Sc Tax Form 2019

What is the SC Tax Form

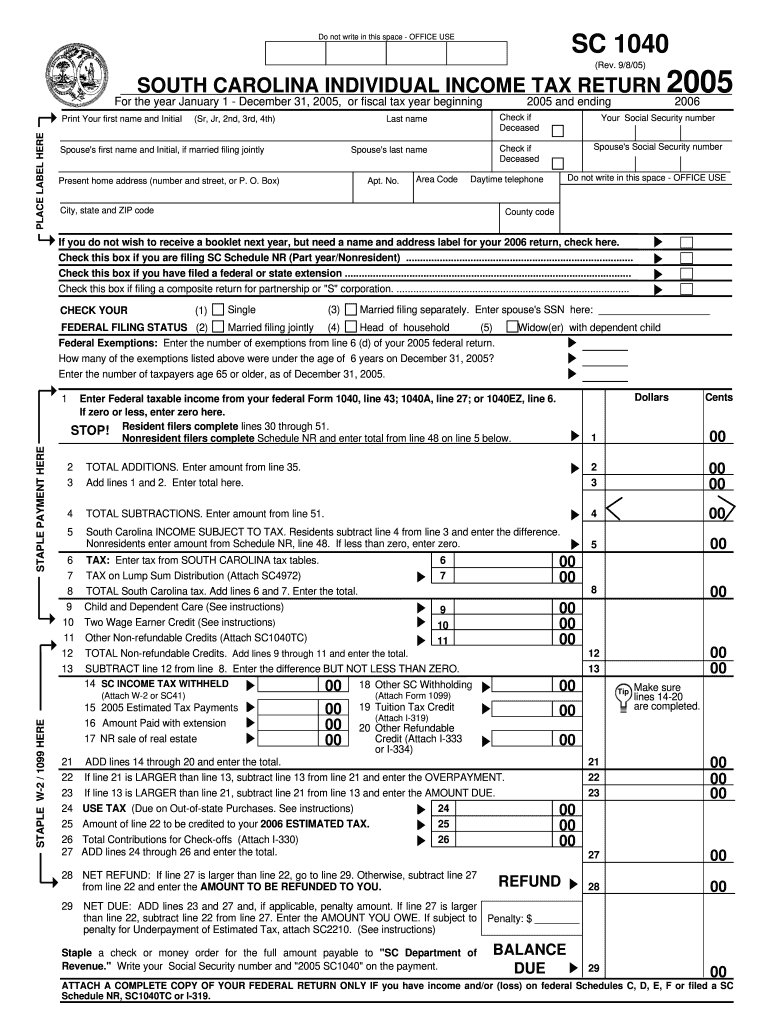

The SC Tax Form is a specific tax document used by residents of South Carolina to report their income and calculate their state tax obligations. This form is essential for individuals and businesses operating within the state, as it ensures compliance with state tax laws. The form typically includes sections for reporting various types of income, deductions, and credits that may apply to the taxpayer's situation.

How to Use the SC Tax Form

Using the SC Tax Form involves several steps to ensure accurate reporting of income and tax calculations. First, gather all necessary financial documents, including W-2s, 1099s, and other income statements. Next, fill out the form by entering your personal information, income details, and applicable deductions. It is crucial to review the completed form for accuracy before submission. Finally, submit the form either electronically or by mail, depending on your preference and the requirements set by the South Carolina Department of Revenue.

Steps to Complete the SC Tax Form

Completing the SC Tax Form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include wages, interest, and dividends.

- Identify and apply any deductions or credits for which you qualify, such as education credits or retirement contributions.

- Calculate your total tax liability based on the provided tax tables and rates.

- Review the form for any errors or omissions before finalizing it.

Legal Use of the SC Tax Form

The SC Tax Form is legally binding when completed and submitted according to the regulations set forth by the South Carolina Department of Revenue. It is essential to ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties or audits. Additionally, utilizing electronic filing methods can enhance the security and efficiency of the submission process, aligning with legal requirements for electronic documentation.

Filing Deadlines / Important Dates

Filing deadlines for the SC Tax Form typically align with federal tax deadlines. Generally, individual taxpayers must submit their forms by April fifteenth of each year. However, it is important to check for any extensions or changes in deadlines, especially during extraordinary circumstances such as natural disasters or public health emergencies. Keeping track of these dates ensures timely compliance and helps avoid potential penalties.

Required Documents

To accurately complete the SC Tax Form, several documents are necessary. These include:

- W-2 forms from employers, detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental or investment income.

- Documentation for deductions, such as receipts for charitable contributions or medical expenses.

- Previous year’s tax return for reference.

Form Submission Methods

The SC Tax Form can be submitted through various methods, including:

- Online filing through the South Carolina Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete 2005 sc tax form

Complete Sc Tax Form effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the needed form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents swiftly without delays. Handle Sc Tax Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Sc Tax Form without any hassle

- Find Sc Tax Form and click Get Form to begin.

- Employ the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to finalize your modifications.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Sc Tax Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2005 sc tax form

Create this form in 5 minutes!

How to create an eSignature for the 2005 sc tax form

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is an SC Tax Form?

The SC Tax Form is a tax document used for filing state income tax in South Carolina. It is essential for both individuals and businesses to accurately report their income and claim applicable deductions. Familiarizing yourself with the SC Tax Form is crucial for ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with SC Tax Form management?

airSlate SignNow simplifies the process of managing SC Tax Form documents by allowing users to eSign and send them easily. With our platform, you can ensure that your SC Tax Form is completed accurately and submitted on time. This reduces the hassle of paperwork, streamlining your tax filing experience.

-

Is airSlate SignNow HIPAA compliant for SC Tax Form eSignatures?

Yes, airSlate SignNow is HIPAA compliant, ensuring that your SC Tax Form eSignatures and any sensitive information are secure. We prioritize data security and compliance, so you can confidently manage and eSign your tax documents without worrying about privacy bsignNowes. Enjoy peace of mind when handling SC Tax Form with our platform.

-

What are the pricing options for using airSlate SignNow for SC Tax Form processing?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs when handling SC Tax Form processing. Plans range from essential features suitable for small businesses to advanced options for enterprises requiring robust document management solutions. Visit our pricing page to find the right plan for your SC Tax Form needs.

-

Can I integrate airSlate SignNow with other software for SC Tax Form documentation?

Absolutely! airSlate SignNow integrates seamlessly with a wide range of software applications to enhance your SC Tax Form documentation process. By connecting with platforms like Google Drive, Salesforce, and others, you can streamline your workflow, ensuring that all your tax documents are managed in one place.

-

What are the benefits of using airSlate SignNow for SC Tax Form eSigning?

Using airSlate SignNow for SC Tax Form eSigning offers numerous benefits, including time savings, increased accuracy, and reduced paper waste. Our easy-to-use interface ensures that users can quickly fill out and eSign documents, while tracking features keep you informed on the status of your SC Tax Form. Experience hassle-free tax filing with our solution.

-

How does airSlate SignNow ensure the security of my SC Tax Form?

airSlate SignNow employs top-notch security measures to protect your SC Tax Form data. We utilize encryption, secure cloud storage, and multi-factor authentication to ensure that all your documents are safe from unauthorized access. Trust us to keep your sensitive information secure while you eSign and manage your tax forms.

Get more for Sc Tax Form

Find out other Sc Tax Form

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application