Form N 323, Rev , Carryover of Tax Credits 2024-2026

What is the Form N-323, Rev, Carryover of Tax Credits

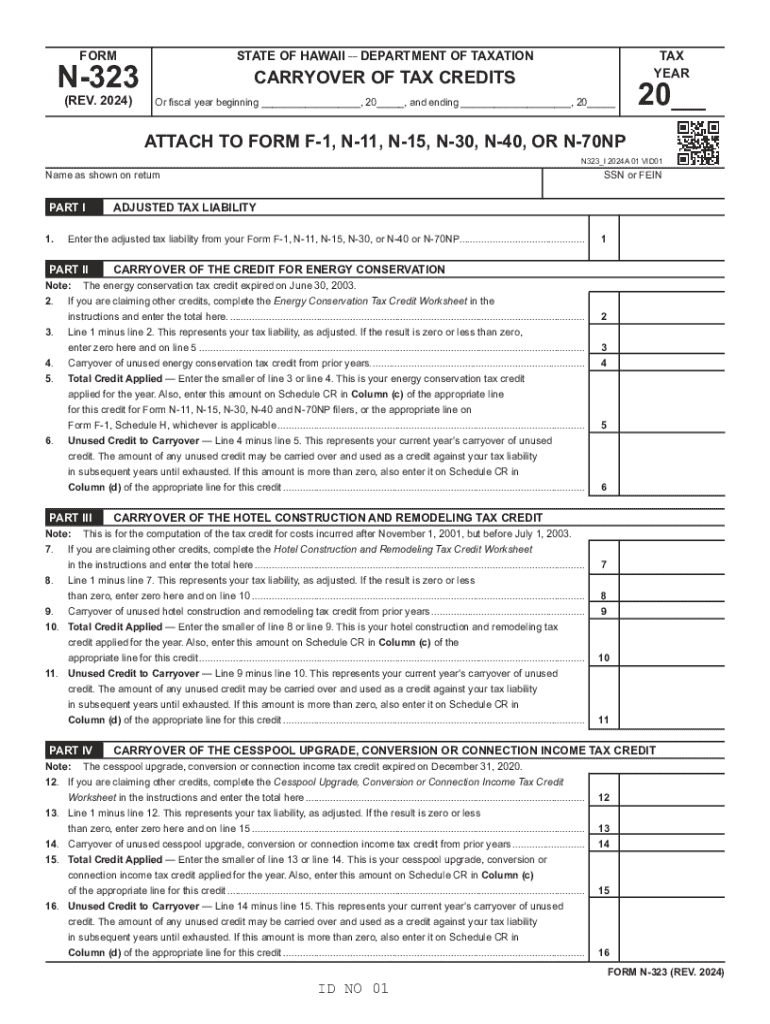

The Form N-323, Rev, is a tax form used in Hawaii to report and claim carryover tax credits. These credits can be applied to reduce the amount of tax owed in future years. The form is specifically designed for taxpayers who have unused tax credits from previous years that they wish to carry forward. Understanding the purpose of this form is essential for effective tax planning and compliance.

How to Use the Form N-323, Rev, Carryover of Tax Credits

Using the Form N-323 involves several steps to ensure accurate reporting of carryover credits. Taxpayers should first gather all relevant documentation regarding their previous tax credits. Next, complete the form by entering personal information, including name, address, and Social Security number. It is crucial to accurately calculate the amount of carryover credits being claimed. Once completed, the form must be submitted according to the filing guidelines set by the Hawaii Department of Taxation.

Steps to Complete the Form N-323, Rev, Carryover of Tax Credits

Completing the Form N-323 requires careful attention to detail. Follow these steps:

- Gather all necessary documentation related to your previous tax credits.

- Provide your personal information in the designated sections of the form.

- Calculate the total amount of carryover credits you are eligible to claim.

- Fill in the appropriate sections with your calculated figures.

- Review the form for accuracy before submission.

Key Elements of the Form N-323, Rev, Carryover of Tax Credits

The key elements of the Form N-323 include sections for personal information, the calculation of carryover credits, and instructions for submission. Each section must be filled out accurately to ensure compliance with state tax laws. Additionally, taxpayers should be aware of any specific instructions related to the type of credits being claimed, as different credits may have unique requirements.

Filing Deadlines / Important Dates

It is important to be aware of filing deadlines for the Form N-323 to avoid penalties. Typically, the form must be submitted by the same deadline as your annual tax return. For the 2024 tax year, ensure that you check the specific dates set by the Hawaii Department of Taxation, as these can vary annually. Missing the deadline may result in the inability to claim the carryover credits.

Eligibility Criteria

To be eligible to use the Form N-323, taxpayers must have carryover tax credits from previous years. These credits can arise from various sources, including renewable energy credits or other specific tax incentives. Understanding the eligibility criteria is crucial to ensure that you can accurately claim the credits and reduce your tax liability effectively.

Create this form in 5 minutes or less

Find and fill out the correct form n 323 rev carryover of tax credits

Create this form in 5 minutes!

How to create an eSignature for the form n 323 rev carryover of tax credits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the hawaii n 323 tax and how does it affect my business?

The hawaii n 323 tax is a specific tax regulation that businesses in Hawaii must comply with. It impacts various aspects of business operations, including document management and compliance. Understanding this tax is crucial for ensuring your business remains compliant and avoids penalties.

-

How can airSlate SignNow help with hawaii n 323 tax compliance?

airSlate SignNow provides an efficient platform for managing documents related to hawaii n 323 tax compliance. With features like eSigning and document tracking, businesses can ensure that all necessary paperwork is completed accurately and on time. This helps streamline compliance processes and reduce the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. Whether you are a small startup or a large enterprise, you can find a plan that fits your budget while ensuring compliance with regulations like the hawaii n 323 tax. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a variety of features designed to enhance document management, such as customizable templates, automated workflows, and secure cloud storage. These features are particularly beneficial for managing documents related to hawaii n 323 tax, ensuring that all necessary forms are easily accessible and properly handled.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications, including CRM systems and accounting tools. This allows businesses to streamline their operations and ensure that all documents related to hawaii n 323 tax are efficiently managed across platforms.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. By utilizing our platform, businesses can ensure that documents related to hawaii n 323 tax are signed quickly and securely, facilitating compliance and operational effectiveness.

-

Is airSlate SignNow suitable for small businesses dealing with hawaii n 323 tax?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an ideal solution for small businesses navigating hawaii n 323 tax requirements. Our platform helps simplify document management and compliance, allowing small businesses to focus on growth.

Get more for Form N 323, Rev , Carryover Of Tax Credits

Find out other Form N 323, Rev , Carryover Of Tax Credits

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now