Schedule B 2023

What is the Schedule B

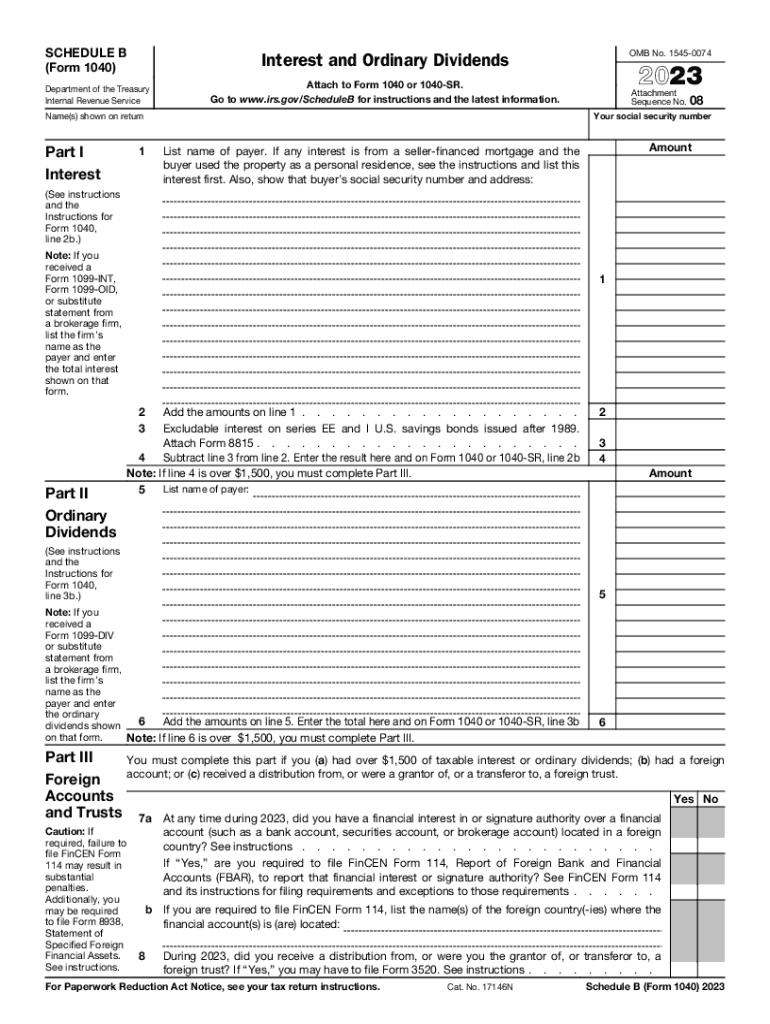

The Schedule B is a supplemental form used in the United States tax system, specifically as part of the IRS Form 1040. It is designed to report interest and ordinary dividends earned during the tax year. Taxpayers must disclose all sources of interest income and dividends, ensuring compliance with federal tax regulations. This form is crucial for accurately calculating taxable income and determining overall tax liability.

How to use the Schedule B

To use the Schedule B effectively, taxpayers should gather all relevant financial documents that detail interest and dividend income. This includes bank statements, brokerage statements, and any Form 1099-DIV or 1099-INT received. After compiling this information, individuals must fill out the form by listing each source of income, along with the corresponding amounts. The totals from Schedule B are then transferred to the main Form 1040, impacting the overall tax calculations.

Steps to complete the Schedule B

Completing the Schedule B involves several key steps:

- Gather all necessary documentation, including Form 1099s.

- List each source of interest and dividends on the form.

- Sum the total interest and dividends for the year.

- Transfer these totals to the appropriate sections of Form 1040.

- Review the completed form for accuracy before filing.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule B. Taxpayers must ensure that all income sources are reported accurately and that they meet the reporting thresholds. For example, if the total interest earned exceeds $1,500, additional reporting requirements may apply. It's essential to refer to the IRS instructions for the most current information and any updates regarding the Schedule B.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule B align with the general tax filing deadlines in the United States. Typically, individual tax returns, including Form 1040 and its schedules, are due by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file their returns.

Penalties for Non-Compliance

Failure to accurately complete and submit the Schedule B can result in penalties from the IRS. These penalties may include fines for underreporting income or failing to file the form altogether. It is important for taxpayers to ensure compliance with all reporting requirements to avoid potential legal and financial repercussions.

Required Documents

To complete the Schedule B, taxpayers need to collect specific documents, including:

- Form 1099-INT for interest income.

- Form 1099-DIV for dividend income.

- Bank statements that detail interest earnings.

- Brokerage statements that outline dividend distributions.

Having these documents ready will facilitate the accurate completion of the form and ensure compliance with IRS regulations.

Quick guide on how to complete schedule b

Effortlessly prepare Schedule B on any device

The management of documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the tools you need to swiftly create, modify, and electronically sign your documents without any delays. Handle Schedule B on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Schedule B with ease

- Obtain Schedule B and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important parts of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunts, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Alter and electronically sign Schedule B while ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule b

Create this form in 5 minutes!

How to create an eSignature for the schedule b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule B and how does it relate to document signing?

Schedule B is a form used by the IRS to report certain income types. When businesses utilize airSlate SignNow for eSigning documents related to Schedule B, they streamline the compliance process. This ensures that all signatures are captured efficiently and that required documents are submitted on time.

-

How can airSlate SignNow help with my Schedule B documentation needs?

airSlate SignNow provides an intuitive platform that simplifies the process of preparing and signing Schedule B forms. With features like templates and automated workflows, users can easily create, edit, and send Schedule B documents for signatures, ensuring accuracy and compliance.

-

What pricing plans does airSlate SignNow offer for businesses that need to manage Schedule B forms?

airSlate SignNow offers flexible pricing plans designed for businesses of all sizes that need to manage documentation such as Schedule B forms. Users can choose from monthly or yearly subscriptions, with plans that provide various features tailored to meet specific business needs related to eSignatures and document management.

-

Can I integrate airSlate SignNow with other software to manage Schedule B filings?

Yes, airSlate SignNow offers robust integrations with various software solutions that can help in managing Schedule B filings. By connecting with tax software, CRM systems, or cloud storage solutions, businesses can enhance their workflow and ensure that all Schedule B-related documents are accessible and up-to-date.

-

What are the key features of airSlate SignNow that assist with Schedule B processing?

airSlate SignNow includes features such as advanced eSignature options, document templates, and audit trails that are invaluable for Schedule B processing. These tools help ensure that all necessary signatures are obtained and that the documentation remains compliant with IRS regulations.

-

Is airSlate SignNow user-friendly for those unfamiliar with Schedule B filing?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy even for those unfamiliar with Schedule B filing. The platform includes step-by-step guides and customer support to assist users in navigating the eSignature process with confidence.

-

Are there security measures in place for Schedule B documents signed with airSlate SignNow?

Yes, airSlate SignNow prioritizes security and offers robust measures to protect your Schedule B documents. Your data is encrypted, and all signatures are legally binding, ensuring that your sensitive information remains secure throughout the signing process.

Get more for Schedule B

Find out other Schedule B

- How To Edit Electronic signature PDF

- Edit Electronic signature Word Mac

- Edit Electronic signature Form Mac

- Edit Electronic signature Document Simple

- How To Edit Electronic signature PPT

- Convert Electronic signature PDF Online

- Convert Electronic signature PDF Free

- How To Convert Electronic signature PDF

- Convert Electronic signature Form Safe

- Convert Electronic signature Form Mac

- Convert Electronic signature Presentation Simple

- Print Electronic signature Document Simple

- How To Convert Electronic signature Presentation

- How To Print Electronic signature PDF

- How To Print Electronic signature Word

- How Can I Print Electronic signature Document

- Print Electronic signature Form Mobile

- Download Electronic signature PDF Free

- Download Electronic signature Word Free

- How To Download Electronic signature Document