Delaware 2019

What is the Delaware Form Income?

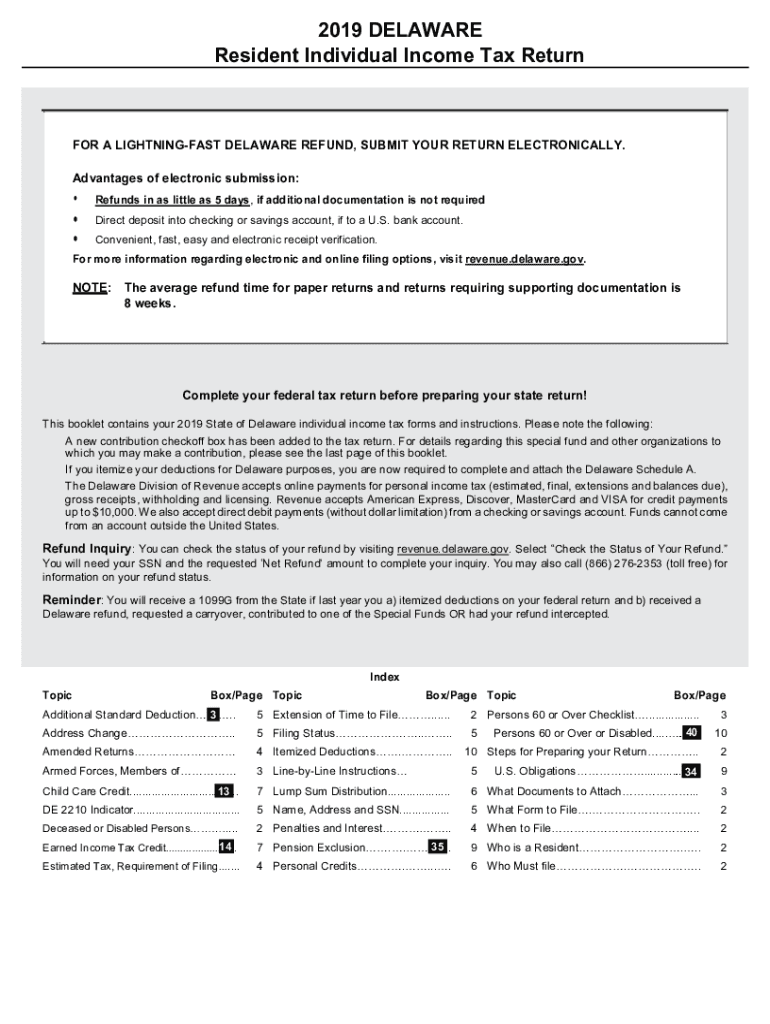

The Delaware Form Income, often referred to as the Delaware Form 200-01, is a crucial document for residents of Delaware who need to report their individual income tax. This form is specifically designed for individuals and is a key component of the Delaware individual income tax system. It allows taxpayers to calculate their taxable income, determine their tax liability, and ensure compliance with state tax regulations.

Steps to Complete the Delaware Form Income

Completing the Delaware Form Income involves several important steps:

- Gather necessary documents, including W-2 forms, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income from all sources, including wages, interest, and dividends.

- Calculate any adjustments to your income, such as retirement contributions or student loan interest.

- Determine your taxable income by subtracting deductions and exemptions.

- Calculate your tax liability using the appropriate tax rates.

- Review the completed form for accuracy before submission.

Legal Use of the Delaware Form Income

The Delaware Form Income is legally binding when filled out correctly and submitted on time. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the Delaware Division of Revenue. This includes providing accurate information and signing the form electronically or in print. Compliance with state tax laws is essential to avoid penalties and ensure that the form is accepted by the state.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is critical for taxpayers. The deadline for submitting the Delaware Form Income typically aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply and ensure that they file their forms on time to avoid late fees.

Form Submission Methods

Taxpayers have several options for submitting the Delaware Form Income:

- Online Submission: The form can be completed and submitted electronically through the Delaware Division of Revenue website.

- Mail Submission: Taxpayers can print the completed form and mail it to the appropriate address provided by the state.

- In-Person Submission: Individuals may also choose to submit their form in person at designated state offices.

Required Documents

To complete the Delaware Form Income accurately, taxpayers should gather the following documents:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Any other relevant financial records that support income and deductions.

Quick guide on how to complete 2019 delaware

Effortlessly Complete Delaware on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to easily find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage Delaware on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Delaware with Ease

- Find Delaware and click Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Emphasize important sections of the documents or obscure sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Delaware and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 delaware

Create this form in 5 minutes!

How to create an eSignature for the 2019 delaware

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is the Delaware form income and why do I need it?

The Delaware form income is a crucial document needed for reporting income for tax purposes in Delaware. Businesses operating in the state must properly complete this form to remain compliant with state tax regulations. Using airSlate SignNow, you can easily fill out, sign, and submit your Delaware form income electronically, ensuring a seamless process.

-

How does airSlate SignNow help with the Delaware form income process?

airSlate SignNow streamlines the creation and submission of the Delaware form income by providing a user-friendly interface for filling out the form electronically. The platform allows you to eSign documents securely and keeps track of submissions, reducing the time spent on paperwork and improving overall efficiency.

-

Is there a cost associated with using airSlate SignNow for the Delaware form income?

Yes, airSlate SignNow offers various pricing plans depending on your business needs. Each plan provides access to features that facilitate the completion and signing of documents, including the Delaware form income. You can choose the plan that best fits your budget while still ensuring compliance with state regulations.

-

What features does airSlate SignNow offer for managing the Delaware form income?

airSlate SignNow offers features such as customizable templates, document storage, and electronic signatures, which are essential for managing your Delaware form income. The platform's collaboration tools also allow multiple users to review and sign documents, streamlining the filing process and boosting productivity.

-

Can I integrate airSlate SignNow with other software for managing the Delaware form income?

Absolutely! airSlate SignNow can easily integrate with various software applications, enhancing your workflow for the Delaware form income. Whether you use accounting, CRM, or project management tools, these integrations allow for a seamless exchange of information and automate the process of document handling.

-

How secure is the data when using airSlate SignNow for the Delaware form income?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and security protocols to protect all documents, including the Delaware form income. You can trust that your sensitive information remains confidential and secure during the eSigning process.

-

Can I use airSlate SignNow to track the status of my Delaware form income submissions?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Delaware form income submissions in real time. You can see when the document is viewed, signed, or completed, ensuring that you stay informed throughout the entire process.

Get more for Delaware

- Vendor informationsubstitute w 9 form azusa pacific university apu

- Compel responses form

- Monroe county landlord statement form

- Nh department of justice new hampshire attorney general form

- Good cause waiver missouri form

- How to file a nevada homestead declarationlaw office of form

- Idnyc complaints status and questionsnyc311idnycaccess nycstart your idnyc application new york cityidnyc complaints status and form

- Bar exam application bar application form

Find out other Delaware

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile