Form MO FPT Food Pantry, Homeless Shelter, or Soup 2022

Understanding the N-323 Form

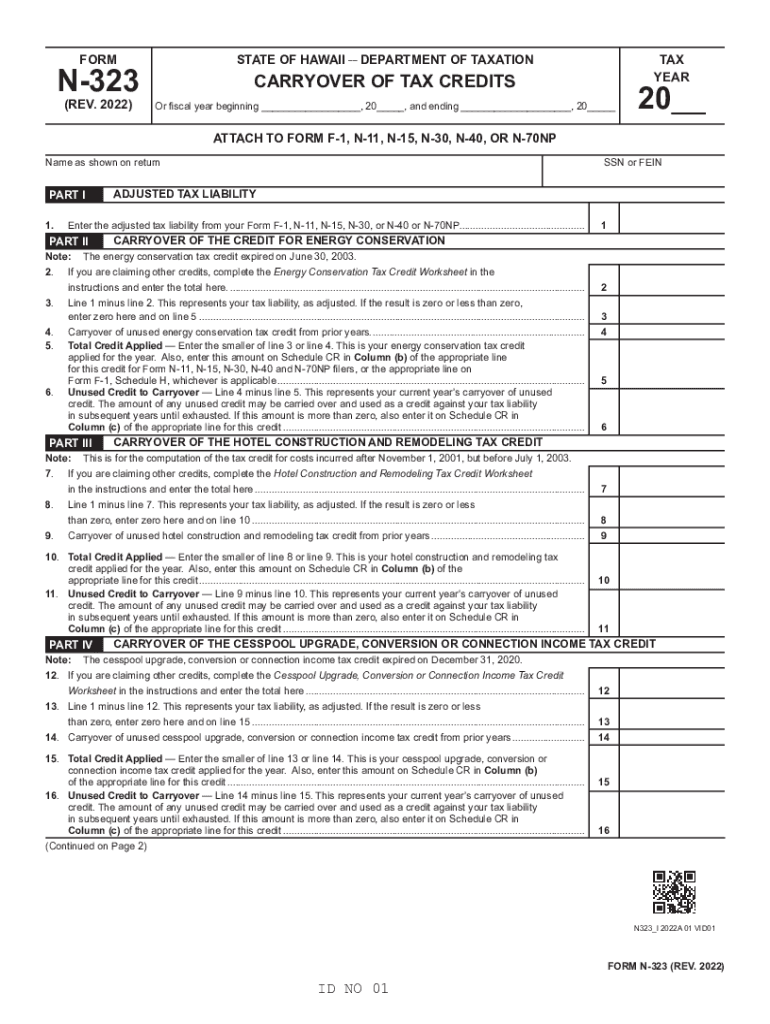

The N-323 form, also known as the Hawaii carryover tax form, is specifically designed for taxpayers in Hawaii who wish to claim carryover credits. This form allows individuals and businesses to report and utilize any unused tax credits from previous years. Understanding its purpose is crucial for ensuring compliance with state tax regulations and maximizing potential tax benefits.

Steps to Complete the N-323 Form

Completing the N-323 form involves several key steps:

- Gather necessary documentation, including prior year tax returns and any relevant carryover credit information.

- Carefully fill out each section of the form, ensuring accurate reporting of carryover amounts.

- Review the completed form for any errors or omissions before submission.

- Submit the form according to the specified guidelines, either electronically or via mail.

Legal Use of the N-323 Form

The N-323 form is legally binding when completed and submitted in accordance with Hawaii tax laws. It is essential to provide accurate information, as any discrepancies could lead to penalties or delays in processing. Compliance with state regulations ensures that taxpayers can legitimately claim their carryover credits without issues.

Filing Deadlines and Important Dates

To avoid penalties, it is important to be aware of the filing deadlines associated with the N-323 form. Typically, the form must be submitted by the tax filing deadline for the year in which the credits are being claimed. Taxpayers should also keep an eye on any changes to deadlines that may occur due to state regulations or special circumstances.

Required Documents for the N-323 Form

When completing the N-323 form, several documents are necessary to support the claims being made:

- Prior year tax returns that detail previously claimed credits.

- Documentation of any unused credits that are being carried over.

- Any additional forms or schedules that may be required by the Hawaii Department of Taxation.

Eligibility Criteria for Carryover Credits

Not all taxpayers may qualify for carryover credits. Eligibility typically depends on the type of credit being claimed and the taxpayer's specific circumstances. It is important to review the criteria outlined by the Hawaii Department of Taxation to determine if you qualify for the N-323 form and the associated credits.

Quick guide on how to complete form mo fpt food pantry homeless shelter or soup

Effortlessly Prepare Form MO FPT Food Pantry, Homeless Shelter, Or Soup on Any Device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to quickly create, modify, and eSign your documents without hassle. Handle Form MO FPT Food Pantry, Homeless Shelter, Or Soup on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Form MO FPT Food Pantry, Homeless Shelter, Or Soup with Ease

- Obtain Form MO FPT Food Pantry, Homeless Shelter, Or Soup and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive details using the tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form MO FPT Food Pantry, Homeless Shelter, Or Soup and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo fpt food pantry homeless shelter or soup

Create this form in 5 minutes!

How to create an eSignature for the form mo fpt food pantry homeless shelter or soup

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is n323 in the context of airSlate SignNow?

n323 refers to a specific feature within airSlate SignNow that allows businesses to streamline their document signing process. This feature enhances workflow efficiency by enabling users to send, track, and eSign documents seamlessly.

-

How does airSlate SignNow's n323 feature improve document management?

The n323 feature in airSlate SignNow enhances document management by automating the eSigning process, reducing turnaround time signNowly. With n323, users can easily manage document templates, track status, and ensure compliance, leading to increased productivity.

-

What pricing options are available for airSlate SignNow with n323 features?

airSlate SignNow provides flexible pricing options that include the n323 feature in various plans. These plans cater to different business sizes and needs, ensuring that organizations can find a cost-effective solution that meets their requirements.

-

Can I integrate n323 with my existing software solutions?

Yes, airSlate SignNow's n323 feature integrates effortlessly with various software applications, including CRMs and document management systems. This capability allows businesses to enhance their workflows by incorporating eSigning into their existing processes.

-

What benefits does the n323 feature offer to small businesses?

For small businesses, the n323 feature in airSlate SignNow provides a budget-friendly solution to manage document signing electronically. By utilizing n323, small businesses can save time, reduce paperwork, and improve customer satisfaction through faster transactions.

-

Is airSlate SignNow with n323 compliant with legal standards?

Yes, the airSlate SignNow platform, including its n323 feature, complies with all major legal standards for electronic signatures. This ensures that documents signed using n323 are legally binding and recognized in courts worldwide.

-

How user-friendly is the n323 feature in airSlate SignNow?

The n323 feature in airSlate SignNow is designed with user-friendliness in mind. Its intuitive interface allows users to quickly navigate through the document signing process without extensive training, making it accessible for everyone.

Get more for Form MO FPT Food Pantry, Homeless Shelter, Or Soup

- Warranty deed for separate or joint property to joint tenancy south carolina form

- Warranty deed to separate property of one spouse to both spouses as joint tenants south carolina form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries south carolina form

- Warranty deed from limited partnership or llc is the grantor or grantee south carolina form

- Sc general warranty form

- Deed of distribution form

- South carolina form 497325983

- South carolina trustee form

Find out other Form MO FPT Food Pantry, Homeless Shelter, Or Soup

- Can I Electronic signature Michigan Lease agreement for house

- How To Electronic signature Wisconsin Landlord tenant lease agreement

- Can I Electronic signature Nebraska Lease agreement for house

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe