it 2105 9 Form 2020

What is the It 2105 9 Form

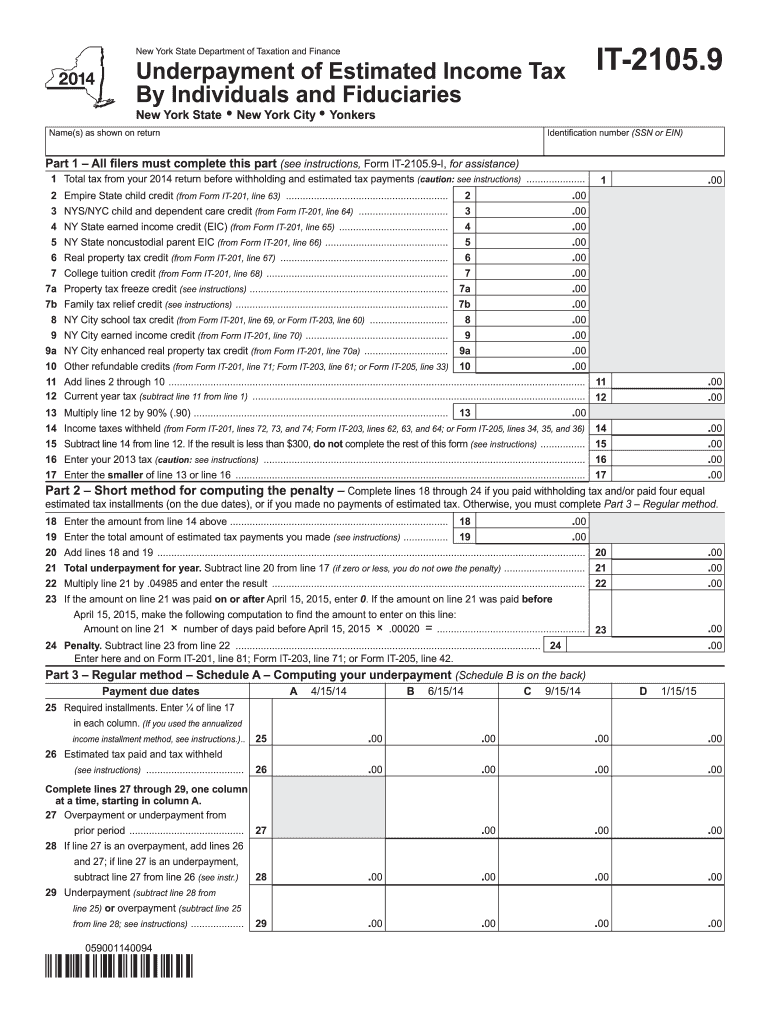

The It 2105 9 Form is a tax-related document used primarily in the United States. It serves as a means for taxpayers to report specific income and deductions to the Internal Revenue Service (IRS). This form is particularly relevant for individuals and businesses who need to provide detailed information regarding their financial activities. Understanding the purpose of this form is essential for ensuring compliance with federal tax regulations.

How to use the It 2105 9 Form

Using the It 2105 9 Form involves several steps to ensure accurate completion and submission. Taxpayers should first gather all necessary financial documents, including income statements and receipts for deductions. Once the required information is compiled, the form can be filled out either digitally or on paper. It is important to follow the instructions provided on the form to avoid errors that could lead to delays or penalties.

Steps to complete the It 2105 9 Form

Completing the It 2105 9 Form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents.

- Read the instructions provided with the form to understand each section.

- Fill out the form accurately, ensuring all information is complete.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, either online or by mail.

Legal use of the It 2105 9 Form

The It 2105 9 Form must be used in accordance with IRS regulations to maintain its legal validity. This includes ensuring that all information provided is truthful and accurate. Failure to comply with these regulations can result in penalties or legal repercussions. It is essential for taxpayers to understand their obligations when using this form to avoid any issues with the IRS.

Filing Deadlines / Important Dates

Timely submission of the It 2105 9 Form is crucial to avoid penalties. Typically, the filing deadline aligns with the annual tax return due date, which is usually April fifteenth. However, taxpayers should verify specific dates each year, as they may vary. Being aware of these deadlines helps ensure compliance and prevents unnecessary complications.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the It 2105 9 Form. The form can be filed online through the IRS website or using approved tax software. Alternatively, individuals may choose to print the form and mail it to the appropriate IRS address. In-person submissions are generally not common for this form, but taxpayers can consult with tax professionals for guidance if needed.

Eligibility Criteria

Eligibility to use the It 2105 9 Form depends on various factors, including income level, filing status, and specific financial situations. Generally, individuals and businesses that meet the IRS criteria for reporting income and deductions must utilize this form. It is advisable to review the eligibility requirements outlined by the IRS to determine if this form is applicable to your situation.

Quick guide on how to complete 2014 it 2105 9 form

Complete It 2105 9 Form seamlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers a perfect eco-friendly substitute to conventional printed and signed paperwork, as you can locate the right form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without holdups. Handle It 2105 9 Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign It 2105 9 Form effortlessly

- Locate It 2105 9 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as an ordinary wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Modify and eSign It 2105 9 Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 it 2105 9 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 it 2105 9 form

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is the It 2105 9 Form?

The It 2105 9 Form is a tax-related document that allows individuals to report certain types of income and calculate their New York State income tax. It serves as a vital tool for ensuring compliance with state tax regulations. By using the airSlate SignNow platform, you can easily prepare and eSign your It 2105 9 Form.

-

How does airSlate SignNow simplify the It 2105 9 Form process?

airSlate SignNow streamlines the It 2105 9 Form process by providing a user-friendly interface for document preparation and electronic signatures. This automation saves time and reduces errors, making it easier for users to complete their forms accurately. With SignNow, you can focus on your tax filings instead of paperwork.

-

Is there a cost associated with using airSlate SignNow for the It 2105 9 Form?

There are various pricing plans available for using airSlate SignNow, including a free trial option. The cost varies based on the chosen plan, but all options provide access to essential features for managing your It 2105 9 Form efficiently. Investing in SignNow can ultimately save you time and resources.

-

Can I integrate airSlate SignNow with other applications for my It 2105 9 Form?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easy to sync data and manage your It 2105 9 Form alongside other business tools. You can integrate with platforms like Google Drive, Dropbox, and more to enhance your workflow. This capability helps in centralizing your documents and boosting productivity.

-

What are the benefits of using airSlate SignNow for the It 2105 9 Form?

Using airSlate SignNow for the It 2105 9 Form provides numerous benefits, including increased efficiency, reduced errors, and enhanced security for your sensitive documents. The electronic signature feature allows for quick approvals, meaning you can finalize your forms faster. Overall, it offers a more convenient way to handle your tax documents.

-

How secure is my information when using airSlate SignNow for the It 2105 9 Form?

airSlate SignNow prioritizes user security and utilizes advanced encryption to protect your information, including your It 2105 9 Form. This ensures that your sensitive data remains confidential and safe from unauthorized access. Trust in SignNow's robust security measures to safeguard your tax-related documents.

-

Can multiple users collaborate on the It 2105 9 Form with airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on your It 2105 9 Form, streamlining group efforts in preparing and reviewing documents. Collaboration features enhance teamwork by enabling real-time edits and feedback. This capability makes it easier to gather necessary approvals and complete your documents promptly.

Get more for It 2105 9 Form

Find out other It 2105 9 Form

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple