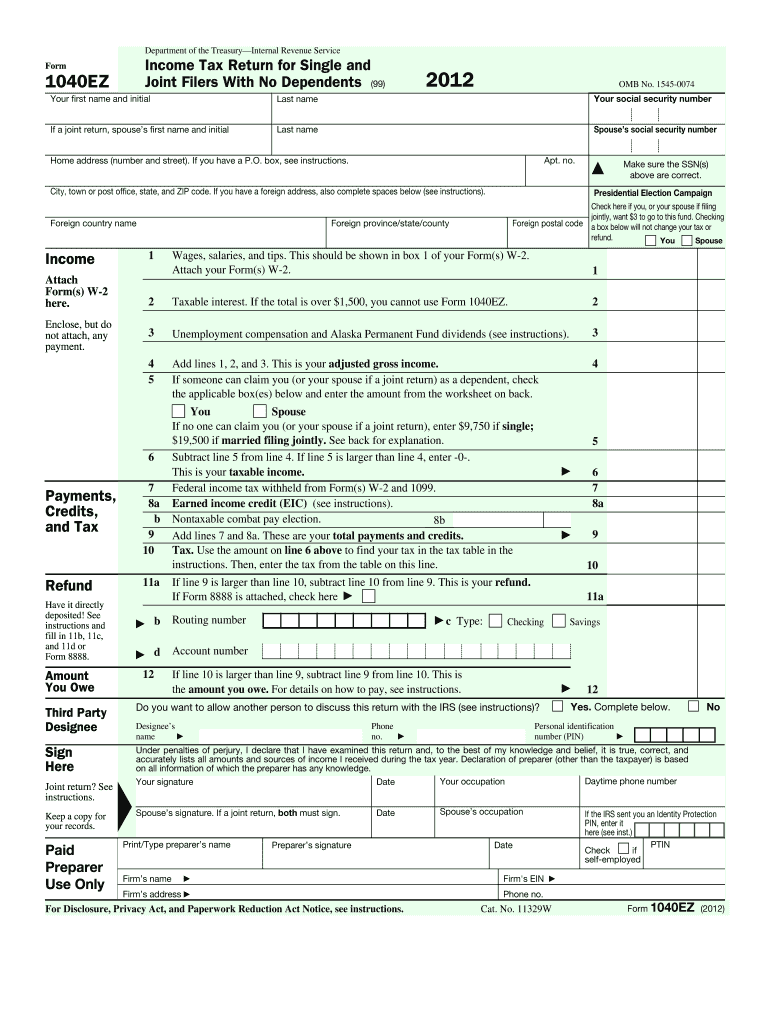

The 1040EZ Form is a simplified tax return form used by individuals in the United States to file their federal income tax. It is designed for taxpayers with straightforward financial situations, allowing for a quicker and more efficient filing process. The form is primarily intended for single or married taxpayers filing jointly, who do not claim dependents and have a taxable income below a specified threshold. The 1040EZ Form streamlines the reporting of income, tax deductions, and credits, making it accessible for those who may not have extensive experience with tax filings.

How to use the 1040EZ Form

Using the 1040EZ Form involves several straightforward steps. First, gather all necessary documents, including your W-2 forms from employers and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your income, which may include wages, salaries, and tips, and calculate your total taxable income. After determining your tax liability, you can claim any applicable credits. Finally, review your completed form for accuracy before submitting it to the IRS.

Steps to complete the 1040EZ Form

Completing the 1040EZ Form requires careful attention to detail. Follow these steps for accurate filing:

- Collect all relevant income documents, such as W-2 forms.

- Enter your personal information, ensuring all details are correct.

- Report your total income from all sources.

- Calculate your adjusted gross income, if applicable.

- Determine your tax liability using the tax tables provided by the IRS.

- Claim any eligible tax credits to reduce your tax owed.

- Sign and date the form before submission.

Legal use of the 1040EZ Form

The 1040EZ Form is legally recognized for filing federal income tax returns in the United States. To ensure compliance, taxpayers must meet specific eligibility criteria, including income limits and filing status. The form must be completed accurately and submitted by the IRS deadline to avoid penalties. Additionally, electronic filing of the 1040EZ is permitted, provided that the eSignature requirements are met, making it a legally binding document when filed electronically.

Filing Deadlines / Important Dates

Filing deadlines for the 1040EZ Form typically align with the annual tax season. Generally, the deadline for submitting your tax return is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to tax deadlines, as the IRS may announce extensions or adjustments based on specific circumstances, such as natural disasters or public health emergencies.

Required Documents

To successfully complete the 1040EZ Form, certain documents are necessary. These include:

- W-2 forms from employers detailing your annual earnings.

- Any 1099 forms for additional income sources.

- Records of any tax credits you plan to claim.

- Identification information, such as your Social Security number.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting your income and tax obligations.

Quick guide on how to complete 2012 1040ez form

Complete 1040ez Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files swiftly without any hold-ups. Handle 1040ez Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign 1040ez Form effortlessly

- Locate 1040ez Form and click on Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Accentuate signNow sections of your documents or conceal sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign 1040ez Form to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 1040ez form

Create this form in 5 minutes!

How to create an eSignature for the 2012 1040ez form

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the 1040ez Form and who should use it?

The 1040ez Form is a simplified tax return form for individuals with straightforward tax situations. It's specifically designed for taxpayers who are single or married filing jointly, have no dependents, and earn a taxable income under $100,000. If you qualify, the 1040ez Form can help streamline your tax filing process.

-

How can airSlate SignNow help with the 1040ez Form?

With airSlate SignNow, you can easily eSign and send your 1040ez Form electronically, ensuring a quick and hassle-free submission process. Our platform allows you to securely handle your tax documents, making it convenient to track and manage your filings. Plus, you can access your forms anytime, anywhere.

-

Is there a cost associated with using airSlate SignNow for the 1040ez Form?

Yes, airSlate SignNow offers a range of pricing plans to suit different needs, including options for individuals and businesses. Our cost-effective solution ensures that you can eSign your 1040ez Form without breaking the bank. You can choose a plan that fits your budget while enjoying all the features we offer.

-

What features does airSlate SignNow provide for handling the 1040ez Form?

airSlate SignNow provides a user-friendly interface, secure eSignature capabilities, and document tracking features perfectly suited for the 1040ez Form. You can also customize templates and set up reminders to ensure timely submissions. These features make managing your tax documents more efficient.

-

Can I integrate airSlate SignNow with other applications when filing my 1040ez Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including cloud storage services and accounting software, which can be beneficial for managing your 1040ez Form. This allows you to streamline your workflow and maintain all your tax documents in one place.

-

How secure is the information I provide on the 1040ez Form with airSlate SignNow?

We prioritize your security at airSlate SignNow. All documents, including your 1040ez Form, are encrypted and stored securely, ensuring your personal information is protected throughout the signing process. You can trust that your data is safe with us.

-

What benefits does eSigning the 1040ez Form offer?

eSigning the 1040ez Form with airSlate SignNow offers numerous benefits, including speed, convenience, and enhanced security. You can sign and submit your form from anywhere, reducing the time spent on paperwork. Additionally, eSigning eliminates the risk of lost documents, ensuring your tax return is filed accurately and on time.

Get more for 1040ez Form

Find out other 1040ez Form

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure