Includes Form 511NR Nonresident and Part Year Resident Return 2020

What is the Includes Form 511NR Nonresident And Part Year Resident Return

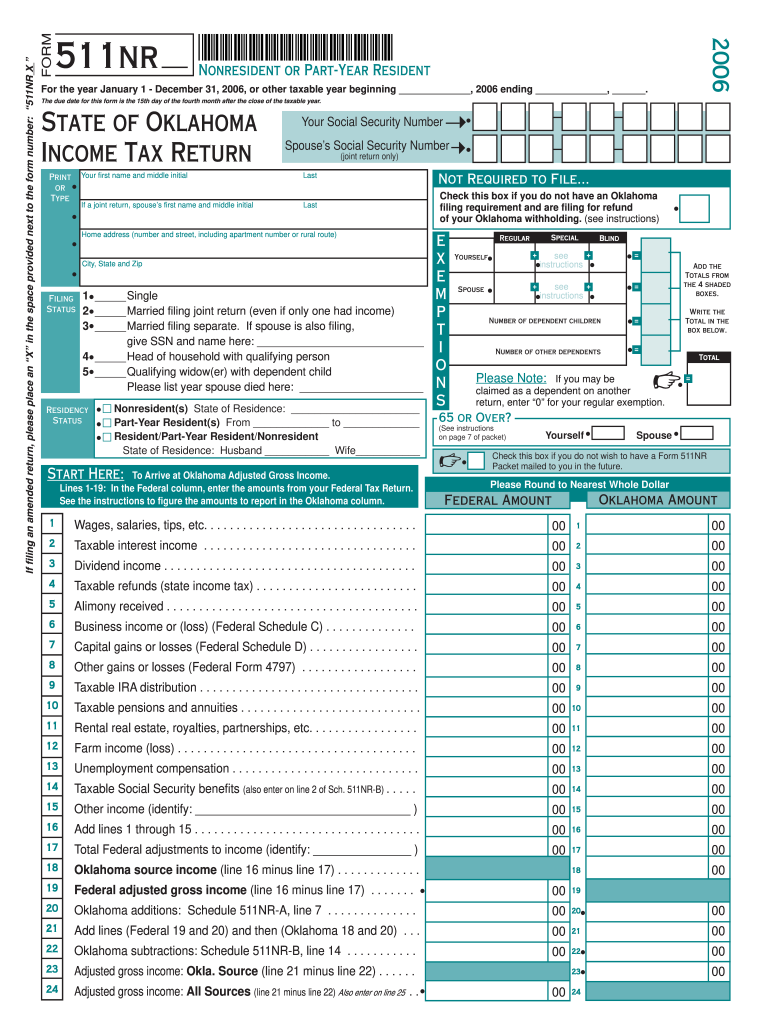

The Includes Form 511NR Nonresident And Part Year Resident Return is a tax document specifically designed for individuals who have earned income in a state while being classified as either a nonresident or a part-year resident. This form allows these individuals to report their income, calculate their tax liability, and ensure compliance with state tax laws. It is essential for those who have lived in multiple states during the tax year or who have income sourced from a state where they do not reside full-time.

How to use the Includes Form 511NR Nonresident And Part Year Resident Return

Using the Includes Form 511NR involves several steps to ensure accurate reporting of income and taxes owed. First, gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, determine the income earned in the state where the form is being filed. Complete the form by entering personal information, income details, and any deductions or credits applicable. Finally, review the completed form for accuracy before submission.

Steps to complete the Includes Form 511NR Nonresident And Part Year Resident Return

Completing the Includes Form 511NR requires careful attention to detail. Follow these steps:

- Gather all necessary documents, such as income statements and prior year tax returns.

- Fill in personal information, including your name, address, and Social Security number.

- Report all income earned while in the state, ensuring to separate it from income earned in other states.

- Apply any applicable deductions or credits specific to nonresidents or part-year residents.

- Calculate the total tax owed based on the state's tax rates.

- Review the form for accuracy and completeness before submission.

Legal use of the Includes Form 511NR Nonresident And Part Year Resident Return

The Includes Form 511NR is legally binding when completed accurately and submitted in accordance with state regulations. It is important to ensure that all information provided is truthful and complete, as discrepancies may lead to penalties or audits. Utilizing a reliable electronic signature solution can enhance the legal standing of the form, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Includes Form 511NR vary by state but typically align with the federal tax deadline of April 15. However, some states may have different deadlines for nonresidents or part-year residents. It is crucial to check the specific state requirements to avoid late fees and penalties. Additionally, extensions may be available, but they must be filed before the original deadline.

Required Documents

To complete the Includes Form 511NR, you will need several documents, including:

- W-2 forms from employers for income earned.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income.

- Documentation for deductions or credits claimed on the form.

Quick guide on how to complete includes form 511nr nonresident and part year resident return 2006 2006 2006 2006 2006 2006 2006 2006 2006 2006 2006 2006 2006

Effortlessly Prepare Includes Form 511NR Nonresident And Part Year Resident Return on Any Device

Managing documents online has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Handle Includes Form 511NR Nonresident And Part Year Resident Return on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

How to Modify and Electronically Sign Includes Form 511NR Nonresident And Part Year Resident Return with Ease

- Obtain Includes Form 511NR Nonresident And Part Year Resident Return and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Select important sections of the documents or obscure sensitive data with the tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Includes Form 511NR Nonresident And Part Year Resident Return to ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct includes form 511nr nonresident and part year resident return 2006 2006 2006 2006 2006 2006 2006 2006 2006 2006 2006 2006 2006

Create this form in 5 minutes!

How to create an eSignature for the includes form 511nr nonresident and part year resident return 2006 2006 2006 2006 2006 2006 2006 2006 2006 2006 2006 2006 2006

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is included in the airSlate SignNow service for the Form 511NR?

airSlate SignNow includes Form 511NR Nonresident And Part Year Resident Return as part of its document preparation services. This ensures you can easily eSign and send your tax documents without any hassle. Our platform simplifies the process, allowing users to manage their forms efficiently.

-

How does airSlate SignNow ensure the security of my Form 511NR?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods to protect all documents, including Form 511NR Nonresident And Part Year Resident Return. Your data is safe with us, ensuring compliance with industry standards for document handling.

-

Are there any additional fees for using Form 511NR with airSlate SignNow?

No, there are no hidden fees for using airSlate SignNow with the Form 511NR Nonresident And Part Year Resident Return. Our pricing plans are transparent, and they include the preparation and eSigning features at an affordable rate, making it a cost-effective solution for your tax needs.

-

Can I integrate airSlate SignNow with other applications for Form 511NR processing?

Yes, airSlate SignNow offers robust integrations with various applications and platforms. This includes options for easily managing and processing the Form 511NR Nonresident And Part Year Resident Return alongside other software, enhancing workflow efficiency.

-

What are the key benefits of using airSlate SignNow for Form 511NR?

One of the main benefits of using airSlate SignNow for the Form 511NR Nonresident And Part Year Resident Return is the ease of use. Our platform is designed for efficiency, allowing you to eSign, send, and track your documents effortlessly. Additionally, the cost-effective pricing makes it accessible for all users.

-

Is there a mobile app for airSlate SignNow that supports Form 511NR?

Yes, airSlate SignNow has a mobile app that supports all features, including managing Form 511NR Nonresident And Part Year Resident Return. This allows you to handle your documents on the go, providing flexibility and convenience whenever you need to eSign.

-

What support does airSlate SignNow offer for users preparing Form 511NR?

airSlate SignNow offers comprehensive customer support for all users, including assistance with the Form 511NR Nonresident And Part Year Resident Return. Our knowledgeable team is available to help with any questions or concerns to ensure a smooth experience as you prepare your documents.

Get more for Includes Form 511NR Nonresident And Part Year Resident Return

Find out other Includes Form 511NR Nonresident And Part Year Resident Return

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document