Form N 323, Rev , Carryover of Tax Credits Forms 2023

What is the Form N-323, Rev, Carryover of Tax Credits?

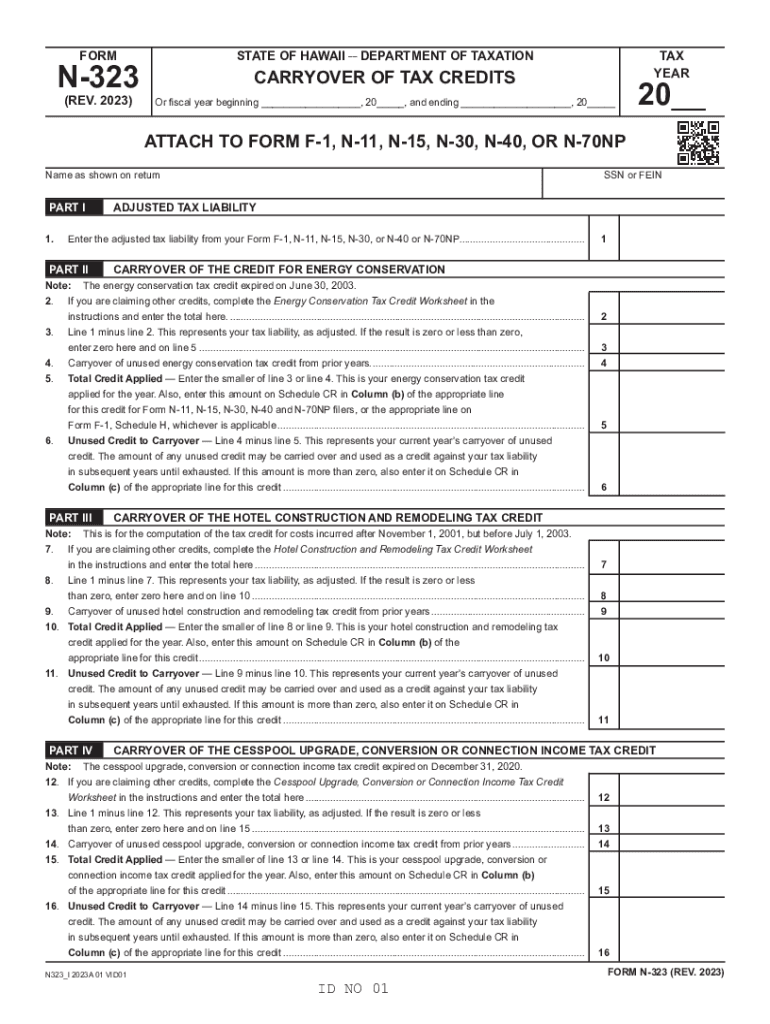

The Form N-323, Rev, is a tax form used in Hawaii for reporting carryover tax credits. This form allows taxpayers to claim any unused tax credits from previous years, ensuring they receive the full benefit of these credits in the current tax year. It is essential for individuals and businesses who have credits that they could not utilize in prior filings. Understanding this form is crucial for maximizing tax benefits and ensuring compliance with state tax regulations.

How to Use the Form N-323, Rev, Carryover of Tax Credits

To effectively use the Form N-323, Rev, taxpayers should first gather all relevant documentation regarding previous tax credits. This includes records of credits that were earned but not fully utilized. Once the form is obtained, fill it out with accurate information regarding the credits being carried over. It is important to follow the instructions provided on the form carefully to ensure proper submission. The completed form can then be included with your tax return for the current year.

Steps to Complete the Form N-323, Rev, Carryover of Tax Credits

Completing the Form N-323, Rev, involves several key steps:

- Gather all necessary documentation related to previous tax credits.

- Obtain the latest version of the Form N-323, Rev.

- Fill in your personal and tax information accurately.

- Detail the specific credits being carried over, including amounts and relevant tax years.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form N-323, Rev, align with Hawaii's tax return deadlines. Typically, individual tax returns are due on April 20 for the previous calendar year. However, if you are filing for an extension, ensure to submit the Form N-323 by the extended deadline. It is crucial to keep track of these dates to avoid penalties and ensure timely processing of your tax credits.

Eligibility Criteria for Using the Form N-323, Rev

Eligibility to use the Form N-323, Rev, primarily depends on having carryover tax credits from previous tax years. Taxpayers must have claimed these credits in prior filings but were unable to utilize the full amount. Additionally, both individuals and business entities can apply for carryover credits, provided they meet the specific criteria set by the Hawaii Department of Taxation.

Key Elements of the Form N-323, Rev, Carryover of Tax Credits

The Form N-323, Rev, includes several key elements that taxpayers must complete:

- Taxpayer Information: Name, address, and identification numbers.

- Credit Information: Details of the credits being carried over, including amounts and years.

- Signature: Taxpayer's signature certifying the accuracy of the information provided.

Who Issues the Form N-323, Rev, Carryover of Tax Credits?

The Form N-323, Rev, is issued by the Hawaii Department of Taxation. This state agency is responsible for managing tax regulations and ensuring compliance among taxpayers. It is advisable to check the department's official website for the most current version of the form and any updates regarding tax credits and filing procedures.

Quick guide on how to complete form n 323 rev carryover of tax credits forms

Complete Form N 323, Rev , Carryover Of Tax Credits Forms seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly and efficiently. Handle Form N 323, Rev , Carryover Of Tax Credits Forms on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Form N 323, Rev , Carryover Of Tax Credits Forms effortlessly

- Locate Form N 323, Rev , Carryover Of Tax Credits Forms and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your alterations.

- Select your preferred method of delivering your form: via email, SMS, or a shared link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and eSign Form N 323, Rev , Carryover Of Tax Credits Forms while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 323 rev carryover of tax credits forms

Create this form in 5 minutes!

How to create an eSignature for the form n 323 rev carryover of tax credits forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is hawaii carryover and how does it work with airSlate SignNow?

Hawaii carryover refers to the ability to roll over unused benefits or services into the next period. With airSlate SignNow, this feature allows users to maximize their investment by ensuring they aren't losing valuable resources. The platform facilitates a seamless process of managing these carryovers, enhancing your overall experience.

-

How much does airSlate SignNow cost for managing hawaii carryover?

The pricing for airSlate SignNow varies depending on the subscription plan you choose, but it generally offers competitive rates to manage hawaii carryover effectively. You can access different pricing tiers based on your business size and needs. Each plan includes essential features that support the efficient management of carryover benefits.

-

What features does airSlate SignNow offer for hawaii carryover?

airSlate SignNow provides several features specifically designed for hawaii carryover management, including automated reminders and tracking systems. These features ensure that you and your team are aware of carryover statuses and deadlines, boosting your operational efficiency. Additionally, the platform allows for easy customization based on your specific needs.

-

Can airSlate SignNow integrate with other tools for hawaii carryover tracking?

Yes, airSlate SignNow offers integrations with various tools that can help in tracking hawaii carryover, such as project management software and accounting systems. These integrations streamline your workflow and enhance data consistency across platforms. This ensures you can manage your carryover efficiently from a single interface.

-

What are the benefits of using airSlate SignNow for hawaii carryover?

Using airSlate SignNow for hawaii carryover provides several benefits, such as improved organization and clarity in managing rolled-over services. The platform simplifies document management, making it easier to keep track of your carryover details. Furthermore, it can lead to signNow time savings, allowing your team to focus on other critical tasks.

-

Is there a free trial available for airSlate SignNow to manage hawaii carryover?

Yes, airSlate SignNow offers a free trial that lets you explore how the platform can assist in managing hawaii carryover. During the trial, you can test drive the various features and capabilities, giving you confidence in your decision. This allows you to assess how well it meets your specific carryover management needs.

-

How secure is airSlate SignNow when handling hawaii carryover documents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive hawaii carryover documents. The platform uses advanced encryption and compliance measures to protect your data against unauthorized access. You can trust that your documents and carryover information are in safe hands.

Get more for Form N 323, Rev , Carryover Of Tax Credits Forms

- Letter of inquiry fillable form

- Glock inspection form

- Print zoning permit form

- Make a fire evacuation plan online form

- State of ohio application for license to carry a concealed handgun ohioattorneygeneral form

- Form oda1043 continuing ed verification form 2014 03 21docx aging ohio

- Ohio exemption application form

- Oh affidavit student das form

Find out other Form N 323, Rev , Carryover Of Tax Credits Forms

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online