Form N 323, Rev , Carryover of Tax Credits Hawaii Gov 2020

What is the Form N-323?

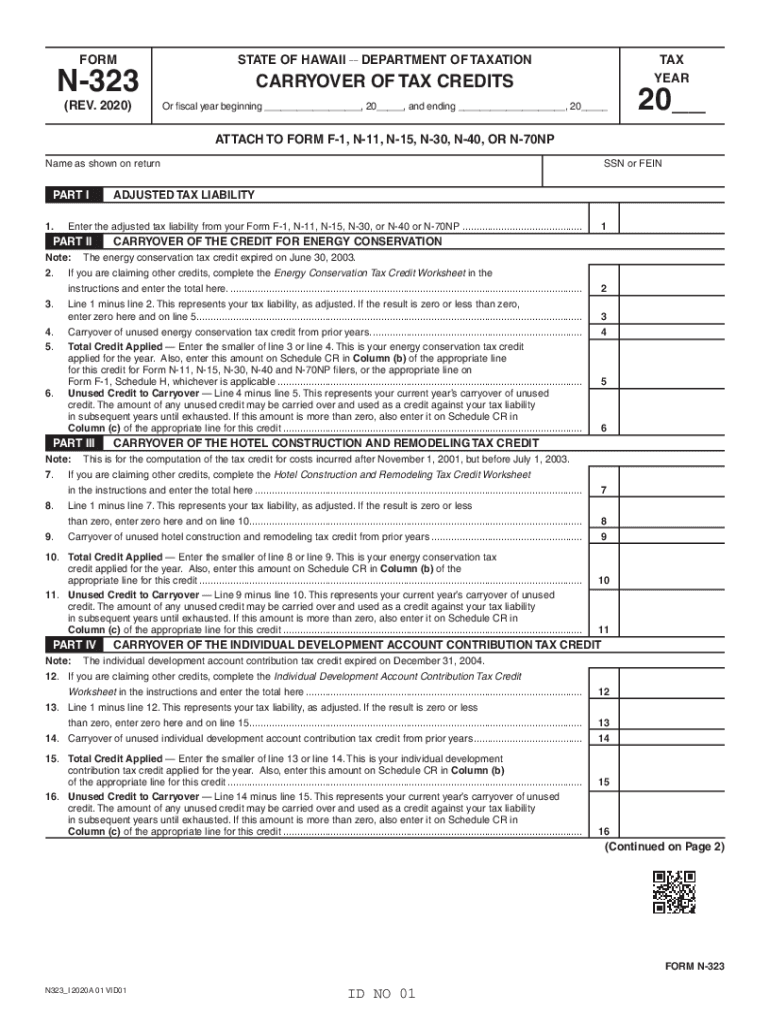

The Form N-323 is a tax form used in Hawaii for the carryover of tax credits. This form allows taxpayers to report any unused tax credits from previous years that can be applied to their current tax liabilities. Understanding the purpose of this form is crucial for ensuring accurate tax filings and maximizing potential tax benefits.

How to Use the Form N-323

To use the Form N-323 effectively, taxpayers must first gather all relevant information regarding their previous tax credits. This includes details about the types of credits being carried over and the amounts. Once the necessary information is collected, taxpayers can fill out the form by entering the relevant data in the designated fields. It is important to follow the instructions closely to ensure compliance with state tax regulations.

Steps to Complete the Form N-323

Completing the Form N-323 involves several key steps:

- Gather all necessary documentation related to prior tax credits.

- Fill out personal information, including name and address.

- Detail the specific tax credits being carried over, including amounts and types.

- Review the completed form for accuracy.

- Submit the form as part of your tax return.

Following these steps ensures that the form is completed correctly and submitted on time.

Legal Use of the Form N-323

The Form N-323 is legally binding when filled out and submitted in accordance with Hawaii tax laws. It is essential for taxpayers to ensure that all information provided is accurate and truthful. Any discrepancies or false information may lead to penalties or legal repercussions. Utilizing a trusted eSignature platform can enhance the security and legality of the submission process.

Filing Deadlines for the Form N-323

Filing deadlines for the Form N-323 align with the general tax filing deadlines in Hawaii. Typically, taxpayers must submit their forms by April fifteenth of each year, unless an extension is granted. It is important to stay informed about any changes to filing dates to avoid late penalties.

Eligibility Criteria for Using the Form N-323

To be eligible to use the Form N-323, taxpayers must have previously claimed tax credits that are eligible for carryover. This includes credits that were not fully utilized in prior tax years. Taxpayers should review the specific eligibility criteria outlined by the Hawaii Department of Taxation to ensure compliance.

Quick guide on how to complete form n 323 rev 2020 carryover of tax credits hawaiigov

Complete Form N 323, Rev , Carryover Of Tax Credits Hawaii gov effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Form N 323, Rev , Carryover Of Tax Credits Hawaii gov on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form N 323, Rev , Carryover Of Tax Credits Hawaii gov without hassle

- Find Form N 323, Rev , Carryover Of Tax Credits Hawaii gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mismanaged documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form N 323, Rev , Carryover Of Tax Credits Hawaii gov and ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 323 rev 2020 carryover of tax credits hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the form n 323 rev 2020 carryover of tax credits hawaiigov

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is n 323 in relation to airSlate SignNow?

n 323 refers to a specific feature within the airSlate SignNow platform designed to enhance the eSigning experience. It allows users to manage and track documents efficiently, ensuring compliance and visibility throughout the signing process.

-

How does airSlate SignNow's n 323 feature improve document management?

The n 323 feature streamlines document management by offering advanced tracking capabilities. Users can easily monitor the status of their documents, receive notifications upon signing, and access audit trails, which helps maintain accountability and transparency.

-

What are the pricing options for airSlate SignNow featuring n 323?

airSlate SignNow offers flexible pricing plans that include the n 323 feature, catering to different business sizes and needs. Prospective customers can choose from monthly or annual subscriptions, allowing them to select a plan that best fits their budget.

-

Can I integrate n 323 with other software solutions?

Yes, airSlate SignNow's n 323 feature is designed to integrate seamlessly with a variety of third-party applications. This allows businesses to streamline their workflows and enhance overall productivity by connecting their existing software tools with the eSigning process.

-

What are the main benefits of using n 323 in airSlate SignNow?

The primary benefits of the n 323 feature include improved efficiency, enhanced security, and reduced paper usage. By utilizing this feature, businesses can accelerate the signing process, protect sensitive information, and contribute to their sustainability goals.

-

Is there a trial available for testing the n 323 feature?

Yes, airSlate SignNow offers a free trial that includes access to the n 323 feature. This allows prospective users to explore the platform's capabilities and determine how it can meet their eSigning needs before committing to a paid plan.

-

How does n 323 enhance user experience on airSlate SignNow?

The n 323 feature enhances user experience by providing an intuitive interface and easy navigation. This ensures that users can quickly send, sign, and manage documents without any technical complexities, making eSigning a hassle-free experience.

Get more for Form N 323, Rev , Carryover Of Tax Credits Hawaii gov

- Osha 30 test questions and answers pdf form

- Gauteng department of education database registration forms

- Meddata critical care form

- Bank of america voided check pdf form

- Snap award letter online texas form

- Childrens health questionnaire form

- Seller interview form with updates 06 16 1 doc

- Out of province power engineer certificate transfer form

Find out other Form N 323, Rev , Carryover Of Tax Credits Hawaii gov

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF