IA1041 Fidicuary Income Tax Return 63001 Iowa Department of 2019

What is the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of

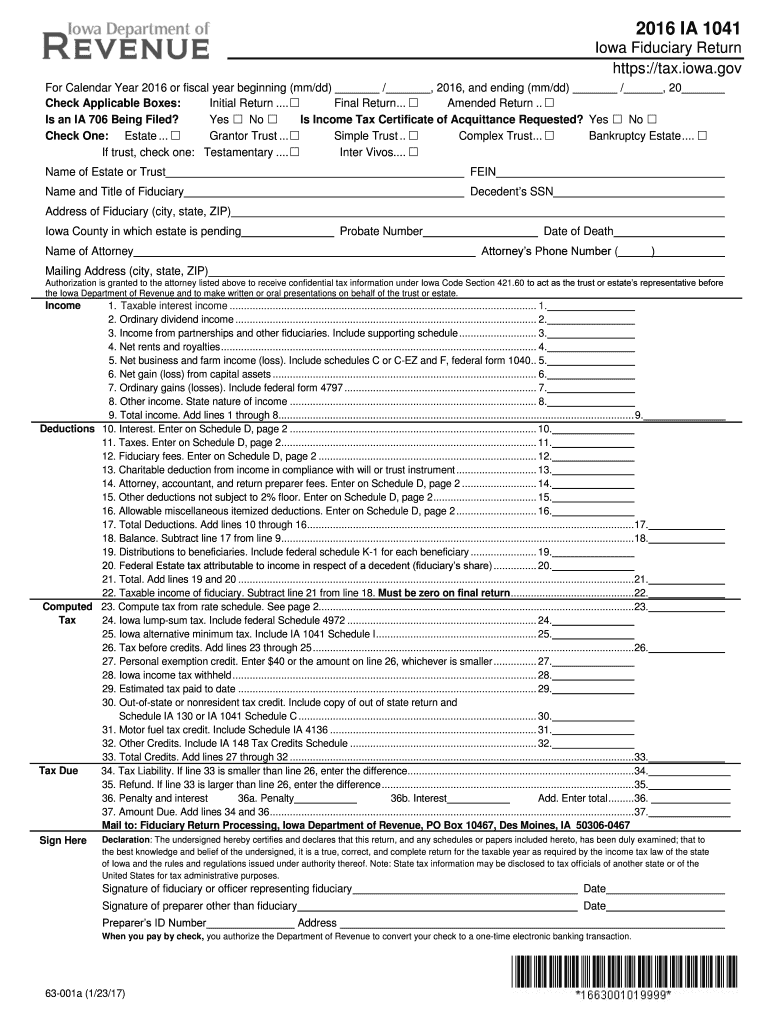

The IA1041 Fiduciary Income Tax Return 63001 is a tax form used by fiduciaries in Iowa to report income, deductions, and tax liability for estates and trusts. This form is essential for ensuring compliance with state tax obligations. It captures various financial activities of the fiduciary, including income generated from investments, distributions to beneficiaries, and any applicable deductions. Understanding the purpose of this form is crucial for fiduciaries managing estates or trusts, as it helps maintain transparency and accountability in financial reporting.

Steps to complete the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of

Completing the IA1041 Fiduciary Income Tax Return involves several key steps. First, gather all relevant financial documents, including income statements, expense records, and any prior tax returns for the estate or trust. Next, fill out the form accurately, ensuring that all income sources and deductions are reported. Be mindful of the specific instructions provided by the Iowa Department of Revenue, as they outline necessary details for each section of the form. After completing the form, review it for accuracy and completeness. Finally, submit the form by the designated deadline to avoid penalties.

Legal use of the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of

The IA1041 Fiduciary Income Tax Return is legally binding when completed and submitted according to Iowa tax laws. This form must be filed by fiduciaries to report the financial activities of trusts and estates, ensuring compliance with state regulations. It is essential for fiduciaries to understand that providing false information or failing to file can result in legal consequences, including fines or penalties. Therefore, accurate reporting and adherence to legal guidelines are critical components of the fiduciary's responsibilities.

Required Documents for the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of

To complete the IA1041 Fiduciary Income Tax Return, several documents are required. These typically include:

- Financial statements for the estate or trust

- Records of income received, such as interest, dividends, and rental income

- Documentation of expenses and deductions, including administrative costs and distributions to beneficiaries

- Prior year tax returns for reference

Having these documents organized and readily available will streamline the completion of the tax return and help ensure accuracy in reporting.

Filing Deadlines / Important Dates for the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of

Filing deadlines for the IA1041 Fiduciary Income Tax Return are critical for compliance. Generally, the return is due on the first day of the fourth month following the close of the tax year. For estates or trusts operating on a calendar year, this typically falls on April 1. It is important to be aware of any extensions that may be available and to keep track of specific dates to avoid late filing penalties. Fiduciaries should also monitor any changes in deadlines announced by the Iowa Department of Revenue.

Who Issues the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of

The IA1041 Fiduciary Income Tax Return is issued by the Iowa Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers in Iowa. The department provides guidance and resources to assist fiduciaries in understanding their obligations and completing the form correctly. For any questions or clarifications regarding the form, fiduciaries can refer to the Iowa Department of Revenue's official resources.

Quick guide on how to complete ia1041 fidicuary income tax return 63001 iowa department of

Prepare IA1041 Fidicuary Income Tax Return 63001 Iowa Department Of effortlessly on any device

Online document management has gained popularity among companies and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and without complications. Manage IA1041 Fidicuary Income Tax Return 63001 Iowa Department Of on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign IA1041 Fidicuary Income Tax Return 63001 Iowa Department Of effortlessly

- Obtain IA1041 Fidicuary Income Tax Return 63001 Iowa Department Of and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign IA1041 Fidicuary Income Tax Return 63001 Iowa Department Of and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ia1041 fidicuary income tax return 63001 iowa department of

Create this form in 5 minutes!

How to create an eSignature for the ia1041 fidicuary income tax return 63001 iowa department of

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of?

The IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of is a tax form used by fiduciaries to report income and pay taxes on behalf of estates and trusts in Iowa. It is crucial for compliant tax filing, ensuring that the fiduciary meets all state tax obligations.

-

How can airSlate SignNow assist with filing the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of?

airSlate SignNow streamlines the process of preparing and signing the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of by providing a user-friendly platform to create, send, and eSign documents. With its features, you can easily manage workflows and ensure secure document handling.

-

Are there any fees associated with using airSlate SignNow for the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of?

Yes, airSlate SignNow offers flexible pricing plans, including cost-effective options tailored to meet the needs of businesses handling the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of. You can choose a plan that aligns with your document management requirements.

-

What are the main benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for managing the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of provides several benefits, including enhanced security, reduced administrative time, and improved accuracy. The platform simplifies the signing process, ensuring timely compliance with tax deadlines.

-

Can airSlate SignNow integrate with accounting software for tax filing?

Absolutely, airSlate SignNow can integrate seamlessly with various accounting software that helps in managing the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of. This integration enhances productivity by allowing you to sync your tax documents directly with your accounting tools.

-

What features does airSlate SignNow offer to simplify the tax return process?

airSlate SignNow offers features like customizable templates, automated reminders, and real-time tracking for documents related to the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of. These tools help ensure that all necessary signatures and approvals are obtained efficiently.

-

Is airSlate SignNow suitable for both individuals and businesses filing the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of?

Yes, airSlate SignNow is suitable for both individuals and businesses needing to file the IA1041 Fiduciary Income Tax Return 63001 Iowa Department Of. Its easy-to-use platform caters to a range of users, ensuring everyone can manage their tax documents effectively.

Get more for IA1041 Fidicuary Income Tax Return 63001 Iowa Department Of

Find out other IA1041 Fidicuary Income Tax Return 63001 Iowa Department Of

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure