Arizona Joint Tax Application Form 2019

What is the Arizona Joint Tax Application Form

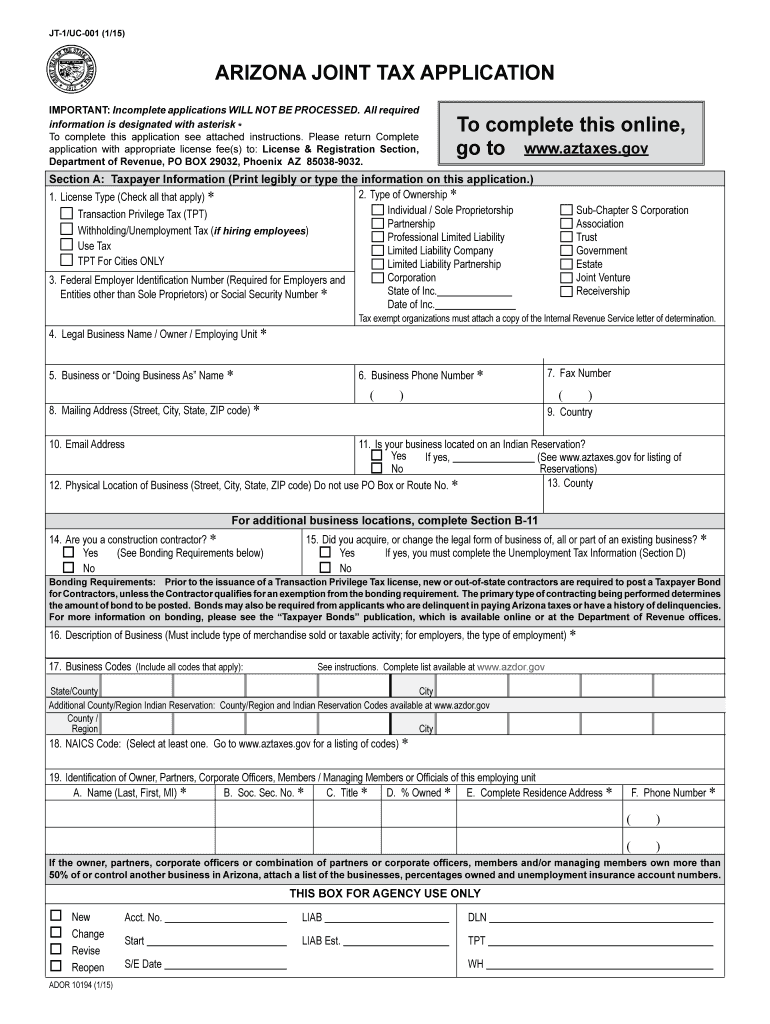

The Arizona Joint Tax Application Form is a crucial document used by couples filing their taxes jointly in the state of Arizona. This form allows taxpayers to combine their incomes and deductions, potentially resulting in a lower tax liability. It is specifically designed for married couples who wish to file a joint return, providing a streamlined process for reporting their combined financial information to the Arizona Department of Revenue. Understanding this form is essential for ensuring compliance with state tax laws and maximizing potential tax benefits.

Steps to complete the Arizona Joint Tax Application Form

Completing the Arizona Joint Tax Application Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements for both spouses. Next, accurately fill out the form by entering personal information, such as Social Security numbers and addresses. Be sure to report all sources of income and applicable deductions. After completing the form, review it carefully for any errors or omissions. Finally, sign and date the form before submitting it to the appropriate tax authority, either online or by mail.

Legal use of the Arizona Joint Tax Application Form

The legal use of the Arizona Joint Tax Application Form is governed by state tax laws. This form must be completed accurately and submitted in accordance with the guidelines established by the Arizona Department of Revenue. When filed correctly, the form serves as a legally binding document that reflects the couple's tax obligations. It is important to ensure that all information provided is truthful and complete, as any discrepancies may lead to penalties or audits. Understanding the legal implications of this form is vital for maintaining compliance with state tax regulations.

Who Issues the Form

The Arizona Joint Tax Application Form is issued by the Arizona Department of Revenue. This state agency is responsible for administering tax laws and collecting taxes in Arizona. The department provides the necessary forms and instructions for taxpayers to ensure they comply with state tax requirements. It is important for taxpayers to obtain the most current version of the form directly from the Arizona Department of Revenue to avoid using outdated or incorrect forms.

Required Documents

When completing the Arizona Joint Tax Application Form, several documents are required to ensure accurate reporting. Taxpayers should have the following items ready:

- W-2 forms from employers for both spouses

- 1099 forms for any additional income

- Records of any deductions or credits claimed

- Previous year’s tax return for reference

- Any relevant financial statements or documentation

Having these documents on hand will facilitate a smoother completion process and help ensure that all income and deductions are accurately reported.

Form Submission Methods

The Arizona Joint Tax Application Form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online through the Arizona Department of Revenue’s e-filing system, which offers a convenient and efficient way to submit the form. Alternatively, the form can be mailed directly to the department or submitted in person at designated offices. Each submission method has its own guidelines and deadlines, so it is essential to choose the one that best fits your needs and ensures timely processing.

Quick guide on how to complete arizona joint tax application 2015 form

Complete Arizona Joint Tax Application Form effortlessly on any device

Online document administration has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents promptly without holdups. Manage Arizona Joint Tax Application Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

The easiest way to modify and electronically sign Arizona Joint Tax Application Form with ease

- Locate Arizona Joint Tax Application Form and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Highlight signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow has specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget the worries of lost or misplaced documents, tedious form navigation, or mistakes that require printing new document versions. airSlate SignNow fulfills your needs in document management in just a few clicks from any device you prefer. Modify and electronically sign Arizona Joint Tax Application Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona joint tax application 2015 form

Create this form in 5 minutes!

How to create an eSignature for the arizona joint tax application 2015 form

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the Arizona Joint Tax Application Form?

The Arizona Joint Tax Application Form is a form used by couples filing taxes jointly in Arizona. This form allows you to accurately report your combined income and tax liabilities, ensuring you take advantage of any joint filing benefits. Using this form can streamline your tax preparation process and help avoid common pitfalls.

-

How do I obtain the Arizona Joint Tax Application Form?

You can easily obtain the Arizona Joint Tax Application Form from the Arizona Department of Revenue's website. Additionally, airSlate SignNow offers an efficient digital solution to access and fill out this form online, making the process both convenient and time-efficient.

-

Is there a cost to use the Arizona Joint Tax Application Form through airSlate SignNow?

Using airSlate SignNow to complete the Arizona Joint Tax Application Form is part of our subscription plans. We offer affordable pricing options tailored for individuals and businesses, allowing you to manage eSignatures and document workflows effectively while minimizing costs associated with paper forms.

-

What features does airSlate SignNow offer for the Arizona Joint Tax Application Form?

airSlate SignNow provides several features for the Arizona Joint Tax Application Form, including secure electronic signatures, automated reminders, and easy document sharing. These features streamline the filing process and ensure your information is securely stored and easily accessible whenever you need it.

-

Can I save my progress on the Arizona Joint Tax Application Form using airSlate SignNow?

Yes, airSlate SignNow allows you to save your progress on the Arizona Joint Tax Application Form. You can come back to the form at any time, ensuring that you can review and complete it at your own pace without losing any information.

-

How does airSlate SignNow ensure the security of my Arizona Joint Tax Application Form?

airSlate SignNow takes data security seriously by implementing advanced encryption technologies and strict privacy policies. Your Arizona Joint Tax Application Form and any sensitive information are protected, ensuring that only authorized users have access.

-

Are there integration options available for the Arizona Joint Tax Application Form with airSlate SignNow?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, including cloud storage and productivity tools, to enhance your experience with the Arizona Joint Tax Application Form. This means you can easily connect your favorite apps and streamline your document management.

Get more for Arizona Joint Tax Application Form

- This form must be typewritten or computer generated

- Use this page to notify the board of your address change after you submit your application form

- Civil case time schedule form

- Attorney for petitioner defendant form

- Affidavit for order for appearance and form

- Verified lockout complaint and application for temporary injunction form

- Transcript or land form

- For ward older than 18 years of age form

Find out other Arizona Joint Tax Application Form

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter