Schedule B Form 2016

What is the Schedule B Form

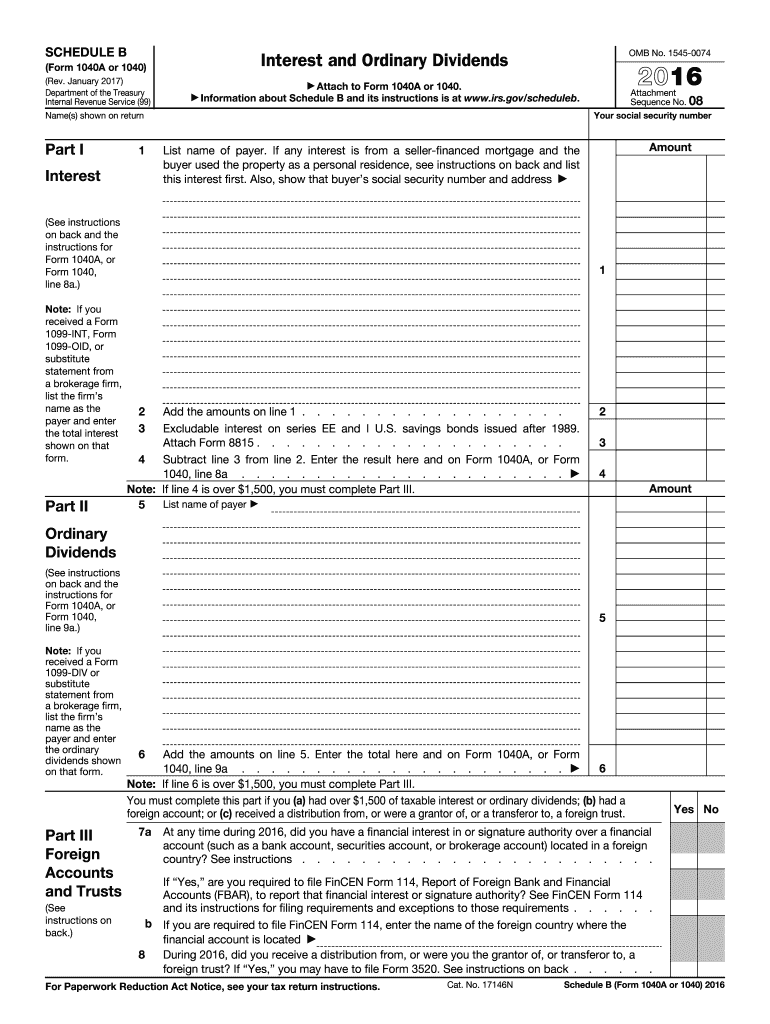

The Schedule B Form is a crucial tax document used by U.S. taxpayers to report interest and dividend income. It is typically filed alongside Form 1040, the individual income tax return. This form helps the Internal Revenue Service (IRS) assess an individual's income from various sources, ensuring that all earnings are accurately reported for tax purposes. The Schedule B Form specifically requires taxpayers to list all financial accounts that generate interest or dividends, along with the amounts earned during the tax year.

How to use the Schedule B Form

Using the Schedule B Form involves a few straightforward steps. First, gather all necessary financial documents that detail your interest and dividend income. Next, complete the form by entering the required information, including the names of financial institutions, account numbers, and the total amount of interest and dividends received. Ensure that you provide accurate figures to avoid any discrepancies. Once completed, attach the Schedule B Form to your Form 1040 when filing your taxes.

Steps to complete the Schedule B Form

Completing the Schedule B Form requires careful attention to detail. Follow these steps:

- Collect all relevant financial statements that show interest and dividend income.

- Fill out your personal information at the top of the form, including your name and Social Security number.

- List each source of interest and dividend income in the designated sections, ensuring accuracy.

- If you have foreign accounts, make sure to check the appropriate box and provide additional details as required.

- Review the completed form for any errors before attaching it to your Form 1040.

Legal use of the Schedule B Form

The Schedule B Form is legally binding when properly completed and submitted as part of your tax return. It is essential to ensure that all information is accurate and truthful, as providing false information can lead to penalties or legal repercussions. The IRS uses this form to verify income, and discrepancies can trigger audits or further investigations. Compliance with tax laws is crucial for maintaining good standing with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule B Form align with the general tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. If you require additional time, you can file for an extension, which usually grants an extra six months. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is important to stay informed about any changes to tax deadlines that may occur due to legislation or IRS updates.

Required Documents

To accurately complete the Schedule B Form, you will need several documents, including:

- Bank statements showing interest earned.

- Brokerage statements detailing dividends received.

- Form 1099-INT for interest income.

- Form 1099-DIV for dividend income.

Having these documents on hand will streamline the process of filling out the form and ensure that all income is reported correctly.

Quick guide on how to complete schedule b 2016 form

Effortlessly Prepare Schedule B Form on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Schedule B Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and eSign Schedule B Form Without Hassle

- Find Schedule B Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred delivery method for your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you choose. Modify and eSign Schedule B Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule b 2016 form

Create this form in 5 minutes!

How to create an eSignature for the schedule b 2016 form

How to make an eSignature for your Schedule B 2016 Form in the online mode

How to generate an eSignature for the Schedule B 2016 Form in Google Chrome

How to generate an eSignature for signing the Schedule B 2016 Form in Gmail

How to generate an electronic signature for the Schedule B 2016 Form from your mobile device

How to make an electronic signature for the Schedule B 2016 Form on iOS

How to make an electronic signature for the Schedule B 2016 Form on Android OS

People also ask

-

What is the Schedule B Form and why is it important?

The Schedule B Form is a crucial document for reporting interest and dividend income to the IRS. Completing the Schedule B Form accurately ensures compliance with tax laws, helps avoid penalties, and allows individuals to track their investments effectively.

-

How can airSlate SignNow assist with the Schedule B Form?

AirSlate SignNow makes it easier to manage, sign, and send the Schedule B Form electronically. Our platform ensures that you can complete the form efficiently, securely, and collaboratively, enhancing your overall tax filing experience.

-

Is there a cost associated with using airSlate SignNow for the Schedule B Form?

Yes, airSlate SignNow offers various pricing plans tailored to different needs. Each plan provides access to essential features for managing documents like the Schedule B Form, ensuring you receive great value for a tenable cost.

-

What features does airSlate SignNow offer for handling the Schedule B Form?

With airSlate SignNow, you can use features such as electronic signatures, document templates, and automated workflows specifically for the Schedule B Form. These tools streamline the process, reduce errors, and save you time in preparing your tax documents.

-

Can airSlate SignNow integrate with other accounting software to manage the Schedule B Form?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to sync data related to the Schedule B Form effortlessly. This integration helps keep your records organized and reduces the chances of manual data entry errors.

-

How secure is the data when using airSlate SignNow for the Schedule B Form?

AirSlate SignNow prioritizes your data security, employing strong encryption protocols to protect the information you use in your Schedule B Form. Our platform complies with industry standards to ensure that your documents remain private and secure.

-

Can I access the Schedule B Form on mobile devices using airSlate SignNow?

Yes, you can easily access and manage the Schedule B Form on mobile devices via the airSlate SignNow app. This mobile capability allows you to sign and send documents on-the-go, ensuring that you never miss a deadline.

Get more for Schedule B Form

Find out other Schedule B Form

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement