Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny 2020

What is the Form CT 13 Unrelated Business Income Tax Return?

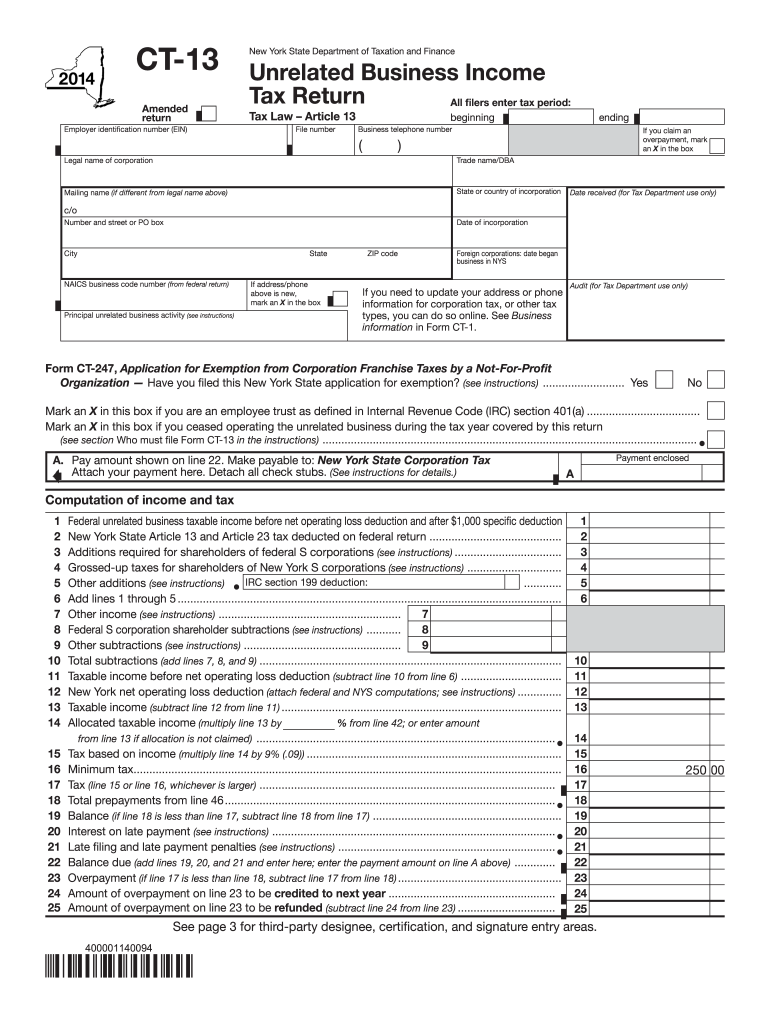

The Form CT 13 Unrelated Business Income Tax Return is a tax document used by organizations in New York to report income generated from activities that are not substantially related to their exempt purposes. This form is essential for tax-exempt organizations, such as charities and nonprofits, that engage in business activities that may generate unrelated business income (UBI). The income reported on this form is subject to taxation, and the form helps ensure compliance with state tax regulations.

How to Use the Form CT 13 Unrelated Business Income Tax Return

To effectively use the Form CT 13, organizations must accurately report all unrelated business income and expenses. This involves identifying all sources of income that do not directly relate to the organization's primary exempt activities. Organizations should gather financial records, including income statements and expense reports, to ensure that all relevant information is included. The completed form must then be submitted to the New York State Department of Taxation and Finance by the designated deadline.

Steps to Complete the Form CT 13 Unrelated Business Income Tax Return

Completing the Form CT 13 involves several key steps:

- Gather necessary financial documents, including income and expense records related to unrelated business activities.

- Fill out the identifying information section, including the organization's name, address, and tax identification number.

- Report all unrelated business income in the appropriate sections, ensuring accuracy and completeness.

- Detail any allowable deductions related to the income reported, such as expenses directly associated with generating that income.

- Review the completed form for errors or omissions before submission.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form CT 13 to avoid penalties. The form is typically due on the fifteenth day of the fifth month following the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due by May 15. It is crucial to mark this date on your calendar and ensure that all necessary documentation is prepared in advance.

Legal Use of the Form CT 13 Unrelated Business Income Tax Return

The legal use of the Form CT 13 is governed by New York tax laws. Organizations must ensure that the information provided is accurate and complete to avoid potential legal issues, including fines or audits. The form serves as a formal declaration of unrelated business income, and failure to file or inaccuracies in reporting can lead to significant penalties. It is advisable for organizations to consult with a tax professional to ensure compliance with all applicable laws and regulations.

State-Specific Rules for the Form CT 13 Unrelated Business Income Tax Return

New York has specific rules regarding the reporting of unrelated business income. Organizations must familiarize themselves with these regulations, which may include definitions of what constitutes unrelated business income, allowable deductions, and specific reporting requirements. Understanding these state-specific rules is essential for accurate form completion and compliance with state tax obligations.

Quick guide on how to complete form ct 132014unrelated business income tax returnct13 tax ny

Complete Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed contracts, allowing you to locate the appropriate form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly and without holdups. Manage Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny effortlessly

- Locate Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of the documents or hide sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, invite link, or download it to the computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Adjust and eSign Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 132014unrelated business income tax returnct13 tax ny

Create this form in 5 minutes!

How to create an eSignature for the form ct 132014unrelated business income tax returnct13 tax ny

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny?

Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny is a tax return filed by organizations that generate unrelated business income. This form specifically helps organizations identify and report their taxable income derived from activities not directly related to their exempt purposes. Ensuring accurate completion of this form is essential for compliance with New York state's tax regulations.

-

How can airSlate SignNow help me with Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny?

airSlate SignNow offers an efficient solution for managing and signing documents related to Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny. Our platform allows you to easily upload, share, and eSign the necessary forms, streamlining the filing process. This eliminates the need for physical paperwork and reduces the risk of errors, ensuring a smoother tax filing experience.

-

What are the pricing options for using airSlate SignNow for Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny?

airSlate SignNow provides competitive pricing plans that cater to different business needs. We offer flexible subscription options, allowing you to choose a plan that best fits your requirements for managing Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny. Our pricing is designed to be cost-effective while offering all the necessary features to assist with your tax document needs.

-

What features does airSlate SignNow offer for completing Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny?

With airSlate SignNow, you get access to a variety of features that simplify the completion of Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny. Key features include customizable templates, document tracking, reminders for important deadlines, and secure cloud storage. These tools enhance the efficiency and accuracy of your tax filing process.

-

Is airSlate SignNow secure for managing sensitive tax documents like Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny?

Absolutely! airSlate SignNow prioritizes the security of your sensitive documents, including Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny. Our platform employs advanced encryption technologies and strict authentication processes to keep your data safe and confidential. You can trust us to protect your information throughout the signing process.

-

Can I integrate airSlate SignNow with other software for handling Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, making it easier to handle Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny alongside your existing software. Whether you use CRM, accounting, or project management tools, our integrations enhance your workflow. This ensures that all your necessary data is streamlined and accessible.

-

What benefits does using airSlate SignNow provide for businesses filing Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny?

Utilizing airSlate SignNow for Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny offers numerous benefits, including saving time and reducing stress associated with tax filing. Our user-friendly platform speeds up the document signing process and minimizes errors, ensuring compliance with tax regulations. Thus, you can focus more on your business and less on paperwork.

Get more for Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny

Find out other Form CT 13Unrelated Business Income Tax Returnct13 Tax Ny

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast