Schedule B Form 2014

What is the Schedule B Form

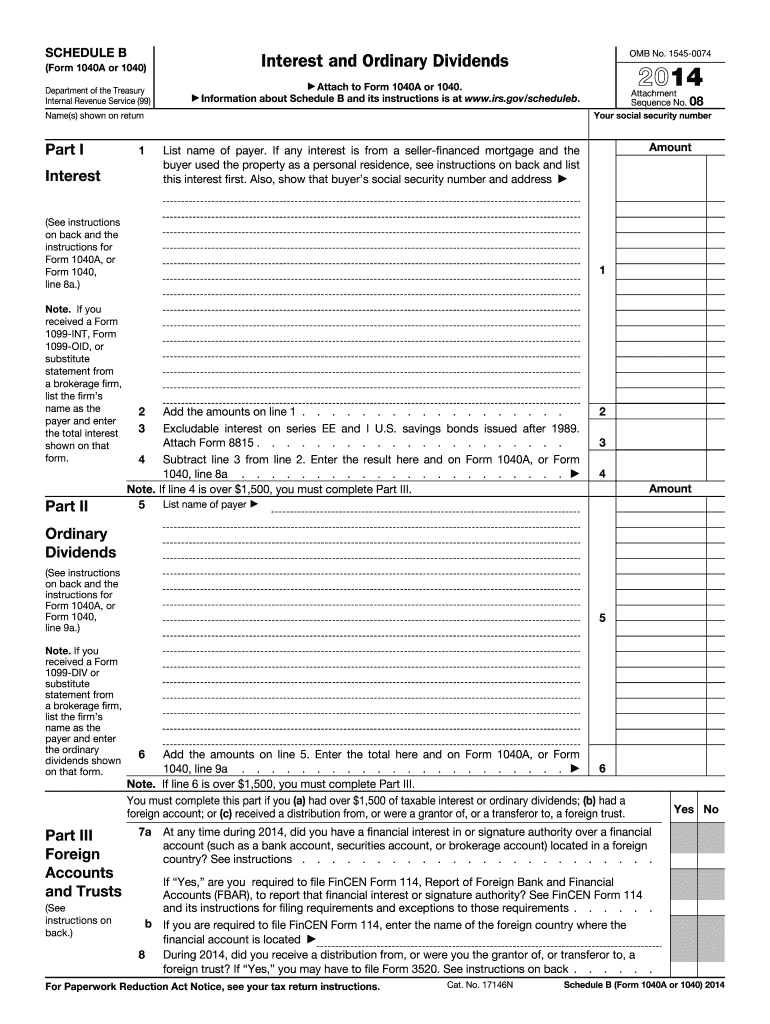

The Schedule B Form is a tax form used by the Internal Revenue Service (IRS) in the United States. It is primarily utilized to report interest and ordinary dividends received during the tax year. Taxpayers must include this form when filing their federal income tax returns, specifically if they have more than $1,500 in taxable interest or dividends. Understanding the Schedule B Form is essential for accurate tax reporting and compliance with IRS regulations.

How to use the Schedule B Form

Using the Schedule B Form involves several straightforward steps. First, gather all relevant financial documents, including bank statements and investment records that detail interest and dividends earned. Next, accurately fill out the form by entering the amounts received in the appropriate sections. It is important to ensure that all figures match those reported on your 1099 forms. Once completed, the Schedule B Form should be attached to your main tax return, such as Form 1040, before submission to the IRS.

Steps to complete the Schedule B Form

Completing the Schedule B Form requires careful attention to detail. Follow these steps:

- Begin with your personal information, including your name and Social Security number.

- List all sources of interest income in Part I, including bank accounts and bonds.

- In Part II, report any ordinary dividends received, ensuring to include all relevant amounts.

- If applicable, answer the questions regarding foreign accounts and trusts to meet disclosure requirements.

- Review the completed form for accuracy before attaching it to your tax return.

Legal use of the Schedule B Form

The Schedule B Form is legally binding when completed accurately and submitted in accordance with IRS guidelines. It serves as an official record of interest and dividend income, which may be subject to audit. Failure to report income accurately can result in penalties or interest charges. Therefore, it is crucial to maintain thorough records and ensure compliance with all relevant tax laws when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule B Form align with the general tax return deadlines. Typically, individual tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes to deadlines, especially if they are filing for an extension. Keeping track of these dates is essential to avoid penalties for late filing.

Form Submission Methods (Online / Mail / In-Person)

The Schedule B Form can be submitted through various methods, depending on how you choose to file your taxes. For electronic filers, the form is included when using tax software or e-filing services. If filing by mail, ensure that you send the completed form along with your tax return to the appropriate IRS address. In-person submissions are generally not available, as the IRS encourages electronic filing for efficiency and security.

Quick guide on how to complete 2014 schedule b form

Complete Schedule B Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally friendly substitute to traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule B Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to modify and electronically sign Schedule B Form with ease

- Locate Schedule B Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to confirm your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced papers, frustrating form searches, or mistakes that require new document printouts. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Schedule B Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 schedule b form

Create this form in 5 minutes!

How to create an eSignature for the 2014 schedule b form

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is a Schedule B Form and why is it important?

The Schedule B Form is a tax form used to report interest and ordinary dividends to the Internal Revenue Service (IRS). It is essential for individuals and businesses to accurately report income to ensure compliance with tax regulations and avoid penalties.

-

How can airSlate SignNow help with the Schedule B Form?

airSlate SignNow streamlines the process of filling out and eSigning the Schedule B Form, making it easier for individuals and businesses to manage their tax documents. Our platform allows you to securely send and sign the form online, reducing paperwork and saving time.

-

Is there a cost associated with using airSlate SignNow for the Schedule B Form?

Yes, airSlate SignNow offers several pricing plans that are cost-effective for businesses of all sizes. You can choose a plan that suits your needs, ensuring you have the necessary features to manage your Schedule B Form efficiently.

-

What features does airSlate SignNow provide for managing tax forms like the Schedule B Form?

airSlate SignNow offers features such as customizable templates, cloud storage, and real-time collaboration to simplify the management of your Schedule B Form. Our user-friendly interface ensures that you can easily navigate the form-filling process.

-

Can I integrate airSlate SignNow with other software for my Schedule B Form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, including accounting and tax software, to enhance your workflow when handling the Schedule B Form. These integrations help you manage your documents more efficiently.

-

How secure is my information when using airSlate SignNow for the Schedule B Form?

Security is a top priority at airSlate SignNow. When you use our platform to manage your Schedule B Form, your data is protected with industry-standard encryption and secure cloud storage, ensuring that your sensitive information remains confidential.

-

Can I track the status of my Schedule B Form once sent for eSignature?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Schedule B Form after it has been sent for eSignature. You will receive notifications about when the document is viewed and signed, keeping you informed throughout the process.

Get more for Schedule B Form

- Minnesota criminal records check release form

- Form 3 20150831doc

- Lp lc ii affidavit to rescind cancellation of limited liability companylimited partnership form

- Download missouri eviction notice form pdf wikidownload

- Mississippi non disclosure agreement nda template form

- North carolina secretary of state notary notary form

- In district court county of state of north dakota case no form

- Affidavit of petitioner north dakota download fillable form

Find out other Schedule B Form

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form