Form 1040 Schedule B 2022

What is the Form 1040 Schedule B

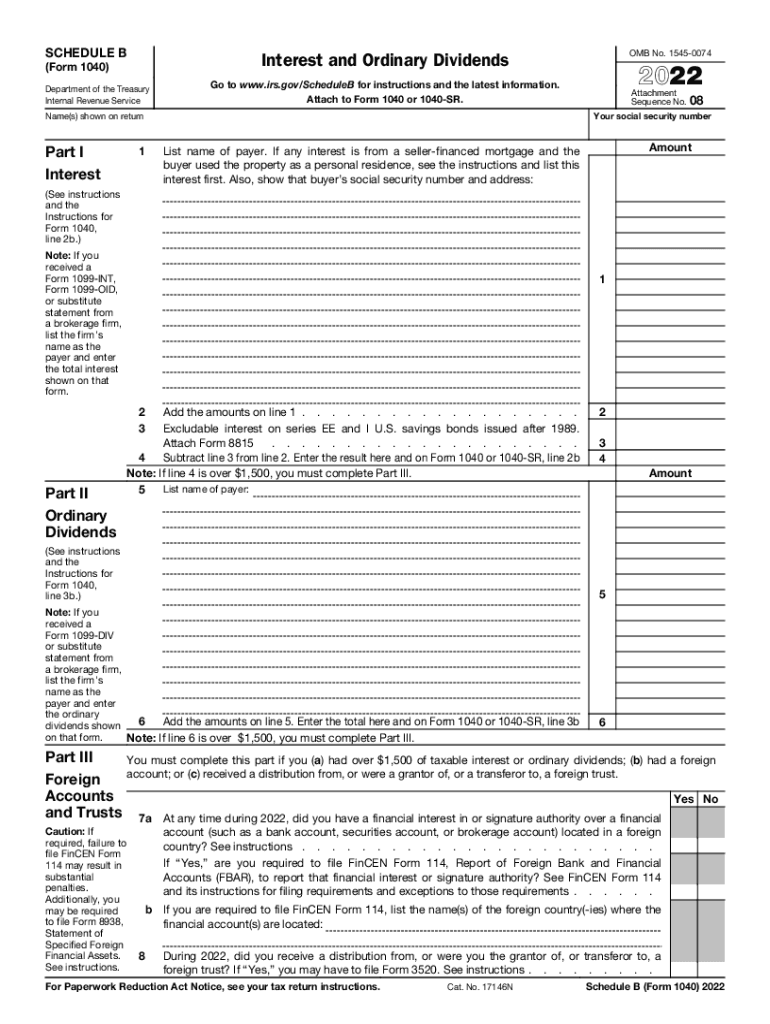

The Form 1040 Schedule B is a supplementary tax form used by individual taxpayers in the United States to report interest and ordinary dividends. This form is essential for those who have received more than $1,500 in interest or dividends during the tax year. It helps the Internal Revenue Service (IRS) track income sources and ensure accurate tax reporting. The information provided on Schedule B is integrated into the main Form 1040, which is the standard individual income tax return.

How to use the Form 1040 Schedule B

To effectively use the Form 1040 Schedule B, taxpayers should first gather all relevant financial documents, including bank statements and brokerage reports. These documents will provide the necessary information regarding interest and dividend income. The form requires taxpayers to list each source of income, along with the corresponding amounts. It is important to ensure that all figures are accurate and reflect the total income for the year. Once completed, Schedule B should be attached to the main Form 1040 when filing taxes.

Steps to complete the Form 1040 Schedule B

Completing the Form 1040 Schedule B involves several straightforward steps:

- Begin by entering your name and Social Security number at the top of the form.

- In Part I, list all sources of interest income, including the name of the payer and the amount received.

- In Part II, report any ordinary dividends received, including the payer's name and the total amount.

- If you have foreign accounts, complete the additional questions regarding foreign financial accounts.

- Review all entries for accuracy before attaching the completed form to your Form 1040.

Legal use of the Form 1040 Schedule B

The legal use of the Form 1040 Schedule B is governed by IRS regulations. Taxpayers are required to report all income accurately to comply with federal tax laws. Failure to report interest and dividend income can lead to penalties and interest charges. The form serves as a declaration of income sources, ensuring transparency and compliance with tax obligations. It is crucial to keep records of all income reported on Schedule B for at least three years in case of an audit.

Key elements of the Form 1040 Schedule B

Key elements of the Form 1040 Schedule B include:

- Part I: This section is dedicated to reporting interest income, requiring details of each source.

- Part II: This section focuses on ordinary dividends, where taxpayers must list the amounts received.

- Foreign Accounts: A section that asks about foreign financial accounts, which may have additional reporting requirements.

- Signature: The form must be signed and dated to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

The filing deadline for the Form 1040 Schedule B aligns with the main Form 1040 submission date, typically April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of these dates to avoid late filing penalties. Additionally, if an extension is filed, the deadline may be extended to October 15, but all tax owed must still be paid by the original deadline to avoid interest and penalties.

Quick guide on how to complete form 1040 schedule b

Complete Form 1040 Schedule B effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documentation, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents promptly without delays. Handle Form 1040 Schedule B on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centered procedure today.

The easiest way to modify and eSign Form 1040 Schedule B with ease

- Find Form 1040 Schedule B and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the files or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Form 1040 Schedule B to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 schedule b

Create this form in 5 minutes!

People also ask

-

What is the 2011 schedule b and why is it important?

The 2011 schedule b is a crucial IRS form that outlines your interests and dividends for accurate tax reporting. It's essential for ensuring compliance and avoiding potential penalties. Understanding its requirements can help you streamline your tax filing process.

-

How can airSlate SignNow help me manage my 2011 schedule b documents?

airSlate SignNow allows you to easily send and eSign your 2011 schedule b documents, ensuring they are securely handled. With our intuitive interface, you can manage all aspects of your document workflow, making tax preparation smoother and more efficient.

-

What are the pricing options for using airSlate SignNow for my 2011 schedule b needs?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs, including those requiring assistance with the 2011 schedule b. You can choose a plan that suits your volume of document signing and eSigning preferences, helping you save costs in your overall process.

-

Does airSlate SignNow offer templates for the 2011 schedule b?

Yes, airSlate SignNow provides customizable templates for the 2011 schedule b and other tax documents. These templates simplify the document creation process, ensuring you don't miss any critical sections and meet IRS requirements seamlessly.

-

What are the benefits of using airSlate SignNow for my tax documents, specifically the 2011 schedule b?

Using airSlate SignNow for your 2011 schedule b offers several benefits, including enhanced security, time-saving features, and easy access to your documents from anywhere. This platform enables faster document turnaround times, ensuring a smooth tax filing experience.

-

Can I integrate airSlate SignNow with my accounting software for handling the 2011 schedule b?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage the 2011 schedule b alongside your other financial documents. This integration helps streamline your workflow and ensures all your financial data is organized in one place.

-

Is airSlate SignNow user-friendly for those unfamiliar with the 2011 schedule b?

Yes, airSlate SignNow is designed to be user-friendly for everyone, even those unfamiliar with the intricacies of the 2011 schedule b. Our straightforward interface, combined with helpful support, ensures you can easily navigate document signing and management.

Get more for Form 1040 Schedule B

Find out other Form 1040 Schedule B

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast