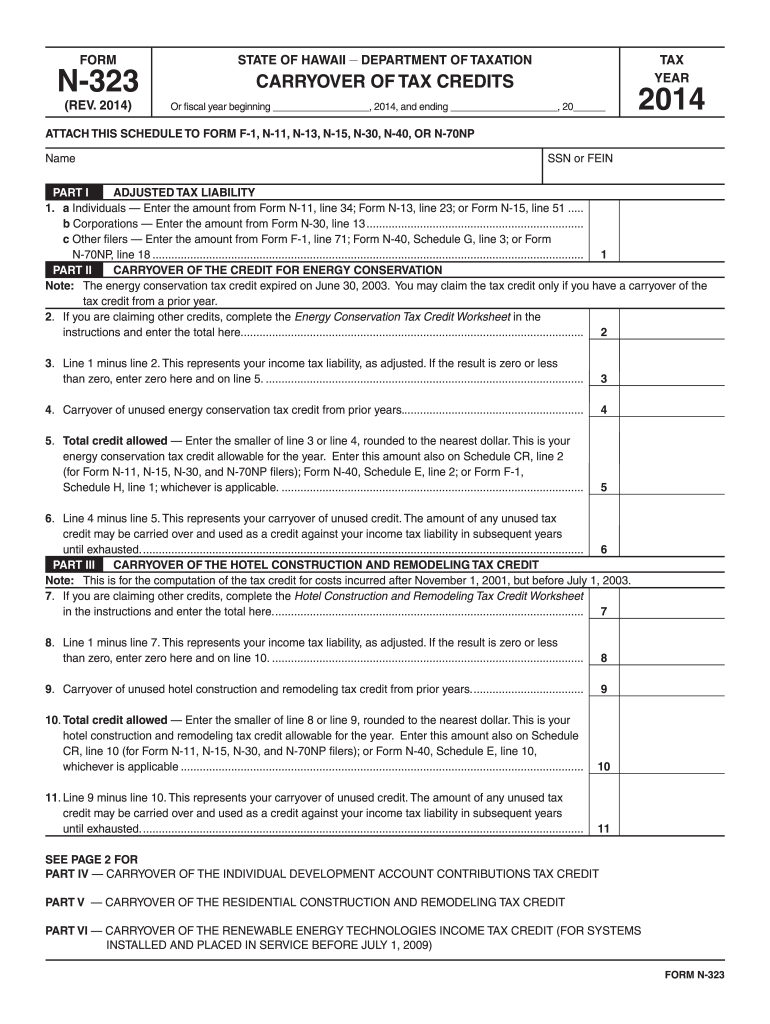

Form N 323, , Carryover of Tax Credits 2014

What is the Form N-323, Carryover Of Tax Credits

The Form N-323, Carryover Of Tax Credits, is an essential document for taxpayers in the United States who wish to carry over unused tax credits to future tax years. This form allows individuals and businesses to report credits that were not fully utilized in the previous tax year, ensuring that they can benefit from these credits in subsequent years. The form is particularly relevant for taxpayers who have credits related to specific tax incentives, such as renewable energy investments or certain educational expenses.

How to use the Form N-323, Carryover Of Tax Credits

Using the Form N-323 involves several steps to ensure accurate reporting of tax credits. Taxpayers must first gather all relevant information regarding their unused credits from previous years. Once the necessary data is collected, the form can be filled out either electronically or on paper. It is important to follow the guidelines provided by the IRS to ensure compliance and avoid potential issues. After completing the form, taxpayers must submit it along with their tax return for the year in which they are claiming the carryover credits.

Steps to complete the Form N-323, Carryover Of Tax Credits

Completing the Form N-323 requires careful attention to detail. Here are the steps to follow:

- Gather documentation of any unused tax credits from prior years.

- Access the Form N-323 from the IRS website or through authorized tax software.

- Fill in your personal information, including your name, address, and Social Security number.

- Report the amount of unused credits you wish to carry over.

- Review the form for accuracy and completeness.

- Sign and date the form.

- Submit the form with your tax return.

Legal use of the Form N-323, Carryover Of Tax Credits

The Form N-323 is legally recognized by the IRS as a valid method for reporting carryover tax credits. To ensure its legal use, taxpayers must adhere to all IRS guidelines regarding eligibility and submission. This includes maintaining accurate records of prior year credits and ensuring that the information provided on the form is truthful and complete. Failure to comply with these requirements may result in penalties or disallowance of the claimed credits.

Filing Deadlines / Important Dates

Filing deadlines for the Form N-323 align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must submit their tax returns by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to be aware of these deadlines to ensure that they do not miss out on claiming their carryover credits.

Who Issues the Form

The Form N-323 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the form as part of its effort to facilitate the reporting of tax credits and ensure that taxpayers can accurately claim any credits they are entitled to carry over. Taxpayers can obtain the form directly from the IRS website or through authorized tax professionals.

Quick guide on how to complete form n 323 2014 carryover of tax credits

Your assistance manual for preparing your Form N 323, , Carryover Of Tax Credits

If you wish to learn how to fill out and submit your Form N 323, , Carryover Of Tax Credits, here are a few brief instructions to simplify your tax filing process.

To begin, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, draft, and complete your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and return to amend details as necessary. Enhance your tax organization with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to finalize your Form N 323, , Carryover Of Tax Credits in just a few minutes:

- Create your account and start editing PDFs in moments.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Click Get form to launch your Form N 323, , Carryover Of Tax Credits in our editor.

- Complete the mandatory fillable fields with your data (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-valid eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that paper filing may lead to errors and delay refunds. Additionally, before e-filing your taxes, check the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form n 323 2014 carryover of tax credits

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

Why is the alternative minimum tax form of 6251 so onerous to fill out?

To make things simpler, ironically.The purpose of the AMT is to ensure that the uber rich pay at least a minimum amount of taxes, but has since morphed into something that hits the upper middle classes*. It does that by having fewer tax brackets, fewer allowed deductions and a higher standard deduction. What you owe is whatever causes you to pay more taxes.However, this needs to be done in addition to the traditional tax calculation. So you need to take your calculations of your various income measures, and put back in various deductions that are disallowed under AMT rules. Or have to be recalculated. It’s a pain.Either someone decided that this was easier than having a completely separate tax form to calculate your AMt tax or someone lobbied to have mor complicated taxes so you’d go to one of the tax places or download tax software.*With the Trump tax changes, AMT affects fewer people.

-

What percent of people don't have the intelligence to fill out tax forms?

Recent statistics that I've seen indicate that about 66% of electronically filed returns are filed by paid preparers. This doesn't necessarily mean that these filers don't have the intelligence but it does indicate that they have a level of discomfort and anxiety and prefer the solace of having a paid preparer fill out and transmit the forms. It all depends on the level of complexity of the form. For the young wage earner living at home with his or her parents, who is able to operate a computer and can operate simple tax return software, I would think that 80% should be intelligent enough to fill out tax forms. Especially because the software is designed to prompt and assist (and check the arithmetic).One of America's most respected jurists, Judge Learned Hand, offers a more thoughtful observation on the law of taxation: ‘In my own case the words of such an act as the Income Tax ... merely dance before my eyes in a meaningless procession; cross-reference to cross-reference, exception upon exception—couched in abstract terms that offer no handle to seize hold of—leave in my mind only a confused sense of some vitally important, but successfully concealed, purport, which it is my duty to extract, but which is within my power, if at all, only after the most inordinate expenditure of time. I know that these monsters are the result of fabulous industry and ingenuity, plugging up this hole and casting out that net, against all possible evasion; yet at times I cannot help recalling a saying of William James about certain passages of Hegal [sic]: that they were no doubt written with a passion of rationality; but that one cannot help wondering whether to the reader they have any significance save that the words are strung together with syntactical correctness.’ Ruth Realty Co. v. Horn, 222 Or. 290, 353 P.2d 524, 526 n. 2 (Or. 1960) (citing 57 Yale L.J. 167, 169 (1947)), overruled on other grounds by Parr v. DOR, 276 Or. 113, 553 P.2d 1051 (Or. 1976). The Humorist Dave Barry had this observation "The IRS is working hard to develop a tax form so scary that merely reading it will cause the ordinary taxpayer's brain to explode.” His candidate for the best effort so far is Schedule J Form 1118 "Separate Limitation Loss Allocations and Other Adjustments Necessary to Determine Numerators of Limitations fraction, Year end Recharacterization Balance and Overall Foreign Loss Account Balances"And don’t forget this observation from Albert Einstein “The hardest thing to understand in the world is the income tax. “ So if Al had trouble understanding taxes, I don't see how a mere mortal has any chance.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the form n 323 2014 carryover of tax credits

How to make an electronic signature for the Form N 323 2014 Carryover Of Tax Credits online

How to create an electronic signature for your Form N 323 2014 Carryover Of Tax Credits in Google Chrome

How to create an eSignature for putting it on the Form N 323 2014 Carryover Of Tax Credits in Gmail

How to create an eSignature for the Form N 323 2014 Carryover Of Tax Credits from your smart phone

How to generate an electronic signature for the Form N 323 2014 Carryover Of Tax Credits on iOS

How to make an electronic signature for the Form N 323 2014 Carryover Of Tax Credits on Android OS

People also ask

-

What is Form N 323, Carryover Of Tax Credits?

Form N 323, Carryover Of Tax Credits, is a tax form used by businesses and individuals to report and carry over unused tax credits to future tax years. Understanding this form is essential for maximizing tax benefits and ensuring compliance with tax regulations.

-

How can airSlate SignNow assist with Form N 323, Carryover Of Tax Credits?

airSlate SignNow simplifies the document signing process, allowing you to quickly and securely eSign your Form N 323, Carryover Of Tax Credits. This streamlines your workflow and helps you manage your tax documents efficiently.

-

What are the pricing options available for using airSlate SignNow?

airSlate SignNow offers various pricing plans to fit different business needs. Each plan includes access to features such as eSigning documents like Form N 323, Carryover Of Tax Credits, along with additional tools to enhance productivity.

-

Is airSlate SignNow user-friendly for beginners?

Yes, airSlate SignNow is designed with user experience in mind, making it accessible even for beginners. You will find it easy to navigate and manage documents, including Form N 323, Carryover Of Tax Credits, regardless of your technical skills.

-

What features does airSlate SignNow offer for document automation?

airSlate SignNow includes features such as custom templates, automated workflows, and integration with other apps, enhancing the efficiency of managing documents like Form N 323, Carryover Of Tax Credits. These features save time and reduce errors.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow can integrate with various applications, allowing you to manage your tax documents seamlessly. This means you can work on your Form N 323, Carryover Of Tax Credits, in conjunction with your favorite financial or accounting tools.

-

How secure is airSlate SignNow for signing important documents?

Security is a top priority at airSlate SignNow. All documents, including Form N 323, Carryover Of Tax Credits, are protected with advanced encryption and security protocols, ensuring your sensitive information remains confidential and secure.

Get more for Form N 323, , Carryover Of Tax Credits

Find out other Form N 323, , Carryover Of Tax Credits

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation