Form N 323, , Carryover of Tax Credits Forms 2019

What is the Form N 323?

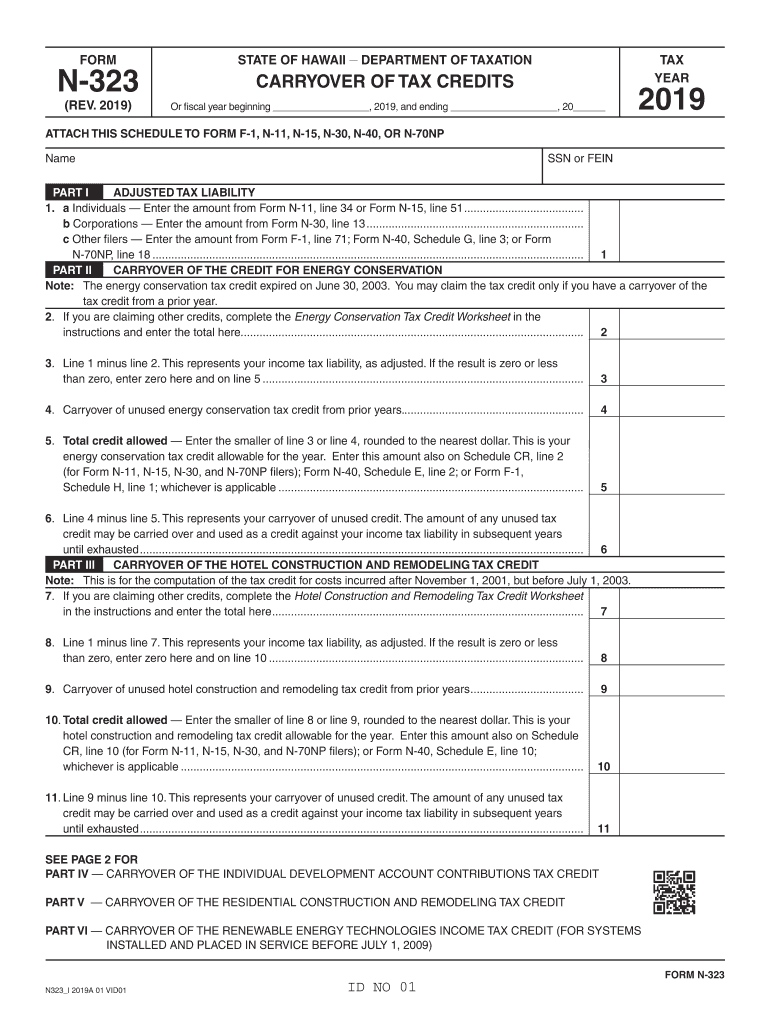

The Form N 323, also known as the Hawaii state tax form N 323, is specifically designed for the carryover of tax credits in the state of Hawaii. This form allows taxpayers to report any unused tax credits from previous years that can be applied to their current tax liabilities. Understanding the purpose of this form is essential for individuals and businesses looking to maximize their tax benefits while remaining compliant with state regulations.

How to use the Form N 323

Using the Form N 323 effectively requires a clear understanding of your tax credits and how they apply to your current tax situation. Taxpayers must first gather information on any tax credits earned in previous years that were not fully utilized. The form provides a structured way to report these credits, ensuring that they are correctly applied to reduce current tax obligations. Accurate completion is vital to avoid potential issues with the Hawaii Department of Taxation.

Steps to complete the Form N 323

Completing the Form N 323 involves several important steps:

- Gather all relevant documentation, including previous tax returns and details of any tax credits.

- Fill out the form by entering your personal information and the details of the credits you wish to carry over.

- Double-check all entries for accuracy to ensure compliance with state tax laws.

- Submit the completed form along with your tax return to the appropriate state tax authority.

Legal use of the Form N 323

The legal use of the Form N 323 hinges on compliance with Hawaii tax laws. Taxpayers must ensure that they are eligible to carry over credits and that all information provided is accurate and truthful. Failing to comply with legal requirements can result in penalties or denial of the carried-over credits. It is advisable to consult with a tax professional if there are uncertainties regarding eligibility or the completion of the form.

Key elements of the Form N 323

Key elements of the Form N 323 include:

- Taxpayer identification information, including name and Social Security number.

- Details of the tax credits being claimed, including the type and amount.

- Signature and date to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form N 323 align with the general tax filing deadlines in Hawaii. Typically, this form must be submitted by the same deadline as your state tax return. It is crucial to stay informed about any changes to deadlines, as late submissions may result in the loss of the opportunity to claim the carryover credits.

Quick guide on how to complete form n 323 2019 carryover of tax credits forms 2019

Prepare Form N 323, , Carryover Of Tax Credits Forms effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents promptly without delays. Manage Form N 323, , Carryover Of Tax Credits Forms on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to edit and eSign Form N 323, , Carryover Of Tax Credits Forms with ease

- Find Form N 323, , Carryover Of Tax Credits Forms and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional pen-and-ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form N 323, , Carryover Of Tax Credits Forms and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 323 2019 carryover of tax credits forms 2019

Create this form in 5 minutes!

How to create an eSignature for the form n 323 2019 carryover of tax credits forms 2019

How to generate an eSignature for your Form N 323 2019 Carryover Of Tax Credits Forms 2019 online

How to make an eSignature for the Form N 323 2019 Carryover Of Tax Credits Forms 2019 in Google Chrome

How to make an electronic signature for signing the Form N 323 2019 Carryover Of Tax Credits Forms 2019 in Gmail

How to create an electronic signature for the Form N 323 2019 Carryover Of Tax Credits Forms 2019 right from your smartphone

How to make an electronic signature for the Form N 323 2019 Carryover Of Tax Credits Forms 2019 on iOS

How to generate an eSignature for the Form N 323 2019 Carryover Of Tax Credits Forms 2019 on Android OS

People also ask

-

What is n 323 and how does it relate to airSlate SignNow?

n 323 refers to a specific feature or functionality offered by airSlate SignNow that enhances electronic signing and document management. This feature streamlines workflows for businesses, making it easier to send, sign, and manage documents securely online.

-

How much does airSlate SignNow cost for users interested in n 323?

Pricing for airSlate SignNow varies based on the features you choose, including access to n 323. Businesses can select from different plans that cater to their size and needs, starting from affordable monthly subscriptions that include all the essential functionalities.

-

What benefits can I expect from using the n 323 feature in airSlate SignNow?

The n 323 feature in airSlate SignNow offers signNow benefits, including increased efficiency in document workflows and enhanced security. Users can enjoy a faster signing process, leading to quicker decisions and improved collaboration across teams.

-

Can n 323 integrate with other applications?

Yes, airSlate SignNow, including the n 323 feature, supports integration with various applications like CRM systems and cloud storage services. This interoperability helps streamline your business processes by allowing seamless information sharing across platforms.

-

Is n 323 suitable for all business sizes?

Absolutely! The n 323 feature in airSlate SignNow is designed to cater to the needs of businesses of all sizes. Whether you run a small startup or a large enterprise, n 323 can adapt to your workflows and improve document management efficiency.

-

What types of documents can I send using n 323 in airSlate SignNow?

With n 323, you can send a wide range of documents using airSlate SignNow, including contracts, agreements, and internal memos. The platform is versatile and supports different document formats to accommodate various business needs.

-

How does n 323 enhance security for eSigning documents?

n 323 incorporates advanced security measures in airSlate SignNow, ensuring that your documents are protected during the signing process. Features such as encryption and audit trails help maintain compliance and safeguard sensitive information.

Get more for Form N 323, , Carryover Of Tax Credits Forms

- Hospital order form

- Form 1670 transfusion reaction investigation reportindd

- Preoperative clearance form

- Doctors note from baptist hospital form

- Omb control number 1505 0184 2016 form

- Corporate resolution date gentlemen the undersigned secretary of the ampquot form

- Higher education application the yavapai apache nation yavapai apache form

- Cit 0480 f form

Find out other Form N 323, , Carryover Of Tax Credits Forms

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple