MI 1040, Michigan Individual Income Tax State of Michigan Mich 2020

What is the MI 1040, Michigan Individual Income Tax State Of Michigan Mich

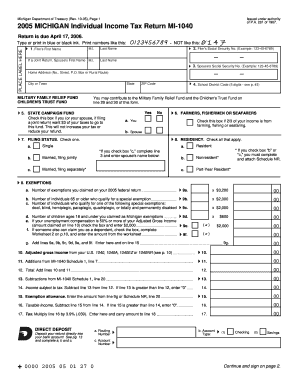

The MI 1040 is the official form used for filing individual income tax in the state of Michigan. It is designed for residents who need to report their income, claim deductions, and calculate their tax liability for the tax year. This form is essential for ensuring compliance with state tax laws and is a critical component of the overall tax filing process.

Taxpayers must provide detailed information including their total income, exemptions, and any applicable credits. The MI 1040 helps determine the amount of tax owed or the refund due, making it a vital document for financial planning and compliance.

Steps to complete the MI 1040, Michigan Individual Income Tax State Of Michigan Mich

Completing the MI 1040 involves several key steps to ensure accurate reporting and compliance with Michigan tax laws. First, gather all necessary documents, such as W-2 forms, 1099s, and any records of deductions or credits you plan to claim.

Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Report your total income from all sources, then calculate your taxable income by subtracting any deductions. After determining your tax liability, you can apply any credits to reduce the amount owed.

Finally, review the completed form for accuracy, sign it, and choose your submission method, whether online, by mail, or in person.

How to obtain the MI 1040, Michigan Individual Income Tax State Of Michigan Mich

The MI 1040 form can be easily obtained through various channels. It is available for download from the Michigan Department of Treasury's official website, where you can find the most recent version of the form along with any accompanying instructions.

Additionally, you can request a physical copy by contacting the Michigan Department of Treasury directly. Many tax preparation services and financial institutions also provide copies of the MI 1040, making it accessible for individuals seeking assistance with their tax filings.

Legal use of the MI 1040, Michigan Individual Income Tax State Of Michigan Mich

The MI 1040 is legally recognized as the official document for reporting individual income tax in Michigan. To ensure its legal validity, it must be completed accurately and submitted by the designated filing deadline. The form must be signed by the taxpayer, affirming that the information provided is true and complete.

Filing the MI 1040 electronically is permissible and is often encouraged for its efficiency and security. However, it is crucial to use compliant eSignature solutions that adhere to state and federal regulations to maintain the form's legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the MI 1040 are typically aligned with the federal tax filing schedule. For most taxpayers, the deadline is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Taxpayers should also be aware of any specific deadlines for estimated tax payments, extensions, and other tax-related submissions to avoid penalties. Keeping track of these dates is essential for maintaining compliance with Michigan tax laws.

Required Documents

To complete the MI 1040, taxpayers need to gather several key documents. These typically include:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as interest or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Any relevant tax credit information, such as education credits or child care expenses.

Having these documents organized will facilitate a smoother and more accurate completion of the MI 1040.

Examples of using the MI 1040, Michigan Individual Income Tax State Of Michigan Mich

There are various scenarios in which individuals may use the MI 1040. For instance, a full-time employee receiving a W-2 will report their salary and withholdings directly on the form. Alternatively, a self-employed individual may need to report income from multiple sources and claim business-related deductions.

Students may also use the MI 1040 if they have earned income and wish to claim education-related tax credits. Each taxpayer's situation is unique, and understanding how to accurately report income and claim deductions is crucial for compliance and maximizing potential refunds.

Quick guide on how to complete mi 1040 2005 michigan individual income tax state of michigan mich

Effortlessly Prepare MI 1040, Michigan Individual Income Tax State Of Michigan Mich on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to quickly create, modify, and electronically sign your documents without delays. Handle MI 1040, Michigan Individual Income Tax State Of Michigan Mich on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Modify and Electronically Sign MI 1040, Michigan Individual Income Tax State Of Michigan Mich

- Find MI 1040, Michigan Individual Income Tax State Of Michigan Mich and click on Get Form to initiate the process.

- Use the tools we offer to complete your form.

- Mark pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which requires mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or filed away documents, tedious form searches, or inaccuracies that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Modify and electronically sign MI 1040, Michigan Individual Income Tax State Of Michigan Mich to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mi 1040 2005 michigan individual income tax state of michigan mich

Create this form in 5 minutes!

How to create an eSignature for the mi 1040 2005 michigan individual income tax state of michigan mich

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the MI 1040, Michigan Individual Income Tax, and who needs to file it?

The MI 1040, Michigan Individual Income Tax, is a tax form required for residents who earn income in Michigan. It is important to file this form to report your income and pay any taxes owed to the State of Michigan. If you are a Michigan resident and received income, you must file the MI 1040.

-

How can airSlate SignNow help with filing the MI 1040, Michigan Individual Income Tax?

airSlate SignNow streamlines the process of filing the MI 1040, Michigan Individual Income Tax by allowing you to easily create, sign, and send tax documents. With its user-friendly platform, you can ensure that your forms are completed accurately and submitted on time, simplifying tax season.

-

What features does airSlate SignNow offer for managing the MI 1040 process?

airSlate SignNow includes features like eSignature, document automation, and secure storage, specifically designed to assist with the MI 1040, Michigan Individual Income Tax. These features help you efficiently manage and track your tax documents, while maintaining compliance with state regulations.

-

Is airSlate SignNow cost-effective for individuals filing the MI 1040, Michigan Individual Income Tax?

Yes, airSlate SignNow offers a cost-effective solution for individuals looking to file their MI 1040, Michigan Individual Income Tax. With various subscription plans tailored to your needs, you can choose an option that fits your budget while ensuring that your tax documents are handled professionally.

-

Can I access airSlate SignNow from any device when filing my MI 1040, Michigan Individual Income Tax?

Absolutely! airSlate SignNow is accessible on any device, including smartphones, tablets, and computers. This allows you to manage your MI 1040, Michigan Individual Income Tax forms on the go, providing flexibility and convenience throughout the process.

-

Does airSlate SignNow integrate with other tax preparation software for the MI 1040, Michigan Individual Income Tax?

Yes, airSlate SignNow seamlessly integrates with various tax preparation software to enhance your filing experience for the MI 1040, Michigan Individual Income Tax. These integrations allow for smooth data transfers and make it easy to incorporate your signed documents into your tax filing system.

-

What are the benefits of using airSlate SignNow for the MI 1040, Michigan Individual Income Tax?

Using airSlate SignNow for the MI 1040, Michigan Individual Income Tax offers numerous benefits, including enhanced security, faster processing times, and reduced paperwork. By utilizing this platform, you can simplify your filing process, allowing you to focus more on other financial matters.

Get more for MI 1040, Michigan Individual Income Tax State Of Michigan Mich

Find out other MI 1040, Michigan Individual Income Tax State Of Michigan Mich

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement