Hawaii Form N 11 2019

What is the Hawaii Form N-11

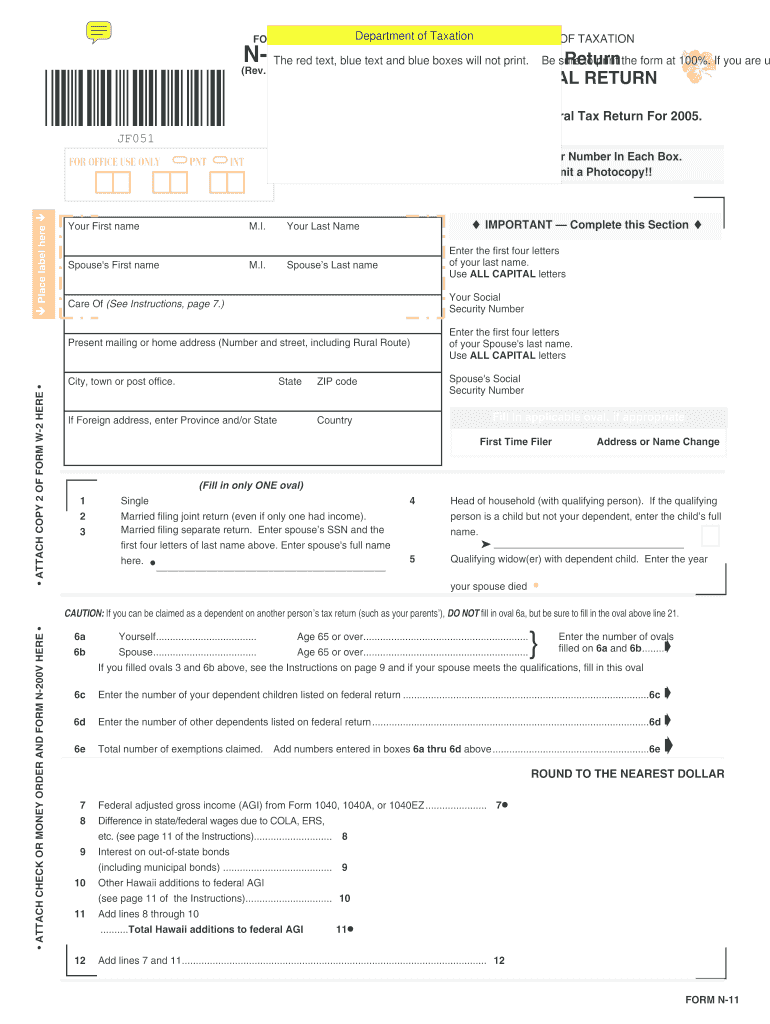

The Hawaii Form N-11 is the state's individual income tax return form, designed for residents who earn income in Hawaii. This form is essential for reporting income, calculating tax liability, and claiming any applicable credits or deductions. It is specifically tailored for individuals, including those who are self-employed, and is used to ensure compliance with state tax laws.

How to use the Hawaii Form N-11

To effectively use the Hawaii Form N-11, taxpayers need to follow a systematic approach. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, complete the form by accurately entering personal information, income details, and deductions. After filling out the form, review it for accuracy before submitting it to the state tax office. Utilizing digital tools can simplify this process, allowing for easier completion and submission.

Steps to complete the Hawaii Form N-11

Completing the Hawaii Form N-11 involves several key steps:

- Gather all relevant financial documents, such as income statements and tax forms.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and investment earnings.

- Claim any deductions or credits you are eligible for, such as the standard deduction or tax credits.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail to the appropriate tax authority.

Legal use of the Hawaii Form N-11

The Hawaii Form N-11 is legally binding when completed and submitted according to state tax laws. It must be signed by the taxpayer, affirming that the information provided is accurate and complete. Failure to comply with tax regulations can result in penalties, including fines or interest on unpaid taxes. Therefore, it is crucial to ensure that the form is filled out correctly and submitted on time.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii Form N-11 are typically aligned with federal tax deadlines. Generally, the form must be submitted by April 20 for the previous tax year. If additional time is needed, taxpayers may request an extension, but they should still estimate and pay any owed taxes by the original deadline to avoid penalties.

Form Submission Methods

Taxpayers have several options for submitting the Hawaii Form N-11. The form can be filed electronically using approved e-filing software, which is often the quickest method. Alternatively, individuals can print and mail the completed form to the state tax office. In-person submissions may also be possible at designated tax offices, providing a direct option for those who prefer face-to-face assistance.

Quick guide on how to complete hawaii 2005 form n 11

Effortlessly Prepare Hawaii Form N 11 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Hawaii Form N 11 on any device with the airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

The Easiest Way to Modify and eSign Hawaii Form N 11

- Obtain Hawaii Form N 11 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow specially offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Carefully review the information and click the Done button to save your modifications.

- Choose how you want to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes requiring new printed copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Alter and eSign Hawaii Form N 11 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hawaii 2005 form n 11

Create this form in 5 minutes!

How to create an eSignature for the hawaii 2005 form n 11

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is Hawaii Form N 11 and why is it important?

Hawaii Form N 11 is a crucial document for taxpayers in Hawaii, as it is used for individual income tax purposes. Understanding how to fill it out correctly ensures compliance with state tax regulations. Using airSlate SignNow simplifies this process by allowing you to easily eSign and submit your Hawaii Form N 11 securely.

-

How can airSlate SignNow assist with filling out Hawaii Form N 11?

airSlate SignNow provides an intuitive interface that guides you in filling out Hawaii Form N 11 efficiently. Our platform offers customizable templates and supports electronic signatures, ensuring that you can complete your forms accurately and effortlessly. This streamlines your tax filing process, making it less stressful.

-

Is there a cost associated with using airSlate SignNow for Hawaii Form N 11?

Yes, airSlate SignNow offers competitive pricing plans tailored to your business needs, allowing you to manage documents like the Hawaii Form N 11 without breaking the bank. We provide various subscription options, so you can choose the one that best fits your budget. Enjoy a cost-effective solution for your eSigning and documentation needs.

-

What features does airSlate SignNow offer for Hawaii Form N 11?

airSlate SignNow includes features such as customizable templates, bulk sending, and secure cloud storage for Hawaii Form N 11 and other documents. The platform also supports integrations with popular applications, enhancing your productivity. These features ensure you can handle your documents efficiently and securely.

-

Can I track the status of my Hawaii Form N 11 with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Hawaii Form N 11 in real-time. You will receive notifications regarding document views, completions, and eSignature statuses, providing full transparency throughout the process. This feature helps you stay organized and informed.

-

What are the benefits of using airSlate SignNow for Hawaii Form N 11?

Using airSlate SignNow for Hawaii Form N 11 offers numerous benefits, including enhanced security, time savings, and improved compliance. Our platform ensures that your documents are securely stored and accessed, while the streamlined signing process speeds up your tax filing. Additionally, it helps minimize errors associated with manual processes.

-

Is airSlate SignNow compliant with Hawaii tax regulations for Form N 11?

Absolutely, airSlate SignNow is designed to comply with Hawaii tax regulations and standards, ensuring that your submissions, including Hawaii Form N 11, are valid and secure. Our platform keeps you updated with the latest compliance requirements, helping you adhere to local laws effortlessly. This means peace of mind as you file your taxes.

Get more for Hawaii Form N 11

- 283c form

- Optumrx reimbursement online form

- State form 43709 5476796

- Mobile home inspection checklist pdf form

- Yearbook order form welleby elementary

- Flexsave claim form final ab mb sk

- Scr 14d form 14d terms of settlement ontariocourtforms on

- Mock chartered engineer application form engineers ireland engineersireland

Find out other Hawaii Form N 11

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation