Massachusetts 355 2020

What is the Massachusetts 355?

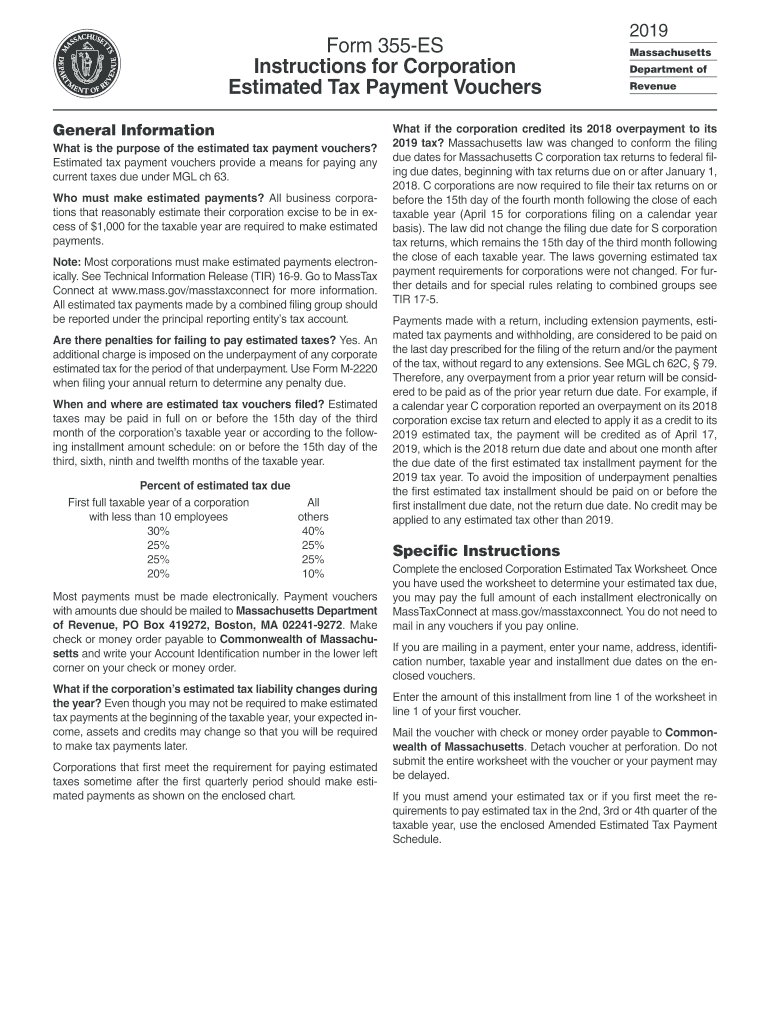

The Massachusetts 355 form, commonly referred to as the Massachusetts Estimated Tax Form, is utilized by individuals and businesses to report and pay estimated taxes for the tax year. This form is essential for taxpayers who expect to owe tax of $400 or more when filing their annual tax return. It helps ensure that taxpayers meet their tax obligations throughout the year, rather than facing a large tax bill at the end of the year.

Steps to complete the Massachusetts 355

Completing the Massachusetts 355 form involves several key steps:

- Gather necessary information: Collect your income details, deductions, and credits that will affect your estimated tax calculation.

- Calculate your estimated tax: Use the provided worksheets to determine your expected tax liability for the year. This includes accounting for any tax credits and deductions.

- Fill out the form: Enter your calculated estimates into the appropriate sections of the Massachusetts 355 form.

- Review your entries: Double-check your calculations and personal information for accuracy.

- Submit the form: Choose your submission method, whether online, by mail, or in person, and ensure you meet the filing deadlines.

Legal use of the Massachusetts 355

The Massachusetts 355 form is legally binding when completed correctly and submitted on time. It must comply with state regulations regarding estimated tax payments. Failure to adhere to these regulations can result in penalties and interest on unpaid taxes. It's important to ensure that the form is filled out accurately and that payments are made according to the established schedule to avoid legal repercussions.

Filing Deadlines / Important Dates

Timely filing of the Massachusetts 355 form is crucial. The estimated tax payments are typically due on the following dates:

- April 15: First quarter payment

- June 15: Second quarter payment

- September 15: Third quarter payment

- January 15 of the following year: Fourth quarter payment

Taxpayers should also be aware of any changes in deadlines due to holidays or special circumstances that may affect the tax calendar.

Required Documents

To accurately complete the Massachusetts 355 form, taxpayers need several documents, including:

- Previous year's tax return for reference

- Current year income estimates

- Records of any deductions and credits

- Any other relevant financial documents that impact tax calculations

Having these documents ready will streamline the completion process and help ensure accurate reporting.

Form Submission Methods

Taxpayers have several options for submitting the Massachusetts 355 form:

- Online: Use the Massachusetts Department of Revenue's online portal for electronic submission.

- Mail: Send a printed copy of the form to the appropriate address provided by the state.

- In-Person: Deliver the form directly to a local tax office, if preferred.

Choosing the right submission method can help ensure that the form is processed efficiently and on time.

Quick guide on how to complete 2019 massachusetts 355

Effortlessly Prepare Massachusetts 355 on Any Device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Handle Massachusetts 355 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to Modify and eSign Massachusetts 355 with Ease

- Obtain Massachusetts 355 and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and eSign Massachusetts 355 while ensuring seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 massachusetts 355

Create this form in 5 minutes!

How to create an eSignature for the 2019 massachusetts 355

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What are the key features of airSlate SignNow relevant to MA estimated 2019?

AirSlate SignNow offers a range of features that cater to users who need efficient document signing solutions in line with MA estimated 2019 regulations. These features include customizable templates, real-time collaboration, and secure cloud storage, ensuring that you can manage your documents easily and compliantly.

-

How does airSlate SignNow handle pricing for businesses focusing on MA estimated 2019?

Our pricing structure is designed to be cost-effective for businesses looking to meet MA estimated 2019 requirements. We provide flexible plans that cater to different needs, making it easier for you to scale as your business grows without compromising on compliance and customer satisfaction.

-

Can airSlate SignNow integrate with other tools for MA estimated 2019 compliance?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, allowing businesses to streamline their processes while adhering to MA estimated 2019 guidelines. This ensures that you can manage your workflows efficiently, using tools you are already familiar with.

-

What benefits does airSlate SignNow offer for businesses focused on MA estimated 2019?

The primary benefits of using airSlate SignNow for MA estimated 2019 compliance include enhanced efficiency, improved security, and ease of use. Our platform empowers you to accelerate your document signing process while ensuring your operations are compliant with local regulations.

-

Is airSlate SignNow suitable for small businesses needing compliance with MA estimated 2019?

Absolutely! AirSlate SignNow is designed to be user-friendly and accessible for businesses of all sizes, including small enterprises concerned about MA estimated 2019 compliance. Our solution provides essential features without overwhelming users, ensuring that even small teams can work efficiently.

-

How secure is airSlate SignNow for managing documents related to MA estimated 2019?

Security is a top priority for airSlate SignNow, especially for documents pertaining to MA estimated 2019. We employ robust encryption methods and strict access controls, ensuring that your sensitive information remains protected at all times during the signing process.

-

What support is available if I have questions about MA estimated 2019 with airSlate SignNow?

AirSlate SignNow provides extensive customer support to assist with any queries related to MA estimated 2019. Our dedicated support team is available via live chat, email, or phone, ensuring you have the resources you need to achieve compliance without hassle.

Get more for Massachusetts 355

Find out other Massachusetts 355

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT