Form N 30, Rev , Corporation Income Tax Return Hawaii Gov 2019

What is the Form N-30, Rev, Corporation Income Tax Return Hawaii Gov

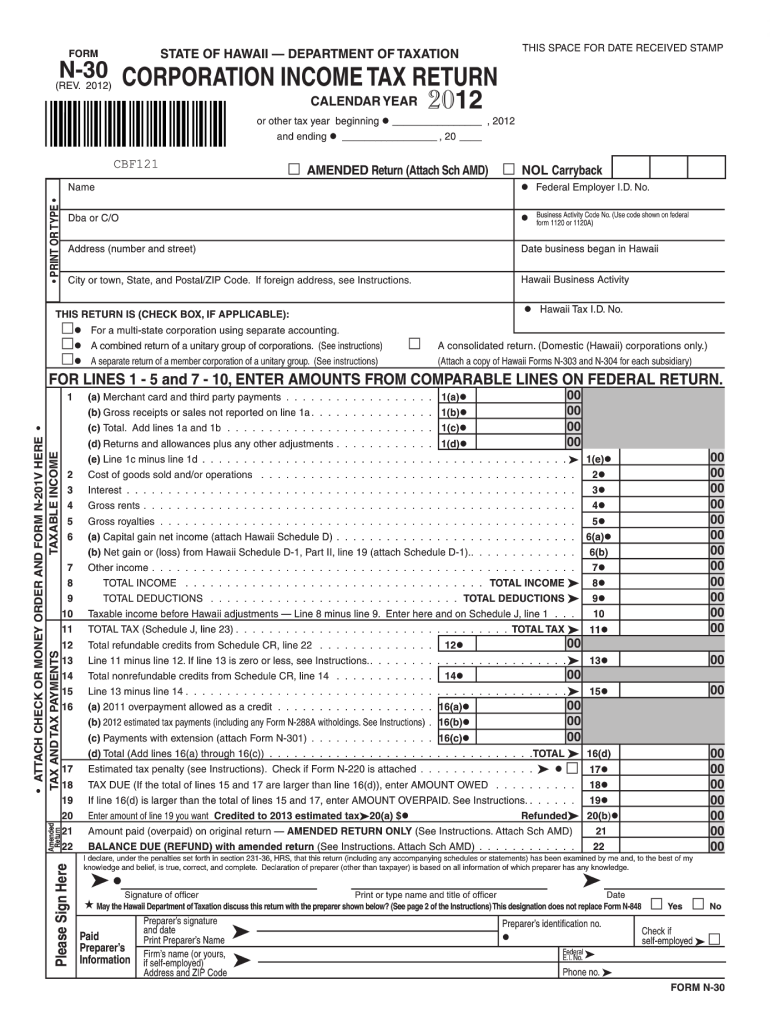

The Form N-30, Rev, is the official Corporation Income Tax Return used by businesses operating in Hawaii. This form is essential for corporations to report their income, deductions, and tax liability to the state. It ensures compliance with state tax laws and provides the necessary information for the Department of Taxation to assess the corporation's tax obligations accurately. The form is specifically designed for corporations, including C corporations and S corporations, and must be filed annually.

Steps to Complete the Form N-30, Rev, Corporation Income Tax Return Hawaii Gov

Completing the Form N-30, Rev, involves several key steps to ensure accuracy and compliance:

- Gather necessary financial documents, including income statements, balance sheets, and records of deductions.

- Fill in the corporation's identifying information, such as name, address, and federal employer identification number (EIN).

- Report total income and allowable deductions in the appropriate sections of the form.

- Calculate the tax liability based on the corporation's taxable income.

- Review the completed form for any errors or omissions before submission.

How to Obtain the Form N-30, Rev, Corporation Income Tax Return Hawaii Gov

The Form N-30, Rev, can be obtained from the Hawaii Department of Taxation’s official website. It is available as a downloadable PDF, allowing businesses to print and complete the form manually. Additionally, the form may also be available at local tax offices or through authorized tax professionals. Ensuring you have the most current version of the form is crucial, as tax regulations may change annually.

Legal Use of the Form N-30, Rev, Corporation Income Tax Return Hawaii Gov

The legal use of the Form N-30, Rev, is crucial for maintaining compliance with Hawaii's tax laws. When completed accurately and submitted on time, it serves as a legally binding document that reports a corporation's financial activities to the state. Failure to file the form or inaccuracies in reporting can lead to penalties, interest on unpaid taxes, and potential audits. It is essential for corporations to understand their obligations and ensure that all information provided is truthful and complete.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form N-30, Rev. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically means the form is due by April 15. It is important for businesses to mark their calendars and prepare their financial documents in advance to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form N-30, Rev, can be submitted through various methods, ensuring flexibility for corporations. The available submission methods include:

- Online: Corporations can file electronically through the Hawaii Department of Taxation’s e-filing system, which is often faster and more efficient.

- Mail: Completed forms can be mailed to the appropriate address provided by the Department of Taxation. It is advisable to use certified mail for tracking purposes.

- In-Person: Corporations may also choose to submit the form in person at local tax offices, where staff can assist with any questions.

Quick guide on how to complete form n 30 rev 2012 corporation income tax return hawaiigov

Effortlessly Prepare Form N 30, Rev , Corporation Income Tax Return Hawaii gov on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form N 30, Rev , Corporation Income Tax Return Hawaii gov on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Form N 30, Rev , Corporation Income Tax Return Hawaii gov with Ease

- Find Form N 30, Rev , Corporation Income Tax Return Hawaii gov and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key parts of your documents or obscure sensitive details with tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Alter and eSign Form N 30, Rev , Corporation Income Tax Return Hawaii gov to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 30 rev 2012 corporation income tax return hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the form n 30 rev 2012 corporation income tax return hawaiigov

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Form N 30, Rev, Corporation Income Tax Return Hawaii gov.?

Form N 30, Rev, Corporation Income Tax Return Hawaii gov. is a tax document required for corporations operating in Hawaii to report their income and calculate their tax liability. This form is essential for compliance with state tax regulations and must be filed annually. Understanding how to complete this form accurately can help businesses avoid penalties and ensure they meet Hawaii's tax obligations.

-

How can airSlate SignNow help with Form N 30, Rev, Corporation Income Tax Return Hawaii gov.?

airSlate SignNow streamlines the process of collecting signatures and managing documents related to Form N 30, Rev, Corporation Income Tax Return Hawaii gov. With its easy-to-use interface, businesses can eSign necessary documents quickly, ensuring they meet submission deadlines without hassle. Additionally, airSlate SignNow provides secure storage for these important files.

-

What are the pricing options for using airSlate SignNow for Form N 30, Rev, Corporation Income Tax Return Hawaii gov.?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, ensuring that preparing and signing documents like Form N 30, Rev, Corporation Income Tax Return Hawaii gov. remains cost-effective. You can choose a plan that best suits your needs, with options for monthly or annual subscriptions. This flexibility allows businesses to manage their expenses while using powerful document management tools.

-

What features does airSlate SignNow offer for managing Form N 30, Rev, Corporation Income Tax Return Hawaii gov.?

airSlate SignNow includes features tailored for managing Form N 30, Rev, Corporation Income Tax Return Hawaii gov., such as template creation, eSigning, and real-time tracking of document status. Users can easily customize templates to ensure all necessary information is captured accurately. These features help eliminate errors and enhance efficiency when handling tax documents.

-

Is airSlate SignNow secure for handling Form N 30, Rev, Corporation Income Tax Return Hawaii gov.?

Yes, airSlate SignNow employs robust security measures to protect sensitive documents, including Form N 30, Rev, Corporation Income Tax Return Hawaii gov. All data is encrypted both at rest and in transit, ensuring that your tax information is safe from unauthorized access. Businesses can trust airSlate SignNow to keep their financial documents secure.

-

Can airSlate SignNow integrate with other software for tax preparation and compliance?

airSlate SignNow offers seamless integrations with various accounting and tax software, allowing businesses to streamline the preparation of Form N 30, Rev, Corporation Income Tax Return Hawaii gov. This connectivity ensures that all necessary financial data is readily accessible, making the overall process faster and reducing the risk of errors during tax filing.

-

What benefits does using airSlate SignNow provide when filing Form N 30, Rev, Corporation Income Tax Return Hawaii gov.?

Using airSlate SignNow for filing Form N 30, Rev, Corporation Income Tax Return Hawaii gov. can signNowly reduce the time spent on document management. Its user-friendly platform allows for quick eSigning and easy tracking, ensuring timely submissions. Additionally, the ability to maintain organized records aids in future reference and compliance.

Get more for Form N 30, Rev , Corporation Income Tax Return Hawaii gov

Find out other Form N 30, Rev , Corporation Income Tax Return Hawaii gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors