Quarterly Tax Return for Boone County Kentucky Boonecountyky 2020

What is the Quarterly Tax Return for Boone County, Kentucky?

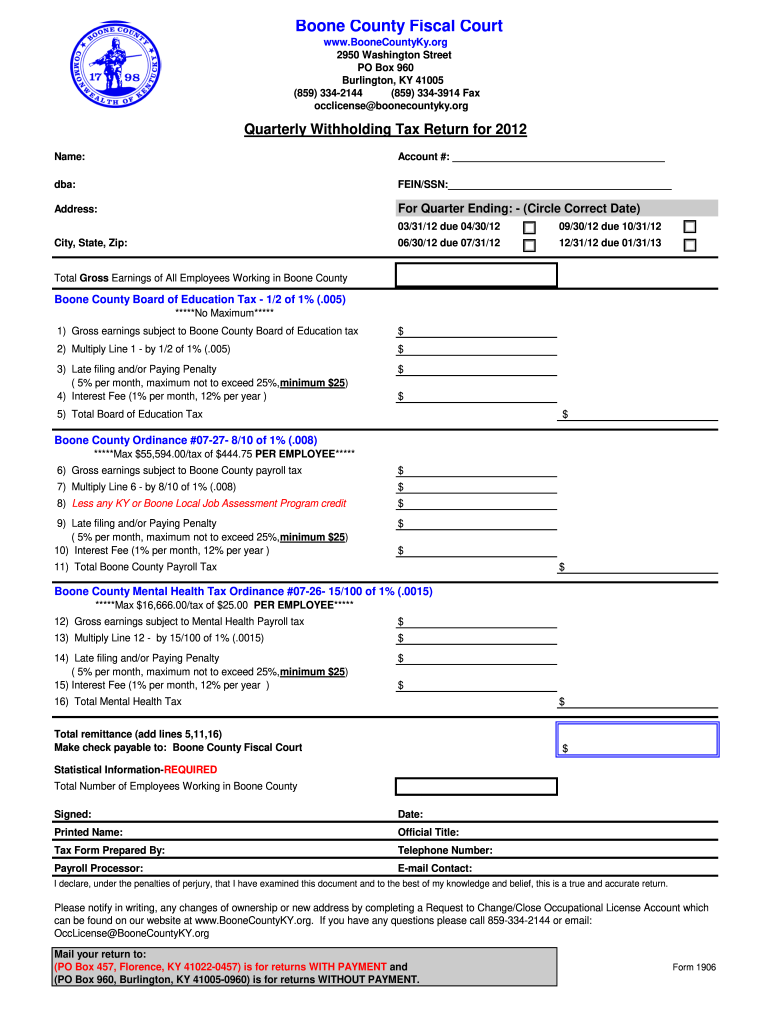

The Quarterly Tax Return for Boone County, Kentucky, is a document that businesses and self-employed individuals must file to report their income and calculate the taxes owed for a specific quarter. This form is essential for ensuring compliance with local tax regulations and helps maintain accurate financial records. It typically includes information about gross receipts, deductions, and the total tax liability for the reporting period. Understanding this form is crucial for anyone operating a business in Boone County, as it directly impacts tax obligations and financial planning.

Steps to Complete the Quarterly Tax Return for Boone County, Kentucky

Completing the Quarterly Tax Return for Boone County involves several key steps:

- Gather necessary documents: Collect all relevant financial records, including income statements, expense receipts, and previous tax returns.

- Fill out the form: Accurately enter your business income, allowable deductions, and calculate your tax liability based on the provided guidelines.

- Review the information: Double-check all entries for accuracy to avoid mistakes that could lead to penalties.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent by the deadline.

Legal Use of the Quarterly Tax Return for Boone County, Kentucky

The Quarterly Tax Return for Boone County is legally binding and must be completed in accordance with local tax laws. Filing this form accurately is essential for compliance with the Boone County tax authority. Failure to file or inaccuracies can result in penalties, interest on unpaid taxes, and potential legal consequences. It is important to understand the legal implications of the information provided on this form to avoid issues with tax authorities.

Filing Deadlines / Important Dates

Adhering to filing deadlines is crucial for maintaining compliance with tax regulations. The Quarterly Tax Return for Boone County typically has specific due dates, which are usually aligned with the end of each quarter. For example, returns for the first quarter might be due by April 30, the second quarter by July 31, the third quarter by October 31, and the fourth quarter by January 31 of the following year. Marking these dates on your calendar helps ensure timely submission and avoids penalties.

Required Documents for the Quarterly Tax Return for Boone County, Kentucky

When preparing to file the Quarterly Tax Return, certain documents are necessary to ensure accurate reporting:

- Income statements: Detailed records of all income generated during the quarter.

- Expense receipts: Documentation of all business-related expenses that can be deducted.

- Previous tax returns: Reference to past filings can provide insight into your tax situation and help ensure consistency.

Form Submission Methods for the Quarterly Tax Return

The Quarterly Tax Return for Boone County can be submitted through various methods, providing flexibility for taxpayers:

- Online submission: Many businesses opt to file electronically through secure platforms, which can streamline the process.

- Mail: Printed forms can be mailed to the appropriate tax authority address, ensuring sufficient time for delivery.

- In-person submission: Taxpayers may also choose to deliver their forms directly to the local tax office for immediate processing.

Quick guide on how to complete quarterly tax return for 2012 boone county kentucky boonecountyky

Complete Quarterly Tax Return For Boone County Kentucky Boonecountyky effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally-friendly alternative to traditional printed and signed papers, as you can access the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents rapidly without delays. Manage Quarterly Tax Return For Boone County Kentucky Boonecountyky on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The simplest way to modify and eSign Quarterly Tax Return For Boone County Kentucky Boonecountyky with ease

- Find Quarterly Tax Return For Boone County Kentucky Boonecountyky and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your edits.

- Choose how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed out. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign Quarterly Tax Return For Boone County Kentucky Boonecountyky and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct quarterly tax return for 2012 boone county kentucky boonecountyky

Create this form in 5 minutes!

How to create an eSignature for the quarterly tax return for 2012 boone county kentucky boonecountyky

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is a Quarterly Tax Return For Boone County Kentucky Boonecountyky?

A Quarterly Tax Return For Boone County Kentucky Boonecountyky is a tax form businesses are required to file every three months to report their income, expenses, and tax liabilities. This ensures that you stay compliant with state tax regulations and helps avoid penalties. Utilizing e-signature solutions like airSlate SignNow can streamline this process.

-

How can airSlate SignNow help with filing a Quarterly Tax Return For Boone County Kentucky Boonecountyky?

airSlate SignNow provides an efficient platform for preparing and signing your Quarterly Tax Return For Boone County Kentucky Boonecountyky. By using our service, you can easily create, send, and eSign your tax documents, ensuring timely submission and compliance with state requirements. Our user-friendly interface makes the entire process simple and fast.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as document templates, e-signature capabilities, and secure storage for your Quarterly Tax Return For Boone County Kentucky Boonecountyky. These tools simplify not only your tax documentation process but also help track and manage all your paperwork efficiently. Our platform is designed to enhance productivity and reduce errors in document management.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, there is a subscription fee for using airSlate SignNow, but we offer various pricing plans to fit different budgets and business needs. These plans allow you to efficiently handle your Quarterly Tax Return For Boone County Kentucky Boonecountyky and other document requirements without breaking the bank. By investing in our service, you also gain access to valuable tax management features.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow can seamlessly integrate with many popular accounting software systems, making it easier to manage your Quarterly Tax Return For Boone County Kentucky Boonecountyky. This integration ensures that all your financial data is synchronized and accessible in one place, providing greater accuracy and efficiency in your tax filings.

-

What are the benefits of using airSlate SignNow for my Quarterly Tax Return For Boone County Kentucky Boonecountyky?

Using airSlate SignNow for your Quarterly Tax Return For Boone County Kentucky Boonecountyky offers several benefits including faster processing times, enhanced security features, and cost savings. Our platform reduces the need for physical paperwork and allows you to eSign documents from anywhere, enhancing convenience for your business operations.

-

How secure is my information when using airSlate SignNow for tax returns?

airSlate SignNow prioritizes your data security, employing industry-standard encryption and compliance protocols to protect your Quarterly Tax Return For Boone County Kentucky Boonecountyky and other sensitive information. Our platform features secure cloud storage and various authentication methods to ensure that your documents remain private and secure.

Get more for Quarterly Tax Return For Boone County Kentucky Boonecountyky

Find out other Quarterly Tax Return For Boone County Kentucky Boonecountyky

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF