Sc1040 Form 2019

What is the Sc1040 Form

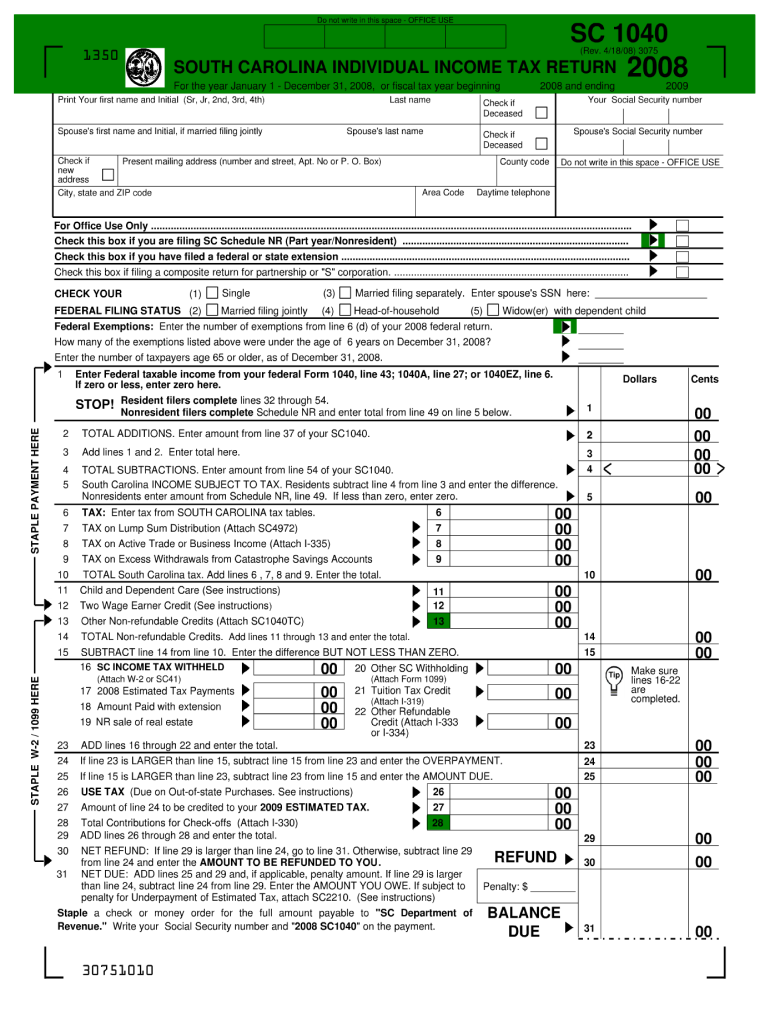

The Sc1040 Form is a tax document used by residents of South Carolina to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, as it helps determine the amount of state tax owed or the refund due. The Sc1040 Form is specifically designed to align with the federal income tax system, allowing taxpayers to provide a comprehensive overview of their financial situation to the South Carolina Department of Revenue.

How to use the Sc1040 Form

Using the Sc1040 Form involves several steps to ensure accurate reporting of income and deductions. Taxpayers must first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Once these documents are collected, individuals can fill out the form by providing personal information, income details, and applicable deductions. It is crucial to follow the instructions provided with the form to avoid errors that could lead to delays in processing or issues with tax compliance.

Steps to complete the Sc1040 Form

Completing the Sc1040 Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary income documents, such as W-2 and 1099 forms.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the form.

- Claim any deductions or credits you are eligible for, which can reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables.

- Sign and date the form before submission.

Legal use of the Sc1040 Form

The Sc1040 Form is legally binding when completed and submitted according to the guidelines set forth by the South Carolina Department of Revenue. To ensure its legal validity, taxpayers must provide accurate information and retain copies of all submitted documents. Additionally, electronic submissions of the Sc1040 Form are accepted, provided that the eSignature used complies with state and federal eSignature laws, ensuring that the form is recognized as legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the Sc1040 Form are crucial to avoid penalties. Typically, the deadline for submitting the form is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure they file the form on time to avoid interest and penalties on unpaid taxes.

Required Documents

To complete the Sc1040 Form, several documents are required. These include:

- W-2 forms from employers, detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Documentation for any other sources of income, such as rental properties or investments.

- Receipts for deductible expenses, including medical expenses, educational costs, and charitable contributions.

Form Submission Methods

Taxpayers can submit the Sc1040 Form through various methods. The options include:

- Online submission via the South Carolina Department of Revenue's website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete 2008 sc1040 form

Complete Sc1040 Form effortlessly on any device

Online document administration has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the correct form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Sc1040 Form on any device using airSlate SignNow Android or iOS applications and simplify any document-focused operation today.

The easiest way to modify and eSign Sc1040 Form seamlessly

- Find Sc1040 Form and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Verify all the information and click the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from your chosen device. Edit and eSign Sc1040 Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 sc1040 form

Create this form in 5 minutes!

How to create an eSignature for the 2008 sc1040 form

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the SC1040 Form?

The SC1040 Form is a tax document used by South Carolina residents to report their income and calculate their state tax liability. This form is crucial for individuals filing state taxes in South Carolina, and it ensures compliance with state tax laws. Using airSlate SignNow, you can easily eSign and submit your SC1040 Form electronically.

-

How can airSlate SignNow help with my SC1040 Form?

airSlate SignNow streamlines the process of signing and submitting your SC1040 Form by providing an easy-to-use interface for electronic signatures. You can upload your form, add necessary signatures, and send it to recipients securely and quickly. This convenience saves you time and effort, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the SC1040 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including individual and business users. The plans are designed to provide value for handling important documents like the SC1040 Form efficiently. You can review the pricing page on our website to find a plan that fits your budget.

-

Can I integrate airSlate SignNow with other software for managing my SC1040 Form?

Absolutely! airSlate SignNow integrates with various popular applications that can enhance your experience with the SC1040 Form. Whether you use accounting software, customer relationship management (CRM) tools, or cloud storage services, you can easily connect them with airSlate SignNow for streamlined document management.

-

What security features does airSlate SignNow provide for my SC1040 Form?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the SC1040 Form. We implement advanced encryption, two-factor authentication, and audit trails to ensure your data and signatures are protected. You can submit your forms confidently, knowing they are safe and secure.

-

How does airSlate SignNow simplify the signing process for the SC1040 Form?

With airSlate SignNow, signing the SC1040 Form is quick and straightforward. Users can sign documents electronically from any device, at any time. The platform allows for multiple signatures, making it easier for all parties involved to complete their forms without the hassle of printing or faxing.

-

Are there any mobile options available for signing the SC1040 Form?

Yes, airSlate SignNow offers a mobile app that allows users to sign the SC1040 Form on the go. This flexibility means you can manage your documents and complete your tax forms from anywhere, whether you're at home or away. The user-friendly interface ensures a seamless signing experience regardless of your device.

Get more for Sc1040 Form

- Priority health member reimbursement form

- Weight watchers exchange plan pdf form

- Ssm financial assistance 60249708 form

- Solving volume problems lesson 9 5 answer key form

- Exponent rules review worksheet with answers form

- 48 hour notice to perform template

- Vrfa medical authorization form deceased patient

- Welcome to soul care psychotherapy soul care psychotherapy form

Find out other Sc1040 Form

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple