S Corporation Income Tax Department of Taxation Hawaii Gov 2019

What is the S Corporation Income Tax Department of Taxation Hawaii gov

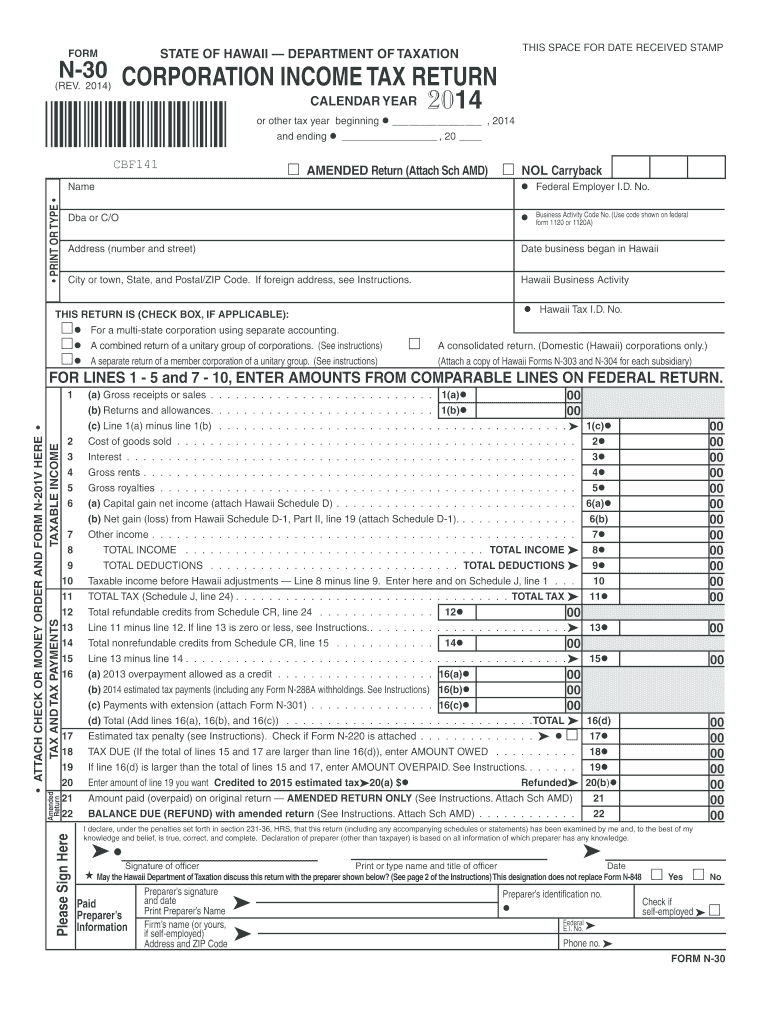

The S Corporation Income Tax Department of Taxation Hawaii gov form is a specific tax document used by S corporations operating in Hawaii. This form is essential for reporting income, deductions, and credits related to S corporation activities. An S corporation is a unique business entity that allows income to pass through to shareholders, avoiding double taxation at the corporate level. Understanding this form is crucial for compliance with state tax laws and ensuring accurate reporting of financial activities.

Steps to complete the S Corporation Income Tax Department of Taxation Hawaii gov

Completing the S Corporation Income Tax Department of Taxation Hawaii gov form involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Ensure you have the correct version of the form, as updates may occur annually.

- Accurately fill out all sections, providing detailed information about the corporation's income and deductions.

- Review the completed form for accuracy and completeness before submission.

- Submit the form by the designated filing deadline to avoid penalties.

Legal use of the S Corporation Income Tax Department of Taxation Hawaii gov

The S Corporation Income Tax Department of Taxation Hawaii gov form is legally binding when completed and submitted according to state regulations. To ensure its legal validity, the form must be signed by an authorized representative of the corporation. Additionally, compliance with eSignature laws is important if submitting electronically. This includes adherence to the ESIGN and UETA acts, which govern the legality of electronic signatures in the United States.

Filing Deadlines / Important Dates

Filing deadlines for the S Corporation Income Tax Department of Taxation Hawaii gov form are critical for compliance. Typically, the form must be filed by the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. It is advisable to check for any updates or changes to these dates annually to avoid late filing penalties.

Required Documents

To complete the S Corporation Income Tax Department of Taxation Hawaii gov form, several documents are required:

- Financial statements, including profit and loss statements.

- Records of all income received during the tax year.

- Documentation of business expenses that can be deducted.

- Shareholder information, including names and ownership percentages.

Form Submission Methods (Online / Mail / In-Person)

The S Corporation Income Tax Department of Taxation Hawaii gov form can be submitted through various methods. Corporations may choose to file online through the Hawaii Department of Taxation's website, which provides a streamlined process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person. Each method has specific guidelines, so it is important to follow the instructions provided for the chosen submission method.

Quick guide on how to complete s corporation income tax department of taxation hawaiigov

Complete S Corporation Income Tax Department Of Taxation Hawaii gov effortlessly on any device

Web-based document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage S Corporation Income Tax Department Of Taxation Hawaii gov on any device with airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The simplest method to alter and electronically sign S Corporation Income Tax Department Of Taxation Hawaii gov with ease

- Locate S Corporation Income Tax Department Of Taxation Hawaii gov and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes requiring the reprinting of new document copies. airSlate SignNow fulfills all your document management demands in just a few clicks from a device of your choice. Edit and electronically sign S Corporation Income Tax Department Of Taxation Hawaii gov while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct s corporation income tax department of taxation hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the s corporation income tax department of taxation hawaiigov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is the S Corporation Income Tax process according to the Department Of Taxation Hawaii gov?

The S Corporation Income Tax process, as outlined by the Department Of Taxation Hawaii gov, involves reporting the income, deductions, and credits of the S corporation. Each shareholder must report their share of income on their personal tax returns. It's essential to follow the guidelines set by the Department Of Taxation to ensure compliance.

-

How can airSlate SignNow assist with S Corporation Income Tax documents?

airSlate SignNow provides an efficient solution to manage S Corporation Income Tax documents. You can easily create, send, and eSign forms required for your tax filings. This helps streamline the process and ensures that your documents are organized and accessible.

-

Are there any costs associated with using airSlate SignNow for S Corporation Income Tax submissions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those focused on S Corporation Income Tax submissions. We provide a cost-effective solution with features designed to enhance your document management experience. Check our pricing page to find the plan that suits your requirements.

-

What features does airSlate SignNow offer for managing S Corporation Income Tax documents?

airSlate SignNow includes features such as secure eSigning, customizable templates, and real-time document tracking, all essential for managing S Corporation Income Tax documents efficiently. Additionally, our solution integrates seamlessly with various software to enhance your workflow, ensuring compliance with Department Of Taxation Hawaii gov requirements.

-

How can I ensure compliance with the Department Of Taxation Hawaii gov using airSlate SignNow?

Using airSlate SignNow helps ensure compliance with the Department Of Taxation Hawaii gov by allowing you to easily manage, store, and sign your S Corporation Income Tax documents securely. Our platform’s compliance features are designed to meet the regulatory requirements set forth by the Department. This minimizes the risk of errors and penalties.

-

What integrations does airSlate SignNow support for S Corporation Income Tax processes?

airSlate SignNow supports various integrations that facilitate S Corporation Income Tax processes. Whether you need to sync with accounting software or document management systems, our platform can easily connect with tools you already use. This integration capability enhances your overall tax management efficiency.

-

Can airSlate SignNow help with the preparation of documents needed for S Corporation Income Tax filings?

Absolutely! airSlate SignNow offers tools that make it easy to prepare necessary documents for S Corporation Income Tax filings. You can create templates for tax forms, ensuring that all required information is collected efficiently, which aligns with the guidelines from the Department Of Taxation Hawaii gov.

Get more for S Corporation Income Tax Department Of Taxation Hawaii gov

Find out other S Corporation Income Tax Department Of Taxation Hawaii gov

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed

- How To eSign Wyoming LLC Operating Agreement

- eSignature North Dakota Quitclaim Deed Fast

- How Can I eSignature Iowa Warranty Deed

- Can I eSignature New Hampshire Warranty Deed

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free

- eSign Louisiana Assignment of intellectual property Fast

- eSign Utah Commercial Lease Agreement Template Online

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template