4 71 10 Form 990 T ProcessingInternal Revenue Service IRS Gov 2020

What is the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov

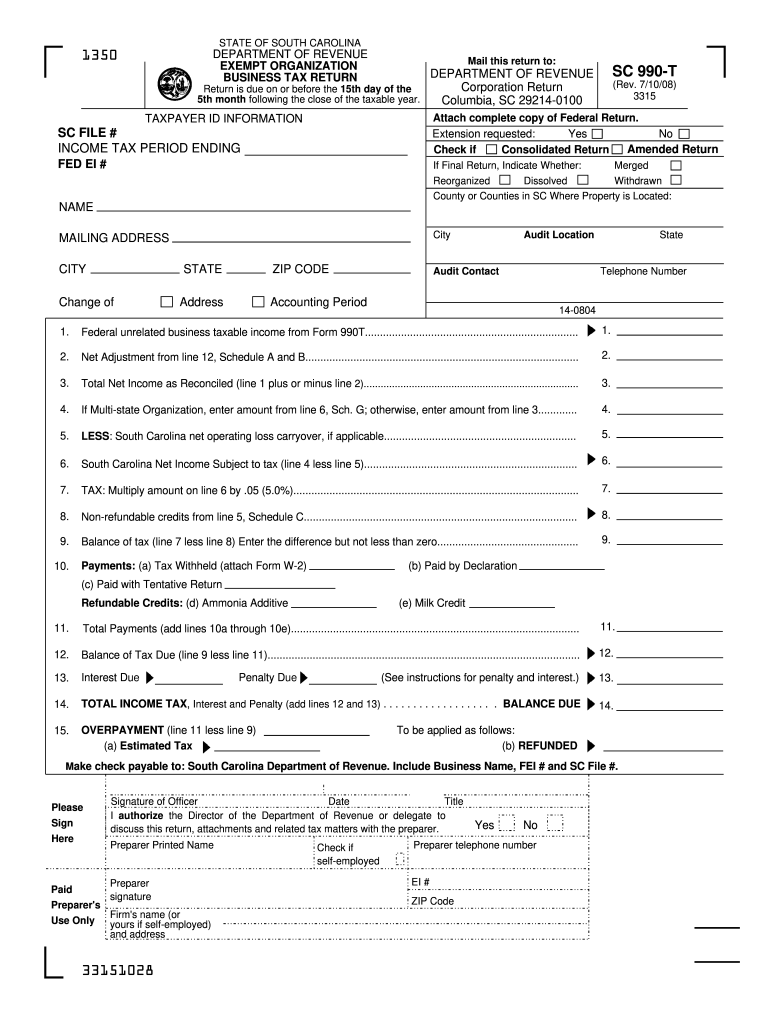

The 4 71 10 Form 990-T is a tax form used by certain tax-exempt organizations to report unrelated business income to the Internal Revenue Service (IRS). This form is essential for organizations that engage in activities not directly related to their exempt purpose, as it ensures compliance with federal tax regulations. By filing this form, organizations disclose income generated from these unrelated activities, which may be subject to taxation. Understanding the purpose and requirements of Form 990-T is crucial for maintaining tax-exempt status while fulfilling reporting obligations.

How to use the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov

Using the 4 71 10 Form 990-T involves several steps to ensure accurate reporting of unrelated business income. First, organizations must gather financial information related to their unrelated business activities. This includes revenue generated, expenses incurred, and any deductions applicable. Next, the form should be completed with precise details, including the organization’s name, address, and Employer Identification Number (EIN). Once filled out, the form must be submitted to the IRS, either electronically or by mail, depending on the organization’s filing preferences and requirements.

Steps to complete the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov

Completing the 4 71 10 Form 990-T requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents related to unrelated business income.

- Fill out the organization’s basic information, including name, address, and EIN.

- Report all unrelated business income on the form, detailing revenue streams.

- Deduct allowable expenses associated with generating that income.

- Calculate the taxable income and any tax owed based on the reported figures.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the required deadline, ensuring compliance with all regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 4 71 10 Form 990-T are crucial for compliance. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this typically means a May 15 deadline. Extensions may be available, but it is essential to file for an extension before the original due date to avoid penalties. Organizations should keep track of these important dates to ensure timely submission and maintain their tax-exempt status.

Penalties for Non-Compliance

Failing to file the 4 71 10 Form 990-T or submitting it late can result in significant penalties. The IRS imposes fines based on the length of the delay and the organization’s gross receipts. Additionally, non-compliance may lead to the loss of tax-exempt status, which can have serious financial implications. Organizations should prioritize timely and accurate filing to avoid these consequences and maintain compliance with federal tax regulations.

Digital vs. Paper Version

Organizations have the option to file the 4 71 10 Form 990-T either digitally or via paper submission. The digital version offers several advantages, including faster processing times and immediate confirmation of receipt from the IRS. Electronic filing is often recommended for its efficiency and reduced risk of errors. However, some organizations may prefer the traditional paper method for various reasons, including familiarity or lack of access to electronic filing systems. Regardless of the method chosen, ensuring accurate completion is vital for compliance.

Quick guide on how to complete 47110 form 990 t processinginternal revenue service irsgov

Complete 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov with ease

- Retrieve 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 47110 form 990 t processinginternal revenue service irsgov

Create this form in 5 minutes!

How to create an eSignature for the 47110 form 990 t processinginternal revenue service irsgov

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov?

The 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov is specifically designed for organizations that generate unrelated business income. This form allows entities to report and pay taxes on that income efficiently. By utilizing airSlate SignNow, businesses can streamline the process of submitting this form.

-

How does airSlate SignNow simplify the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov submission?

airSlate SignNow provides a user-friendly interface, allowing users to easily fill out and electronically sign the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov. This reduces the time spent on form preparation and ensures compliance with IRS requirements. Our solution also offers templates that help speed up the process.

-

What are the costs associated with using airSlate SignNow for the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov?

The pricing for airSlate SignNow is designed to be cost-effective, giving users access to features that simplify the completion and signing of the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov. Various plans are available to accommodate different business sizes. Interested users can review our pricing page for detailed information on subscription options.

-

Can airSlate SignNow integrate with other software for 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov?

Yes, airSlate SignNow seamlessly integrates with various software solutions to enhance your experience with the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov. This includes accounting and document management systems, allowing for automation and improved data accuracy. These integrations save time and reduce manual errors during submission.

-

What benefits does airSlate SignNow offer for eSigning the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov?

Using airSlate SignNow for eSigning the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov provides quick turnaround times and ensures security. Documents can be signed remotely, facilitating faster approvals. The electronic signatures are legally compliant, making your submissions trustworthy.

-

How does airSlate SignNow ensure compliance with IRS requirements for the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov?

airSlate SignNow is committed to maintaining compliance with IRS regulations, including those pertaining to the submission of the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov. Our platform guides users through the entire process, helping to minimize errors and ensuring that all necessary information is accurately captured. Regular updates to the software ensure ongoing compliance with any changes in regulations.

-

Is support available for users of airSlate SignNow working on the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov?

Absolutely! airSlate SignNow offers comprehensive support for users needing assistance with the 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov. Our dedicated support team is available via chat, email, and phone to answer any questions. We also provide resources and tutorials to help guide you through the process.

Get more for 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov

Find out other 4 71 10 Form 990 T ProcessingInternal Revenue Service IRS gov

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself