Form N 323, Rev , Carryover of Tax Credits Hawaii Gov 2021

Understanding the Form N-323: Carryover of Tax Credits

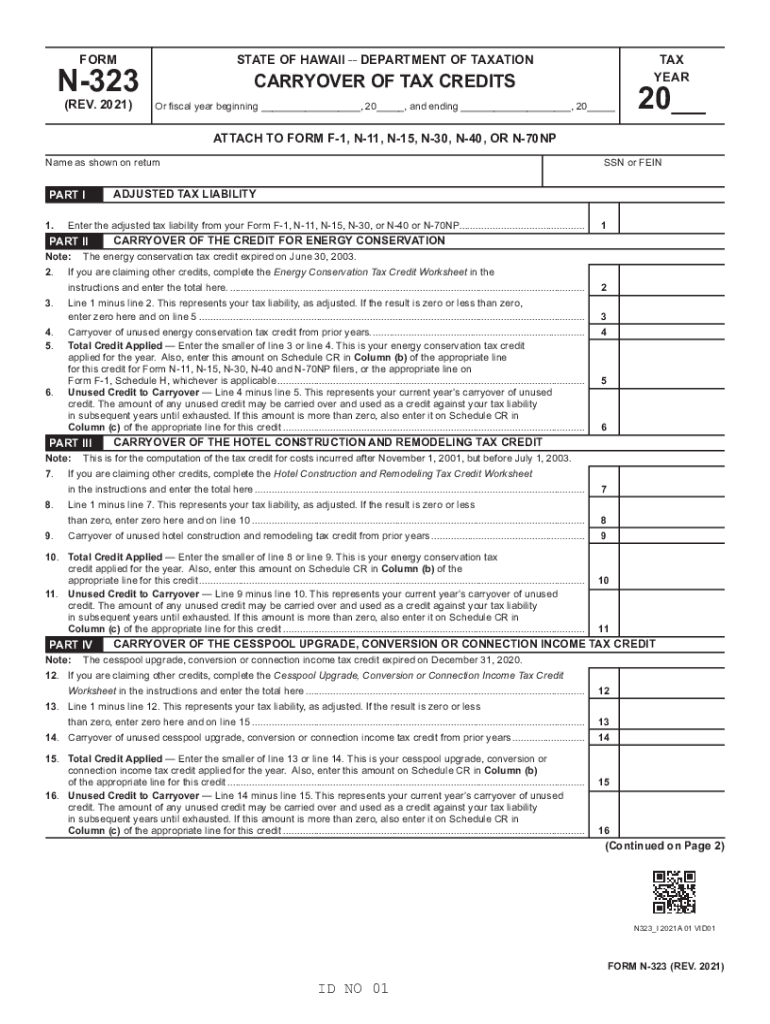

The Form N-323 is a crucial document for taxpayers in Hawaii seeking to carry over unused tax credits to future tax years. This form allows individuals and businesses to maximize their tax benefits by applying credits that were not fully utilized in the previous year. Understanding the purpose and function of the N-323 can help ensure that taxpayers take full advantage of available credits, ultimately reducing their tax liability.

Steps to Complete the Form N-323

Completing the Form N-323 involves several key steps:

- Gather Required Information: Collect all necessary documentation related to the tax credits you wish to carry over.

- Fill Out Personal Information: Provide your name, address, and Social Security number or taxpayer identification number.

- Detail Credit Information: Clearly indicate the type and amount of credits being carried over from previous years.

- Review and Sign: Ensure all information is accurate before signing the form to validate your submission.

Legal Use of the Form N-323

The Form N-323 is legally recognized under Hawaii state tax law, allowing taxpayers to carry over credits as prescribed by the Department of Taxation. To ensure compliance, it is essential to follow the guidelines set forth by the state, including proper documentation and timely submission. Utilizing this form correctly can provide significant tax benefits, making it a valuable tool for financial planning.

Filing Deadlines for the Form N-323

Taxpayers must adhere to specific deadlines when submitting the Form N-323. Typically, the form should be filed by the due date of your tax return for the year in which the credits were generated. Late submissions may result in the loss of the ability to carry over the credits, emphasizing the importance of timely filing.

Obtaining the Form N-323

The Form N-323 can be easily obtained through the Hawaii Department of Taxation's official website. It is available for download in a printable format, making it accessible for all taxpayers. Additionally, physical copies may be available at local tax offices or through tax professionals who assist with state tax filings.

Eligibility Criteria for Using the Form N-323

To be eligible to use the Form N-323, taxpayers must have unused tax credits from prior years that meet specific criteria established by the Hawaii Department of Taxation. This includes ensuring that the credits are valid and applicable to the current tax year. Understanding these eligibility requirements is crucial for effective tax planning.

Quick guide on how to complete form n 323 rev 2021 carryover of tax credits hawaiigov

Complete Form N 323, Rev , Carryover Of Tax Credits Hawaii gov effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Handle Form N 323, Rev , Carryover Of Tax Credits Hawaii gov on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Form N 323, Rev , Carryover Of Tax Credits Hawaii gov effortlessly

- Acquire Form N 323, Rev , Carryover Of Tax Credits Hawaii gov and then click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form N 323, Rev , Carryover Of Tax Credits Hawaii gov to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 323 rev 2021 carryover of tax credits hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the form n 323 rev 2021 carryover of tax credits hawaiigov

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The way to generate an e-signature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The way to generate an e-signature for a PDF on Android devices

People also ask

-

What is n 323 in the context of airSlate SignNow?

The term n 323 refers to a specific feature within airSlate SignNow that enhances document management and electronic signing. It streamlines the process of sending and signing documents, making transactions quicker and more efficient for businesses of all sizes.

-

How does airSlate SignNow ensure the security of documents when using n 323?

airSlate SignNow utilizes advanced encryption methods to protect documents shared through the n 323 feature. This ensures that your sensitive information remains confidential and secure throughout the entire signing process.

-

What are the pricing options for using n 323 with airSlate SignNow?

n 323 is included in the various pricing plans offered by airSlate SignNow. These plans are competitively priced to provide businesses with a cost-effective solution for electronic signatures and document management, ensuring you only pay for what you need.

-

Can n 323 be integrated with other software tools?

Yes, airSlate SignNow's n 323 feature easily integrates with popular business applications like CRM and project management tools. This integration helps streamline workflows and enhances productivity by allowing users to manage all their documents from a single platform.

-

What benefits does n 323 provide for businesses?

By utilizing the n 323 feature, businesses can signNowly reduce the time spent on document signing and approval processes. This leads to faster transactions, improved customer satisfaction, and a more efficient workflow overall.

-

Is training available for using n 323 in airSlate SignNow?

Absolutely! airSlate SignNow offers comprehensive training resources and customer support to help users effectively utilize the n 323 feature. This ensures that your team can quickly get up to speed and make the most of the platform.

-

Who can benefit from using airSlate SignNow's n 323 feature?

Businesses of all sizes and industries can benefit from airSlate SignNow's n 323 feature. Whether you are a startup needing to send contracts or a large enterprise managing multiple agreements, n 323 simplifies the electronic signing process.

Get more for Form N 323, Rev , Carryover Of Tax Credits Hawaii gov

- Gift deed one individual to two individuals as joint tenants maryland form

- Quitclaim deed from one individual to three individuals as joint tenants with the right of survivorship maryland form

- Md quitclaim 497310607 form

- Maryland quitclaim deed 497310608 form

- Md quitclaim deed form

- Maryland ucc1 form

- Maryland financing statement form

- Financing statement amendment 497310612 form

Find out other Form N 323, Rev , Carryover Of Tax Credits Hawaii gov

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document