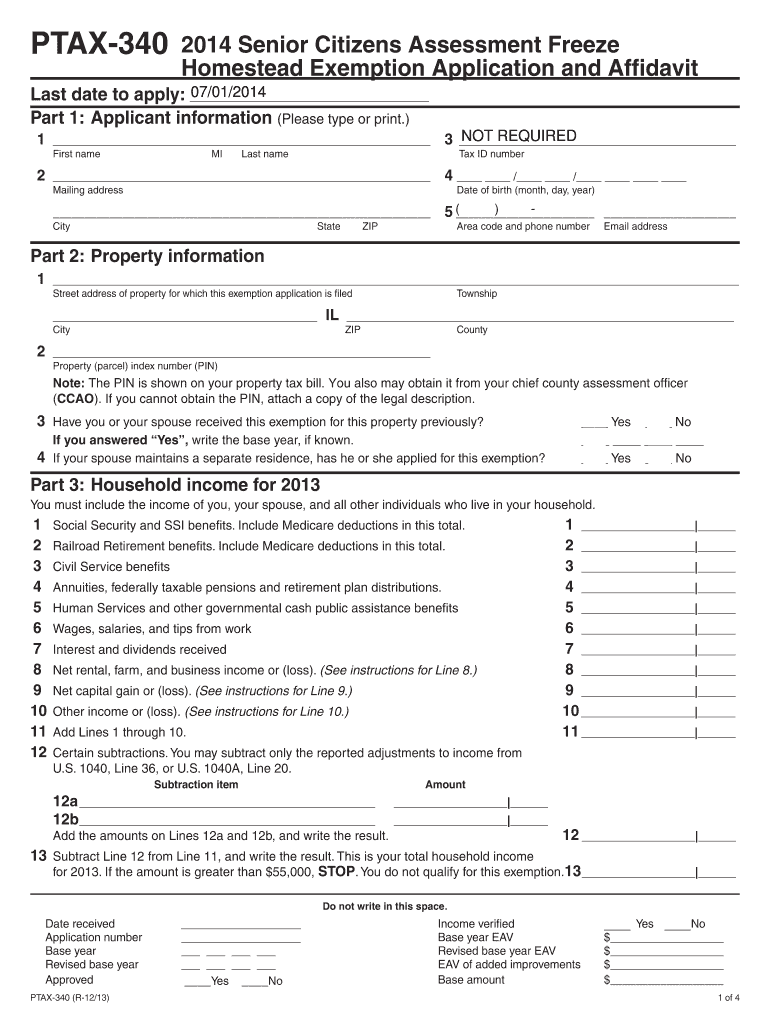

PTAX 340 Senior Citizens Assessment Ze Homestead Exemption Application and Affidavit JULY 1, Last Date to Apply Part 1 Applicant 2020

What is the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit?

The PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit is a form used in Clinton County, Illinois, to apply for a property tax exemption specifically designed for senior citizens. This exemption can significantly reduce the property tax burden for eligible seniors, allowing them to keep more of their income for essential expenses. The application must be completed accurately and submitted by the designated deadline to ensure eligibility for the exemption.

Steps to Complete the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit

Completing the PTAX 340 form involves several important steps:

- Gather necessary documents, including proof of age and residency.

- Fill out the applicant information section clearly, ensuring all details are accurate.

- Provide any required signatures and dates as specified on the form.

- Review the completed application for any errors or omissions.

- Submit the application by the deadline, either online, by mail, or in person.

Eligibility Criteria for the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit

To qualify for the homestead exemption, applicants must meet specific eligibility criteria. Generally, applicants must be at least sixty-five years old, own and occupy the property for which they are applying, and meet certain income limits. It is essential to check the latest regulations and income thresholds to ensure compliance.

Required Documents for the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit

When completing the PTAX 340 form, applicants need to provide several documents to support their application:

- Proof of age, such as a driver's license or birth certificate.

- Documentation of residency, like a utility bill or lease agreement.

- Income verification, which may include tax returns or pay stubs.

Filing Deadlines for the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit

The deadline to submit the PTAX 340 application is July 1 of the assessment year. It is crucial to adhere to this deadline to ensure that the exemption is applied for the current tax year. Late submissions may result in the loss of the exemption for that year.

Form Submission Methods for the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit

Applicants can submit the PTAX 340 form through various methods:

- Online submission via the designated state or county website.

- Mailing the completed form to the appropriate local tax office.

- In-person submission at the local tax assessor's office during business hours.

Quick guide on how to complete ptax 340 2016 senior citizens assessment freeze homestead exemption application and affidavit july 1 2016 last date to apply

Accomplish PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit JULY 1, Last Date To Apply Part 1 Applicant effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary forms and securely save them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit JULY 1, Last Date To Apply Part 1 Applicant on any platform using airSlate SignNow’s Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and electronically sign PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit JULY 1, Last Date To Apply Part 1 Applicant effortlessly

- Find PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit JULY 1, Last Date To Apply Part 1 Applicant and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or mask sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit JULY 1, Last Date To Apply Part 1 Applicant to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ptax 340 2016 senior citizens assessment freeze homestead exemption application and affidavit july 1 2016 last date to apply

Create this form in 5 minutes!

How to create an eSignature for the ptax 340 2016 senior citizens assessment freeze homestead exemption application and affidavit july 1 2016 last date to apply

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit?

The PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit is a crucial document that allows eligible seniors in Clinton County, Illinois, to apply for a tax exemption on their property. This application must be submitted by July 1 to qualify for the relevant tax year, and it provides financial relief to senior homeowners.

-

How do I complete the PTAX 340 form for Clinton County, Illinois?

To complete the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit, individuals need to fill in required details such as applicant information, property details, and proof of age. Ensure that you type or print clearly to avoid processing delays, and remember to submit it before the July 1 deadline.

-

Who is eligible to apply for the PTAX 340 exemption?

Eligibility for the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit includes being a senior citizen, residing in the property, and meeting specific income criteria. It's important to review the guidelines in Clinton County, Illinois, to ensure you qualify before applying.

-

What documents do I need to submit with my PTAX 340 application?

Along with the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit, you will typically need to provide proof of age, residency documentation, and possibly your income statements. Having these documents ready will streamline the application process in Clinton County, Illinois.

-

What happens if I miss the July 1 application deadline?

If you miss the July 1 deadline for the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit, you may not receive the tax exemption for the current year. It's crucial to keep track of these deadlines to ensure you can benefit from the potential savings on your property taxes in Clinton County, Illinois.

-

Can I apply for the PTAX 340 exemption online?

Currently, the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit must be submitted via mail or in person in Clinton County, Illinois. However, you can find resources and guidelines online to assist you in completing the application process efficiently.

-

What benefits does the PTAX 340 exemption provide for seniors?

Applying for the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit can signNowly reduce property tax expenses for seniors in Clinton County, Illinois. This exemption can provide financial relief, allowing more funds for daily living and other essential needs for eligible seniors.

Get more for PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit JULY 1, Last Date To Apply Part 1 Applicant

- Pa schedule w2s form

- Ratio word problems worksheets pdf form

- Plumbing aptitude test practice pdf form

- Certified copy application form pdf

- Cancer paperwork form

- Franklin county area tax bureau 100032708 form

- Assam gramin vikash bank internet banking pdf form

- Travel expense claiming footnote this form is to

Find out other PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit JULY 1, Last Date To Apply Part 1 Applicant

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement