Tax Alaska 2020

What is the Tax Alaska

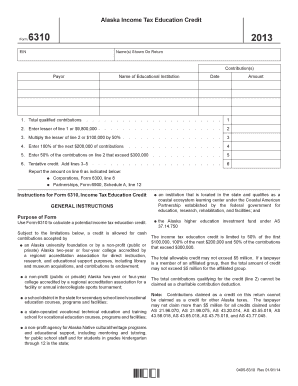

The Tax Alaska refers to specific tax forms and regulations applicable within the state of Alaska. These documents are essential for individuals and businesses to report income, claim deductions, and comply with state tax laws. Understanding the Tax Alaska is crucial for ensuring accurate tax filings and avoiding potential penalties.

How to use the Tax Alaska

Using the Tax Alaska involves filling out the appropriate forms accurately and submitting them to the state tax authority. It's important to gather all necessary information, such as income details, deductions, and credits, before starting the process. Utilizing digital tools can streamline this process, making it easier to complete and submit forms electronically.

Steps to complete the Tax Alaska

Completing the Tax Alaska typically involves several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Choose the correct tax form based on your filing status and income type.

- Fill out the form accurately, ensuring all information is correct and complete.

- Review your entries for any errors or omissions.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the Tax Alaska

The legal use of the Tax Alaska is governed by state tax laws and regulations. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Alaska Department of Revenue. This includes understanding filing deadlines, maintaining accurate records, and ensuring that all submitted information is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska are crucial for avoiding penalties. Typically, individual tax returns are due on April fifteenth. However, specific deadlines may vary based on the type of form being filed or any extensions granted. Staying informed about these dates helps ensure timely submissions.

Required Documents

To complete the Tax Alaska, several documents are typically required, including:

- W-2 forms from employers

- 1099 forms for other income

- Receipts for deductible expenses

- Previous year's tax return for reference

Who Issues the Form

The Tax Alaska forms are issued by the Alaska Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. It provides resources and support for individuals and businesses navigating the tax filing process.

Quick guide on how to complete tax alaska 6967210

Effortlessly Prepare Tax Alaska on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage Tax Alaska on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

The Easiest Way to Edit and Electronically Sign Tax Alaska Stress-Free

- Find Tax Alaska and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Tax Alaska and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967210

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967210

The best way to create an eSignature for your PDF in the online mode

The best way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is Tax Alaska and how does airSlate SignNow assist with it?

Tax Alaska refers to the tax regulations and filing requirements specific to the state of Alaska. airSlate SignNow helps businesses efficiently eSign and send necessary tax documents, streamlining the process and ensuring compliance with Alaska's tax requirements.

-

How does airSlate SignNow simplify the tax filing process in Alaska?

With airSlate SignNow, you can create, send, and eSign tax-related documents quickly and efficiently. This eliminates the need for physical paperwork, helping Alaskan businesses manage their tax responsibilities with ease and ensuring all filings are completed on time.

-

What are the pricing options for using airSlate SignNow for Tax Alaska needs?

airSlate SignNow offers various pricing plans tailored to different business sizes and needs. Whether you're a small business or a larger enterprise dealing with Tax Alaska, there’s a cost-effective solution available to help you meet your document signing needs.

-

What features does airSlate SignNow offer for managing Tax Alaska documents?

airSlate SignNow provides several features for managing Tax Alaska documents, such as customizable templates, bulk sending, and advanced security measures. These features enhance the efficiency of preparing and managing tax documents, ensuring they are handled correctly and securely.

-

Can airSlate SignNow integrate with other tax software used in Alaska?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software solutions commonly used in Alaska. This integration allows for a smooth workflow, making it easier to sync data and manage tax-related documents effectively.

-

How secure is airSlate SignNow for handling confidential Tax Alaska documents?

airSlate SignNow prioritizes the security of your documents. With advanced encryption and compliance with the latest security standards, you can trust that your confidential Tax Alaska documents are safe and protected throughout the signing process.

-

Is airSlate SignNow suitable for both individuals and businesses dealing with Tax Alaska?

Absolutely! airSlate SignNow caters to both individuals and businesses in Alaska needing to manage tax documents. Its user-friendly interface and robust features make it an ideal solution for anyone navigating the Tax Alaska landscape.

Get more for Tax Alaska

Find out other Tax Alaska

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast