Et 706 Fill in Form 2020

What is the Et 706 Fill In Form

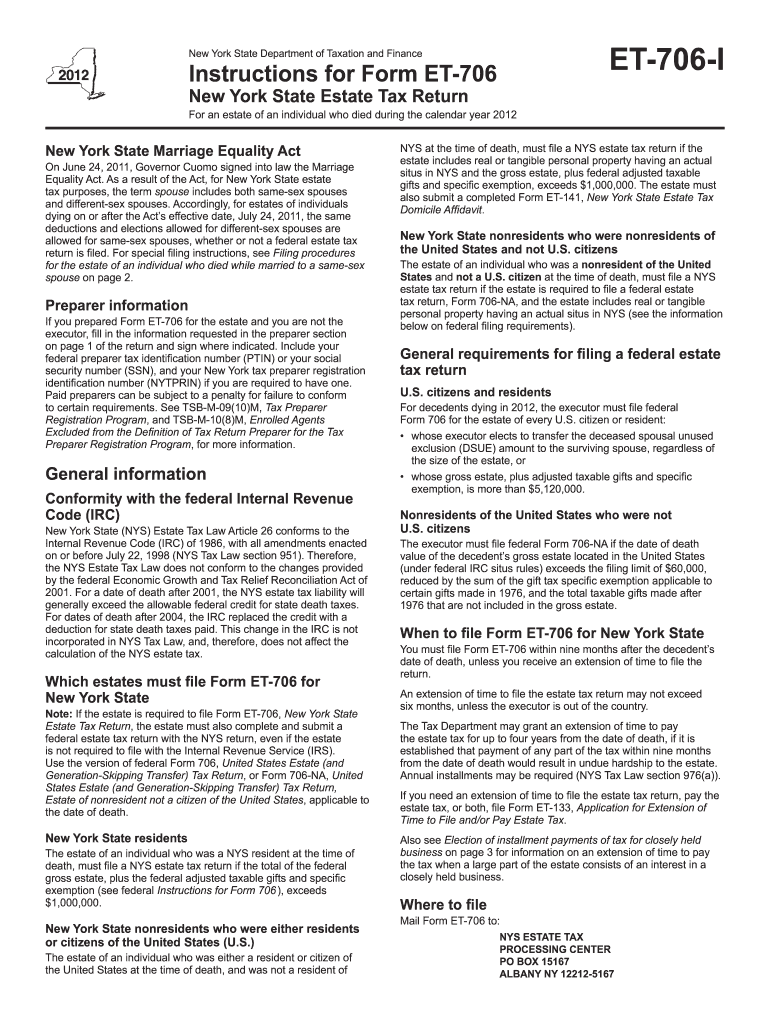

The Et 706 Fill In Form is a crucial document used for estate tax purposes in the United States. This form is specifically designed to report the estate of a deceased individual and calculate the estate tax owed. It is essential for executors and administrators of estates to accurately complete this form to ensure compliance with federal tax regulations. The form collects information about the decedent's assets, liabilities, and any deductions that may apply, ultimately determining the taxable estate value.

How to use the Et 706 Fill In Form

Using the Et 706 Fill In Form involves several steps to ensure that all required information is accurately reported. First, gather all necessary documentation, including details about the decedent's assets, debts, and any applicable deductions. Next, carefully fill out each section of the form, ensuring that all information is complete and accurate. After completing the form, it is advisable to review it for any errors before submission. The form can be submitted electronically or via mail, depending on the preferences of the executor.

Steps to complete the Et 706 Fill In Form

Completing the Et 706 Fill In Form requires a systematic approach. Follow these steps:

- Gather all relevant financial documents, including bank statements, property deeds, and investment records.

- Identify all assets and liabilities of the decedent to provide a comprehensive overview of the estate.

- Fill out the form, ensuring that each section is completed accurately, including information about the decedent and the estate's value.

- Calculate any deductions that may apply to the estate, such as funeral expenses or debts.

- Review the form for accuracy and completeness before submission.

Legal use of the Et 706 Fill In Form

The Et 706 Fill In Form holds legal significance as it is used to report estate taxes to the IRS. To be legally valid, the form must be completed accurately and submitted within the required time frame. Failure to comply with the regulations surrounding this form can lead to penalties or interest charges. It is important for executors to understand the legal implications of the form and ensure that it is used correctly to avoid any legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Et 706 Fill In Form are critical to avoid penalties. Generally, the form must be filed within nine months of the decedent's death. Executors can request a six-month extension if needed, but this must be done before the original deadline. Staying aware of these dates is essential for compliance and to ensure that the estate is settled in a timely manner.

Required Documents

To successfully complete the Et 706 Fill In Form, several documents are required. These include:

- Death certificate of the decedent.

- Financial statements detailing all assets and liabilities.

- Records of any debts owed by the decedent.

- Documentation for any deductions being claimed, such as funeral expenses.

Having these documents readily available will facilitate the completion of the form and ensure accuracy in reporting.

Quick guide on how to complete et 706 fill in form 2012

Effortlessly Complete Et 706 Fill In Form on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without delays. Manage Et 706 Fill In Form on any device using the airSlate SignNow apps available for Android or iOS and simplify your document-focused processes today.

The Easiest Way to Edit and eSign Et 706 Fill In Form with Ease

- Find Et 706 Fill In Form and click on Get Form to begin.

- Utilize our available tools to fill out your document.

- Emphasize signNow sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Choose your preferred method to share your form, be it via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign Et 706 Fill In Form and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct et 706 fill in form 2012

Create this form in 5 minutes!

How to create an eSignature for the et 706 fill in form 2012

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the Et 706 Fill In Form?

The Et 706 Fill In Form is a powerful document used for estate tax purposes. It allows users to report the value of an estate and calculate the required estate tax. Using airSlate SignNow, you can easily fill in and eSign this form to ensure compliance with tax regulations.

-

How can airSlate SignNow help with the Et 706 Fill In Form?

AirSlate SignNow provides an efficient platform to complete the Et 706 Fill In Form. With its user-friendly interface, you can easily fill in all required fields, save your progress, and eSign the form securely. This helps streamline your estate tax filing process.

-

Is there a cost associated with using the Et 706 Fill In Form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans allowing users to choose a package that fits their business needs. Each plan offers access to features including the Et 706 Fill In Form. Check our pricing page for detailed information on costs.

-

What features does airSlate SignNow offer for completing the Et 706 Fill In Form?

AirSlate SignNow includes features like document templates, real-time collaboration, and automatic notifications. These tools enhance the experience of filling out the Et 706 Fill In Form, ensuring all stakeholders can participate in the process seamlessly.

-

Can I integrate airSlate SignNow with other applications when using the Et 706 Fill In Form?

Absolutely! AirSlate SignNow offers robust integrations with various applications, making it easy to work with your existing business tools. This flexibility allows you to streamline processes related to the Et 706 Fill In Form and improve overall productivity.

-

What are the benefits of using airSlate SignNow for the Et 706 Fill In Form?

Using airSlate SignNow for the Et 706 Fill In Form provides multiple benefits, including time-saving automation, reduced paperwork, and improved accuracy in form submission. Additionally, it enhances security with eSigning, ensuring your sensitive information remains protected.

-

How long does it take to complete the Et 706 Fill In Form using airSlate SignNow?

The time it takes to complete the Et 706 Fill In Form using airSlate SignNow depends on the complexity of the estate and your preparedness. Generally, with our easy-to-use platform, users can fill out and eSign the form in a matter of minutes, speeding up the filing process.

Get more for Et 706 Fill In Form

Find out other Et 706 Fill In Form

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form