Et 706 Instructions Form 2020

What is the Et 706 Instructions Form

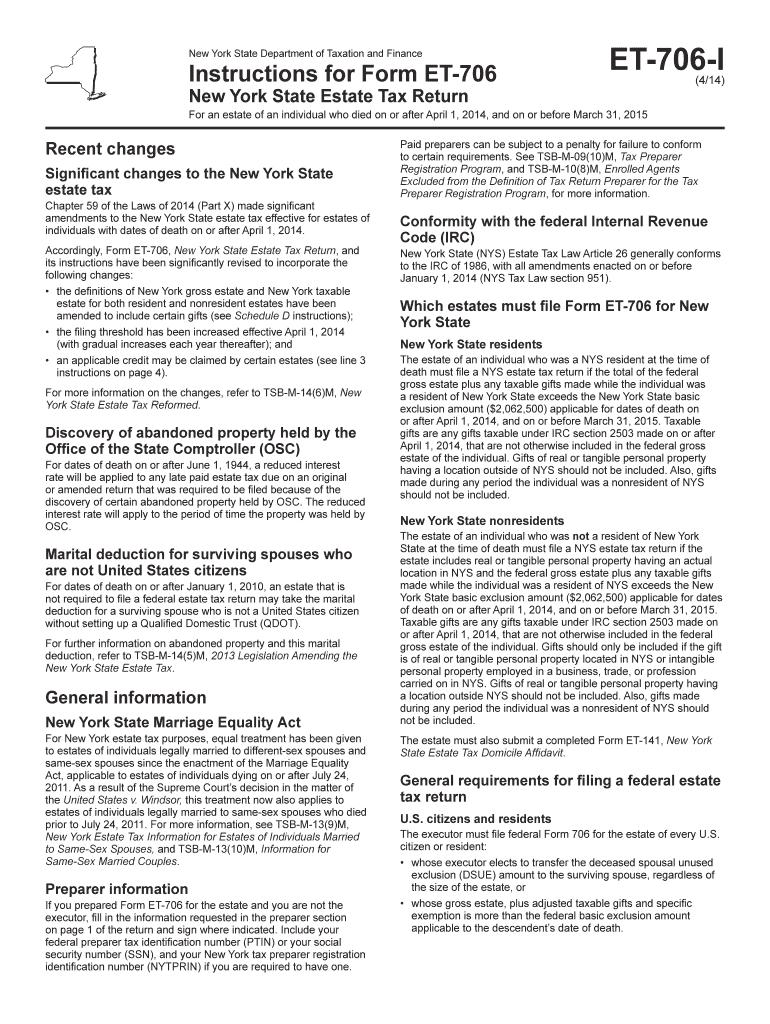

The Et 706 Instructions Form is a crucial document used for reporting estate tax in the United States. This form provides detailed guidance on how to calculate the estate tax owed after an individual's death. It is essential for the executor or administrator of the estate to understand the requirements outlined in this form to ensure compliance with federal tax laws. The instructions cover various aspects, including valuation of assets, deductions, and credits that may apply to the estate. Proper completion of this form is vital for the timely and accurate filing of estate taxes.

Steps to complete the Et 706 Instructions Form

Completing the Et 706 Instructions Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the deceased's assets and liabilities. This includes bank statements, property deeds, and investment records. Next, follow the instructions provided in the form to determine the gross estate value, which encompasses all assets owned at the time of death.

After calculating the gross estate, apply any applicable deductions, such as debts and funeral expenses, to arrive at the taxable estate amount. The form also requires information about beneficiaries and any transfers made prior to death. Finally, review the completed form for accuracy and submit it to the IRS by the specified deadline.

How to obtain the Et 706 Instructions Form

The Et 706 Instructions Form can be obtained directly from the Internal Revenue Service (IRS) website. It is available as a downloadable PDF, which can be printed for completion. Additionally, the form may be accessible through various tax preparation software that includes IRS forms. If preferred, individuals can also request a physical copy by contacting the IRS directly or visiting a local IRS office.

Legal use of the Et 706 Instructions Form

The legal use of the Et 706 Instructions Form is governed by federal tax laws, specifically regarding estate tax obligations. This form must be filed accurately and on time to avoid penalties and interest charges. The IRS requires that the form be signed by the executor or administrator of the estate, affirming that the information provided is true and complete. Failure to comply with the legal requirements associated with this form can result in significant financial consequences for the estate.

Filing Deadlines / Important Dates

Filing deadlines for the Et 706 Instructions Form are critical to avoid penalties. The form must be filed within nine months of the date of death of the individual whose estate is being reported. However, an extension may be requested, which can provide an additional six months for filing. It is important to note that any taxes owed must still be paid by the original deadline to avoid interest charges. Executors should keep track of these dates to ensure compliance with IRS regulations.

Required Documents

To complete the Et 706 Instructions Form, several documents are required. These include:

- Death certificate of the deceased

- Financial statements detailing assets and liabilities

- Property deeds and titles

- Records of any gifts made prior to death

- Tax returns for the deceased, if applicable

Having these documents readily available will facilitate the accurate completion of the form and help ensure compliance with all requirements.

Examples of using the Et 706 Instructions Form

Examples of situations where the Et 706 Instructions Form is utilized include estates with significant assets, such as real estate, investments, and business interests. For instance, if an individual passes away leaving behind a house valued at five hundred thousand dollars and various investments totaling two hundred thousand dollars, the executor would need to report these assets using the Et 706 Instructions Form. Additionally, if there were debts, such as a mortgage or outstanding loans, these would also need to be documented to determine the net taxable estate.

Quick guide on how to complete et 706 instructions 2014 form

Complete Et 706 Instructions Form effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Handle Et 706 Instructions Form on any platform with the airSlate SignNow apps for Android or iOS, streamlining any document-related process today.

The easiest way to modify and eSign Et 706 Instructions Form with ease

- Obtain Et 706 Instructions Form and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate the reprinting of document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Et 706 Instructions Form and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct et 706 instructions 2014 form

Create this form in 5 minutes!

How to create an eSignature for the et 706 instructions 2014 form

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Et 706 Instructions Form and why is it important?

The Et 706 Instructions Form is a crucial document for estate tax filings in the United States. It guides individuals on how to correctly report and calculate the estate taxes owed. Understanding this form can help ensure compliance with tax regulations and avoid penalties.

-

How can airSlate SignNow assist with the Et 706 Instructions Form?

airSlate SignNow simplifies the process of completing and eSigning the Et 706 Instructions Form. With our intuitive platform, you can effortlessly upload, fill out, and sign this form digitally, streamlining your estate planning and tax preparation.

-

Is there a cost associated with using airSlate SignNow for the Et 706 Instructions Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. For users specifically dealing with forms like the Et 706 Instructions Form, our cost-effective solutions ensure that you only pay for the features you need, making it accessible for all budgets.

-

What features does airSlate SignNow provide for managing the Et 706 Instructions Form?

AirSlate SignNow provides features like customizable templates, progress tracking, and the ability to easily share documents for review. These features enhance your experience with the Et 706 Instructions Form, ensuring that you can complete it efficiently and accurately.

-

Can I integrate airSlate SignNow with other software for managing the Et 706 Instructions Form?

Absolutely! airSlate SignNow supports various integrations with popular software solutions. This allows you to synchronize your workflows and manage the Et 706 Instructions Form alongside your existing tools, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for the Et 706 Instructions Form?

Using airSlate SignNow for the Et 706 Instructions Form ensures a smooth, user-friendly experience. It enables faster document processing, reduces paperwork, and provides a secure platform for eSigning, ultimately saving time and minimizing stress.

-

How is the security of documents handled when using airSlate SignNow for the Et 706 Instructions Form?

AirSlate SignNow prioritizes document security by implementing robust encryption and compliance measures. This ensures that your Et 706 Instructions Form and other sensitive documents are protected, providing peace of mind during the eSigning process.

Get more for Et 706 Instructions Form

Find out other Et 706 Instructions Form

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms