Ct 3 S Form 2020

What is the Ct 3 S Form

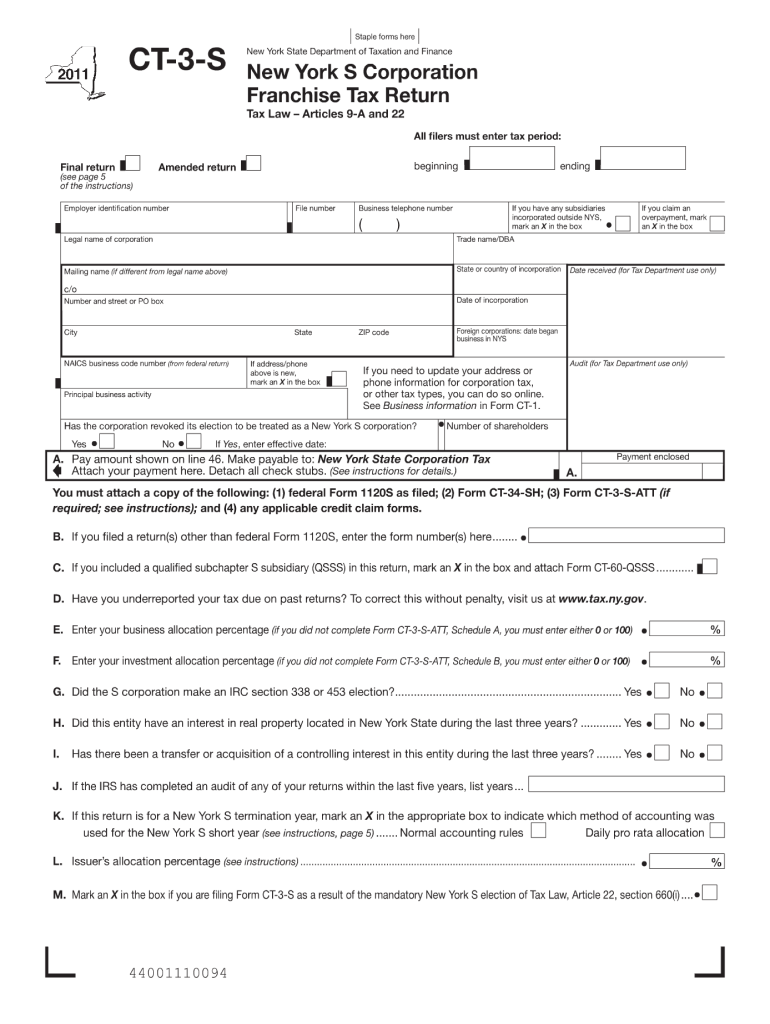

The Ct 3 S Form is a tax form used by businesses in the United States, specifically for reporting and calculating the state corporate tax. This form is essential for corporations that are subject to the state’s corporate income tax, allowing them to declare their income, deductions, and credits. The form helps ensure compliance with state tax laws and provides the necessary information for accurate tax assessments.

How to use the Ct 3 S Form

Using the Ct 3 S Form involves several key steps. First, gather all relevant financial information, including income statements and expense records. Next, fill out the form accurately, ensuring that all sections are completed. It is important to review the form for any errors before submission. Once completed, the form can be submitted either online or via mail, depending on the state’s requirements. Keeping a copy for your records is also advisable.

Steps to complete the Ct 3 S Form

Completing the Ct 3 S Form can be straightforward if you follow these steps:

- Collect all necessary financial documents, such as profit and loss statements and balance sheets.

- Fill in the business identification information, including the name, address, and tax identification number.

- Report total income, including gross receipts and any other income sources.

- Detail allowable deductions, such as operating expenses and other tax credits.

- Calculate the taxable income and the corresponding tax liability.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline.

Legal use of the Ct 3 S Form

The Ct 3 S Form must be used in compliance with state tax laws. It is legally binding and serves as an official document for reporting corporate income. Accurate completion of this form is crucial, as incorrect information can lead to penalties or audits. Additionally, the form must be submitted by the due date to avoid late fees or other legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 3 S Form vary by state but are generally aligned with the corporate tax year. Most states require the form to be filed by the 15th day of the fourth month following the end of the tax year. It is important to be aware of these dates to ensure timely submission and avoid penalties. Businesses should also keep track of any changes in state regulations that may affect filing deadlines.

Who Issues the Form

The Ct 3 S Form is issued by the state tax authority. Each state has its own tax department responsible for creating and updating tax forms, including the Ct 3 S Form. Businesses should refer to their specific state tax authority for the most current version of the form and any accompanying instructions.

Quick guide on how to complete ct 3 s 2011 form

Effortlessly prepare Ct 3 S Form on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Manage Ct 3 S Form on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to edit and electronically sign Ct 3 S Form with ease

- Find Ct 3 S Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you'd like to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow simplifies document management for you in just a few clicks from any device of your choosing. Edit and electronically sign Ct 3 S Form and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3 s 2011 form

Create this form in 5 minutes!

How to create an eSignature for the ct 3 s 2011 form

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is the Ct 3 S Form, and how can airSlate SignNow help with it?

The Ct 3 S Form is a specific tax document required for certain businesses. airSlate SignNow streamlines the process by allowing you to easily send, sign, and manage your Ct 3 S Form electronically, ensuring compliance and accuracy in your submissions.

-

Is there a cost associated with using airSlate SignNow for the Ct 3 S Form?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs. Depending on the features you require for managing your Ct 3 S Form, you can choose a plan that provides great value for services like eSignature, document storage, and tracking.

-

What features does airSlate SignNow offer for managing the Ct 3 S Form?

airSlate SignNow provides features such as customizable templates, real-time tracking, and mobile capabilities to simplify the handling of your Ct 3 S Form. These features ensure that your documents are easily accessible and can be signed quickly from anywhere.

-

Can I integrate airSlate SignNow with other software for the Ct 3 S Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and more. This allows you to manage your Ct 3 S Form along with other documents and workflows effectively within your existing systems.

-

How secure is the airSlate SignNow platform when handling the Ct 3 S Form?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and complies with industry standards, ensuring that your Ct 3 S Form and all documents are kept safe and confidential during the signing process.

-

Can multiple users sign the Ct 3 S Form using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to sign the Ct 3 S Form, making it convenient for businesses that require collaboration. You can easily manage and collect multiple signatures in a smooth and efficient manner, reducing turnaround times.

-

What are the benefits of using airSlate SignNow for the Ct 3 S Form compared to traditional methods?

Using airSlate SignNow for the Ct 3 S Form offers numerous benefits, including faster processing times, reduced paper usage, and improved tracking capabilities. This not only enhances efficiency but also promotes sustainability within your business operations.

Get more for Ct 3 S Form

Find out other Ct 3 S Form

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online