St 100 Form 2020

What is the St 100 Form

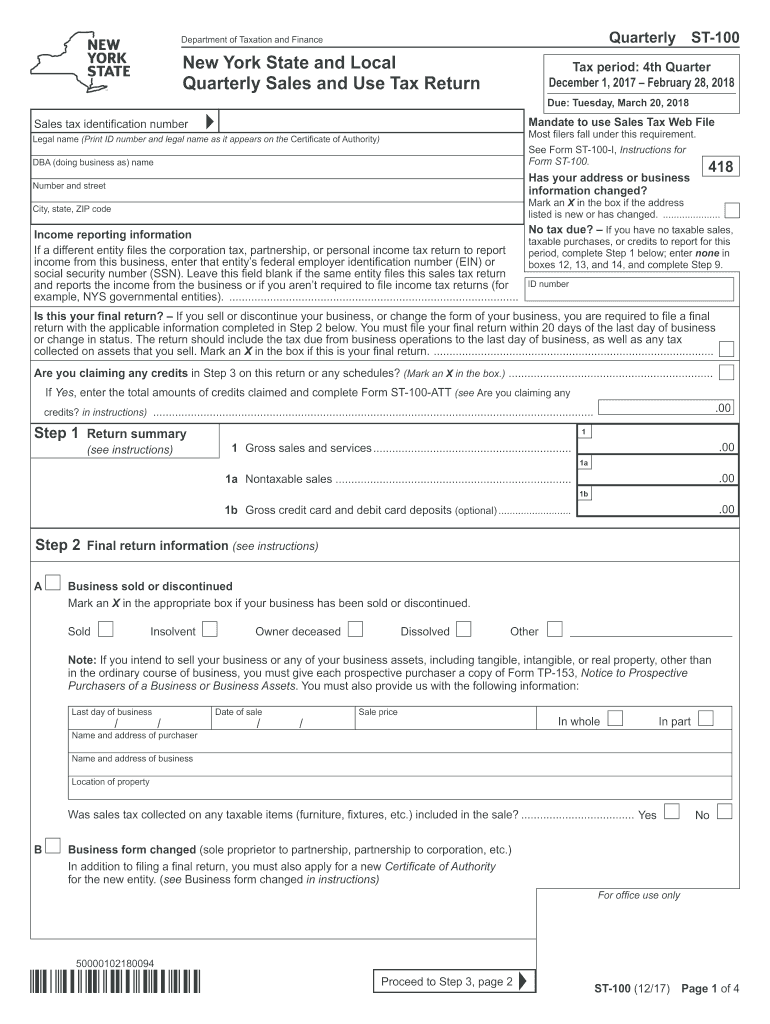

The St 100 Form is a crucial document used primarily for tax purposes in the United States. It serves as a sales and use tax return form, allowing businesses to report their taxable sales and remit the appropriate taxes to the state. This form is essential for ensuring compliance with state tax regulations and helps businesses maintain accurate financial records. Understanding the purpose and requirements of the St 100 Form is vital for any business owner looking to operate within the legal framework of tax obligations.

How to use the St 100 Form

Using the St 100 Form involves several key steps to ensure accurate reporting and compliance. First, gather all necessary financial records related to sales, purchases, and tax collected. Next, fill out the form with details such as total sales, exempt sales, and the amount of tax due. It is important to review the completed form for accuracy before submission. Once verified, the form can be submitted either online or by mail, depending on the state’s requirements. Keeping a copy of the submitted form for your records is also advisable.

Steps to complete the St 100 Form

Completing the St 100 Form requires careful attention to detail. Follow these steps for accurate completion:

- Gather all relevant sales records and receipts.

- Identify any exempt sales and document them accordingly.

- Calculate the total sales and the corresponding sales tax collected.

- Fill in the form with the necessary information, including business details and tax amounts.

- Review the form for any errors or omissions.

- Submit the form by the specified deadline, either online or by mail.

Legal use of the St 100 Form

The St 100 Form has legal implications for businesses, as it is used to report sales tax liabilities to the state. Proper use of this form ensures compliance with state tax laws, helping businesses avoid penalties and legal issues. It is important to understand the legal requirements surrounding the form, including filing deadlines and accuracy in reporting. Failure to comply with these regulations can result in fines or other legal consequences, making it essential for businesses to prioritize the correct use of the St 100 Form.

Key elements of the St 100 Form

Several key elements must be included when completing the St 100 Form to ensure it is valid and compliant. These elements include:

- Business name and address

- Tax identification number

- Total sales amount

- Amount of tax collected

- Exempt sales details

- Signature of the authorized person

Each of these components plays a critical role in the processing of the form and the accurate calculation of tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the St 100 Form vary by state and can depend on the frequency of tax reporting required (monthly, quarterly, or annually). It is essential to be aware of these deadlines to avoid late fees and penalties. Businesses should maintain a calendar of important dates related to tax filings, including the due date for submitting the St 100 Form and any associated payments. Staying informed about these deadlines helps ensure timely compliance with tax obligations.

Quick guide on how to complete 2011 st 100 form

Complete St 100 Form effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Handle St 100 Form on any platform with airSlate SignNow's Android or iOS apps and enhance any document-related process today.

The easiest way to alter and eSign St 100 Form without hassle

- Locate St 100 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure confidential details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your needs in document management in just a few clicks from any device of your choice. Alter and eSign St 100 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 st 100 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 st 100 form

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the St 100 Form?

The St 100 Form is a tax form used by New York businesses to report sales and use tax. It allows businesses to accurately report their tax liability and claims for refunds. Utilizing airSlate SignNow can make this process easier by enabling electronic signing and submission.

-

How can airSlate SignNow help with the St 100 Form?

airSlate SignNow streamlines the process of completing the St 100 Form by allowing users to electronically sign documents and collaborate with team members. This reduces errors and improves turnaround times for tax submissions. By using our platform, businesses can maintain compliance while saving valuable time.

-

What features does airSlate SignNow offer for managing the St 100 Form?

airSlate SignNow provides features such as document templates, secure e-signatures, and audit trails that are essential for managing the St 100 Form. These tools enhance accuracy and compliance, making it easier for businesses to handle their sales tax reports. Additionally, integrations with popular accounting software can simplify data management.

-

Is airSlate SignNow cost-effective for filing the St 100 Form?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to file the St 100 Form. Our flexible pricing plans cater to different business sizes, ensuring affordability without compromising on features. By reducing paper use and processing time, airSlate SignNow helps in lowering overall operational costs.

-

Are there any integrations available for the St 100 Form with airSlate SignNow?

airSlate SignNow offers seamless integrations with various accounting and tax software, making it easy to manage the St 100 Form. These integrations ensure that your financial data is accurate and up-to-date. This connectivity simplifies workflows, allowing users to focus on their core business operations.

-

How secure is the submission of the St 100 Form through airSlate SignNow?

The submission of the St 100 Form through airSlate SignNow is highly secure, with industry-standard encryption and compliance with data protection regulations. Our platform ensures that sensitive information is protected during transmission and storage. Users can have peace of mind knowing their documents are handled securely.

-

Can multiple users collaborate on the St 100 Form using airSlate SignNow?

Yes, airSlate SignNow allows for collaboration among multiple users when working on the St 100 Form. Team members can comment, edit, and sign the form seamlessly, ensuring that every stakeholder is involved in the process. This collaborative feature enhances accuracy and speeds up the submission process.

Get more for St 100 Form

Find out other St 100 Form

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document