706 Iowa Inheritance Estate Tax Return Form 2020

What is the 706 Iowa Inheritance Estate Tax Return Form

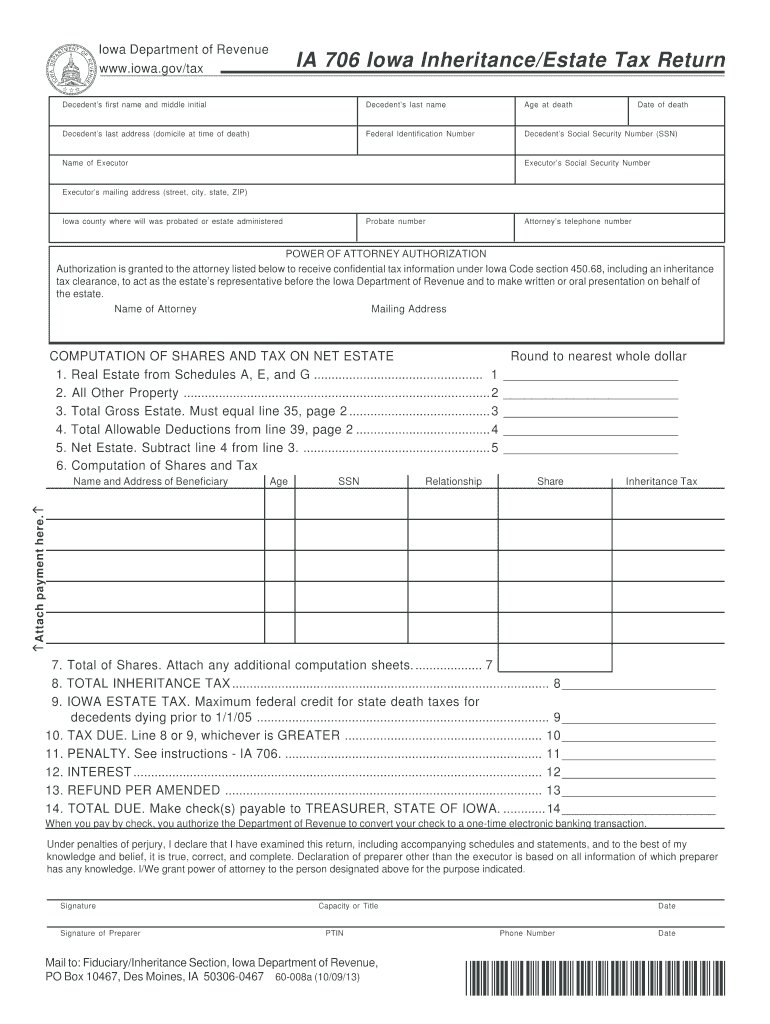

The 706 Iowa Inheritance Estate Tax Return Form is a legal document required for reporting the estate tax obligations of a deceased individual in the state of Iowa. This form is essential for the executor or administrator of an estate to disclose the value of the estate and calculate any taxes owed to the state. It is specifically designed to ensure compliance with Iowa's inheritance tax laws, which may vary based on the relationship of the heirs to the deceased and the total value of the estate.

Steps to complete the 706 Iowa Inheritance Estate Tax Return Form

Completing the 706 Iowa Inheritance Estate Tax Return Form involves several key steps:

- Gather necessary documentation, including the decedent's will, financial statements, and property valuations.

- Determine the total value of the estate by assessing all assets, including real estate, bank accounts, and personal property.

- Identify the beneficiaries and their relationship to the deceased, as this will affect the tax rates applicable.

- Fill out the form accurately, ensuring all required information is provided, including the decedent's details and a breakdown of the estate's assets.

- Review the completed form for accuracy and completeness before submission.

How to obtain the 706 Iowa Inheritance Estate Tax Return Form

The 706 Iowa Inheritance Estate Tax Return Form can be obtained through several means:

- Visit the Iowa Department of Revenue's official website to download the form directly.

- Request a physical copy by contacting the Iowa Department of Revenue office.

- Consult with a tax professional or attorney who can provide the form and assist with its completion.

Key elements of the 706 Iowa Inheritance Estate Tax Return Form

Understanding the key elements of the 706 Iowa Inheritance Estate Tax Return Form is crucial for accurate completion. Important sections include:

- Decedent's information, including full name, date of death, and Social Security number.

- Detailed listing of all assets, including their fair market value at the time of death.

- Identification of beneficiaries and their respective shares of the estate.

- Calculation of the total inheritance tax owed based on the estate's value and applicable tax rates.

Form Submission Methods

The completed 706 Iowa Inheritance Estate Tax Return Form can be submitted through various methods:

- Online submission via the Iowa Department of Revenue's e-filing system, if available.

- Mailing the completed form to the appropriate state office.

- In-person submission at designated Iowa Department of Revenue locations.

Filing Deadlines / Important Dates

Awareness of filing deadlines is critical to avoid penalties. The 706 Iowa Inheritance Estate Tax Return Form must typically be filed within nine months of the decedent's date of death. Extensions may be available under certain circumstances, but they must be requested prior to the original deadline.

Quick guide on how to complete 706 iowa inheritance estate tax return 2013 form

Complete 706 Iowa Inheritance Estate Tax Return Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to acquire the correct document and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without holdups. Manage 706 Iowa Inheritance Estate Tax Return Form on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-driven workflow today.

How to edit and eSign 706 Iowa Inheritance Estate Tax Return Form with ease

- Find 706 Iowa Inheritance Estate Tax Return Form and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to finalize your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign 706 Iowa Inheritance Estate Tax Return Form and guarantee effective communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 706 iowa inheritance estate tax return 2013 form

Create this form in 5 minutes!

How to create an eSignature for the 706 iowa inheritance estate tax return 2013 form

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is the 706 Iowa Inheritance Estate Tax Return Form?

The 706 Iowa Inheritance Estate Tax Return Form is a document required for filing Iowa inheritance tax on estates. It provides details regarding the estate's assets, debts, and evaluations. Properly completing this form ensures compliance with Iowa tax regulations.

-

How can airSlate SignNow help with the 706 Iowa Inheritance Estate Tax Return Form?

airSlate SignNow offers an efficient way to prepare, sign, and eFile the 706 Iowa Inheritance Estate Tax Return Form. Our platform streamlines document management and allows for easy collaboration between stakeholders. This simplifies the process and reduces the chances for errors.

-

Is there a cost associated with using airSlate SignNow for the 706 Iowa Inheritance Estate Tax Return Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost-effectiveness of our platform allows you to handle the 706 Iowa Inheritance Estate Tax Return Form without breaking the bank. You can choose the plan that best suits your requirements.

-

What features does airSlate SignNow provide for managing the 706 Iowa Inheritance Estate Tax Return Form?

With airSlate SignNow, you gain access to features like customizable templates, eSigning capabilities, and secure document storage. These features enhance your experience while working on the 706 Iowa Inheritance Estate Tax Return Form. They ensure your documents are professional and compliant.

-

Can I integrate airSlate SignNow with other applications for the 706 Iowa Inheritance Estate Tax Return Form?

Yes, airSlate SignNow supports various integrations with popular applications. This allows you to easily combine your workflow for preparing the 706 Iowa Inheritance Estate Tax Return Form with the tools you are already using. Enhancing connectivity can increase efficiency in your document processes.

-

How secure is the airSlate SignNow platform when handling the 706 Iowa Inheritance Estate Tax Return Form?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and security protocols to protect your data, including the 706 Iowa Inheritance Estate Tax Return Form. You can have peace of mind knowing your sensitive information is safeguarded.

-

Are there any customer support options available for help with the 706 Iowa Inheritance Estate Tax Return Form?

Absolutely! airSlate SignNow provides comprehensive customer support to assist users with any inquiries concerning the 706 Iowa Inheritance Estate Tax Return Form. Our support team is readily available via chat, email, or phone to help you navigate the process smoothly.

Get more for 706 Iowa Inheritance Estate Tax Return Form

- Warren city dog license form

- Sutter health prior authorization form

- Shikshakara kalyana nidhi application form

- Form llc 12 online

- Security guard medical examination form

- Navmc 11743 black belt 1st degree performance test reformattrd corrected per tecom g 3

- Citi payment safeguard form

- Aeroflow breastpumps order form p p

Find out other 706 Iowa Inheritance Estate Tax Return Form

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile