Ct 3 S Form 2020

What is the Ct 3 S Form

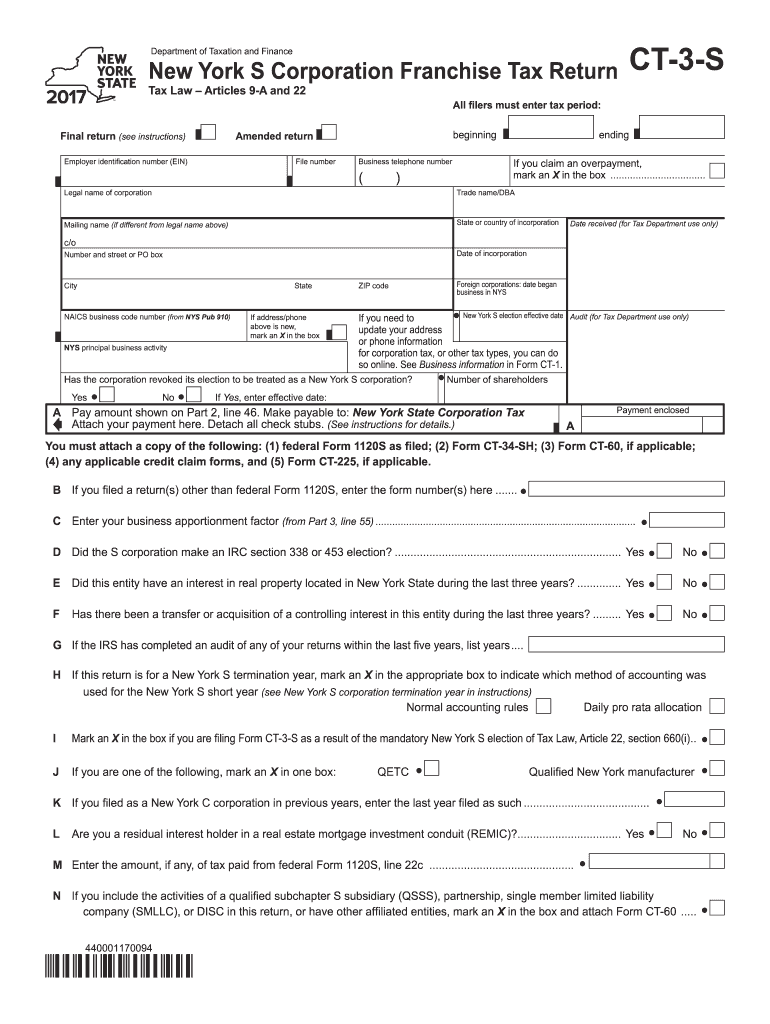

The Ct 3 S Form is a tax document used by corporations in the state of New York to report their income, deductions, and credits. This form is specifically designed for small businesses and certain types of corporations, allowing them to file their taxes efficiently. It is essential for ensuring compliance with state tax regulations and helps businesses calculate their tax liabilities accurately.

How to use the Ct 3 S Form

To use the Ct 3 S Form, businesses must first gather all necessary financial information, including income statements, expense reports, and any applicable tax credits. The form requires detailed entries regarding gross income, allowable deductions, and tax calculations. Once completed, the form can be submitted electronically or via mail, depending on the business's preference and compliance requirements.

Steps to complete the Ct 3 S Form

Completing the Ct 3 S Form involves several steps:

- Gather necessary financial documents, such as income statements and expense records.

- Fill out the form with accurate financial information, ensuring all entries are correct.

- Review the form for completeness and accuracy to avoid errors.

- Submit the form electronically through an approved platform or mail it to the appropriate tax authority.

Legal use of the Ct 3 S Form

The Ct 3 S Form is legally binding when filled out correctly and submitted on time. It is crucial for businesses to adhere to state laws regarding tax reporting and payment. Failure to file the form or inaccuracies in reporting can lead to penalties or legal repercussions. Ensuring compliance with the regulations governing this form is essential for maintaining good standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 3 S Form typically align with the end of the corporation's fiscal year. Corporations must file the form by the 15th day of the fourth month following the close of their fiscal year. It is important for businesses to be aware of any changes in deadlines and to plan accordingly to avoid late fees or penalties.

Who Issues the Form

The Ct 3 S Form is issued by the New York State Department of Taxation and Finance. This department is responsible for overseeing tax compliance and ensuring that all businesses adhere to state tax laws. It is advisable for businesses to consult the department's resources for any updates or changes to the form and its requirements.

Quick guide on how to complete ct 3 s 2013 form

Facilitate Ct 3 S Form effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly option to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without hold-ups. Manage Ct 3 S Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Ct 3 S Form without hassle

- Find Ct 3 S Form and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize essential sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Ct 3 S Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3 s 2013 form

Create this form in 5 minutes!

How to create an eSignature for the ct 3 s 2013 form

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the Ct 3 S Form and why is it important?

The Ct 3 S Form is a vital document for businesses filing their corporate tax returns in Connecticut. It provides essential financial information to the state, allowing for accurate assessments of tax liabilities. Utilizing airSlate SignNow simplifies this process, enabling you to eSign and send your Ct 3 S Form securely and efficiently.

-

How does airSlate SignNow help with filing the Ct 3 S Form?

airSlate SignNow streamlines the filing of the Ct 3 S Form by offering a user-friendly interface for document preparation and signing. You can easily upload your completed form, get the necessary signatures, and send it directly to the state. This ensures that your filing is quick and compliant with state regulations.

-

Is there a cost associated with using airSlate SignNow for the Ct 3 S Form?

Yes, there is a subscription fee for using airSlate SignNow, but it is designed to be cost-effective for businesses. The pricing includes access to essential features for managing your Ct 3 S Form and other documents. This investment can save you time and reduce the risks of errors in your tax filings.

-

What features does airSlate SignNow offer for managing the Ct 3 S Form?

airSlate SignNow offers a variety of features for managing the Ct 3 S Form, including secure eSigning, document templates, and status tracking. You can also integrate the platform with other tools you use for accounting and tax preparation. These features enhance collaboration and efficiency in your filing process.

-

Can I integrate airSlate SignNow with other software for my Ct 3 S Form?

Absolutely! airSlate SignNow supports integration with various software platforms, including accounting and CRM tools. This allows you to seamlessly manage your Ct 3 S Form without switching between different applications, ensuring a smooth workflow for your team.

-

What benefits does electronic signing of the Ct 3 S Form provide?

Electronic signing of the Ct 3 S Form offers numerous benefits, such as speed, security, and environmental friendliness. With airSlate SignNow, you can sign documents instantly, reducing paper clutter and delays. Moreover, digital records are easier to manage and store compared to traditional paper forms.

-

How secure is my information when using airSlate SignNow for the Ct 3 S Form?

airSlate SignNow prioritizes the security of your information, employing advanced encryption technologies to protect your documents and data. Your Ct 3 S Form and other sensitive information are stored securely, ensuring compliance with industry standards. Rest assured, your files are safe and confidential when using our platform.

Get more for Ct 3 S Form

- Pt inr conversion table form

- Complete the sentences with the correct form of the verbs in brackets

- Kotak life insurance maturity payout form

- Passenger locator card pdf form

- Fill in sc1120 form

- Lafalaise form

- Referral form childrens care coordination

- Fredericksburg orthopaedic associates pc patient form

Find out other Ct 3 S Form

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile