592 F 2020

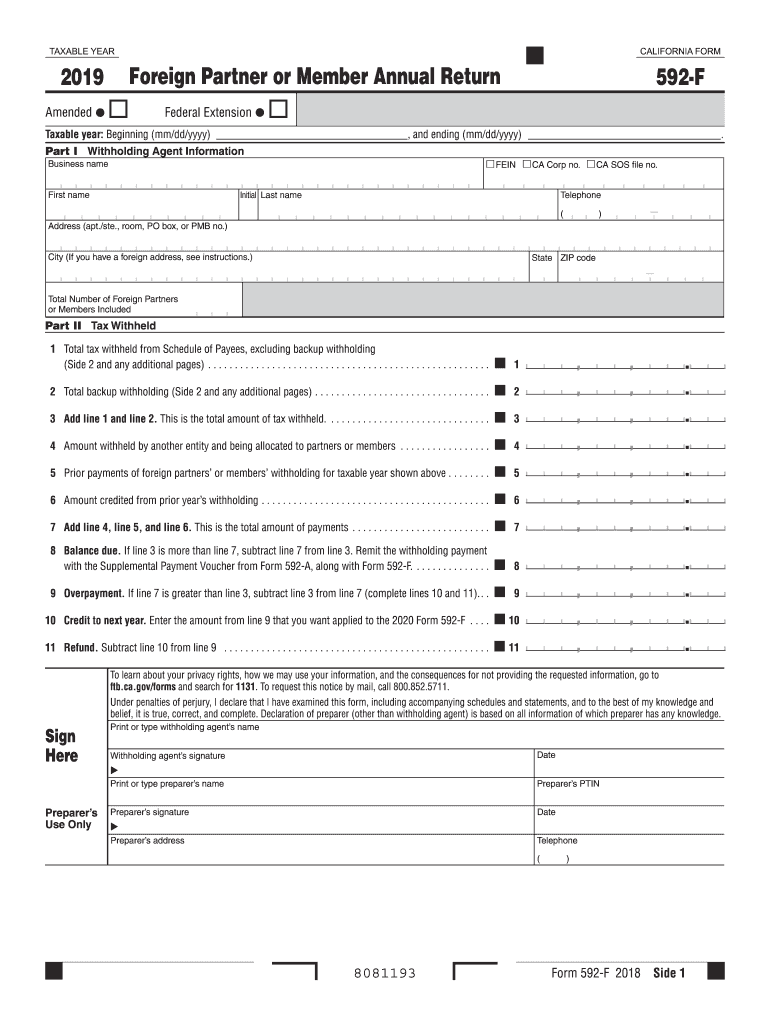

What is the 592 F?

The 592 F form is a California tax document used primarily for reporting and withholding tax on payments made to non-residents. This form is essential for businesses and individuals who make payments to non-residents for services rendered, particularly in California. It helps ensure compliance with state tax regulations and provides the necessary information for the California Franchise Tax Board (FTB) to track tax obligations. Understanding the purpose and requirements of the 592 F is crucial for anyone involved in cross-border transactions or services in California.

Steps to complete the 592 F

Completing the 2018 592 F fillable form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the payee's details, payment amounts, and the nature of the services provided. Next, accurately fill in the required fields on the form, ensuring that all information is correct and complete. Pay special attention to the withholding tax rates applicable to the specific type of payment. After completing the form, review it for any errors before submission. Finally, submit the form to the California Franchise Tax Board by the established deadlines to avoid penalties.

Legal use of the 592 F

The legal use of the 592 F form is governed by California tax laws, which require accurate reporting and withholding of taxes on payments to non-residents. This form serves as a declaration of the amount paid and the tax withheld, ensuring compliance with state regulations. It is important to use the form correctly to avoid legal issues, such as penalties for non-compliance. Additionally, using a reliable digital platform like signNow can help ensure that the form is completed and submitted securely, maintaining its legal validity.

Form Submission Methods

The 2018 592 F form can be submitted through various methods, including online, by mail, or in person. For online submissions, users can utilize the California Franchise Tax Board’s electronic filing system, which provides a streamlined process for completing and submitting the form. If submitting by mail, ensure that the form is sent to the correct address specified by the FTB, and consider using certified mail for tracking purposes. In-person submissions can be made at designated FTB offices, providing an opportunity for immediate assistance if needed.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the 2018 592 F form to avoid penalties. Generally, the form must be submitted by the 15th day of the month following the payment made to the non-resident. For example, if a payment is made in January, the form should be filed by February 15. Keeping track of these deadlines ensures compliance with state tax laws and helps maintain good standing with the California Franchise Tax Board.

Key elements of the 592 F

The 592 F form includes several key elements that must be accurately completed for effective tax reporting. These elements include the payee’s name, address, and taxpayer identification number (TIN), as well as the total amount paid and the withholding tax amount. Additionally, the form requires the type of payment being reported, which can affect the withholding rate. Understanding these key components is essential for ensuring that the form is filled out correctly and meets all legal requirements.

Examples of using the 592 F

Examples of using the 592 F form include scenarios where a business hires a consultant from out of state or pays a non-resident for freelance services. In such cases, the business is responsible for withholding the appropriate amount of tax from the payment and reporting it using the 592 F form. This ensures that the non-resident complies with California tax laws, and it protects the business from potential penalties associated with improper tax reporting. Each situation may vary, so it is important to assess the specific details of each transaction.

Quick guide on how to complete 592 f

Effortlessly Prepare 592 F on Any Device

Digital document management is gaining traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage 592 F on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign 592 F effortlessly

- Find 592 F and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or blackout confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, either via email, SMS, invite link, or download it to your PC.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Edit and eSign 592 F and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 592 f

Create this form in 5 minutes!

How to create an eSignature for the 592 f

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is the 2018 592 f fillable form, and how can it be used?

The 2018 592 f fillable form is a tax form used for withholding on payments to non-residents in California. This form can be easily completed using airSlate SignNow, allowing you to fill out, sign, and send it securely. Utilizing our platform ensures that your document is processed smoothly, meeting compliance requirements effectively.

-

Is the 2018 592 f fillable form available for download?

Yes, the 2018 592 f fillable form can be downloaded directly from the airSlate SignNow platform. This feature allows you to easily access, fill, and customize the form according to your needs. Our solution simplifies the process, so you can focus on what matters most.

-

Are there any costs associated with using the 2018 592 f fillable form on airSlate SignNow?

Using the 2018 592 f fillable form on airSlate SignNow is part of our subscription plans, which are competitively priced. We offer various pricing tiers to suit different business needs and budgets. With our cost-effective solutions, you can ensure compliance and efficiency in document handling.

-

What features does airSlate SignNow offer for the 2018 592 f fillable form?

airSlate SignNow provides several features for the 2018 592 f fillable form, including e-signature functionality, document sharing, and secure storage. Our platform allows for real-time collaboration, letting you collect signatures and feedback seamlessly. This enhances your productivity and ensures all parties are on the same page.

-

How can I integrate the 2018 592 f fillable form with other applications?

airSlate SignNow supports integration with numerous applications, enhancing your workflow when using the 2018 592 f fillable form. You can connect with popular platforms like Google Drive, Dropbox, and others to streamline document management. This interoperability allows for a more efficient business process.

-

What are the security measures for handling the 2018 592 f fillable form through airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the 2018 592 f fillable form. We use advanced encryption and secure cloud storage to protect your information. Additionally, our platform complies with various regulations, ensuring that your data remains safe and confidential.

-

Can I access the 2018 592 f fillable form from mobile devices?

Absolutely! The 2018 592 f fillable form can be accessed and completed on mobile devices through the airSlate SignNow mobile app. This flexibility allows you to manage your documents on-the-go, making it easy to fill out, sign, and send forms whenever and wherever you need.

Get more for 592 F

- Order setting divorce trial and requiring pretrial statements wyoming form

- Required pretrial disclosures in divorce actions wyoming form

- Divorce with children form

- Vital statistics form state of wyoming department of health absolute divorce or annulment for plaintiff without children wyoming

- Complaint for divorce for plaintiff without children wyoming form

- Summons wyoming form

- Initial disclosures form

- Initial disclosures divorce form

Find out other 592 F

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form