Schedule Ca 540 Form 2019

What is the Schedule Ca 540 Form

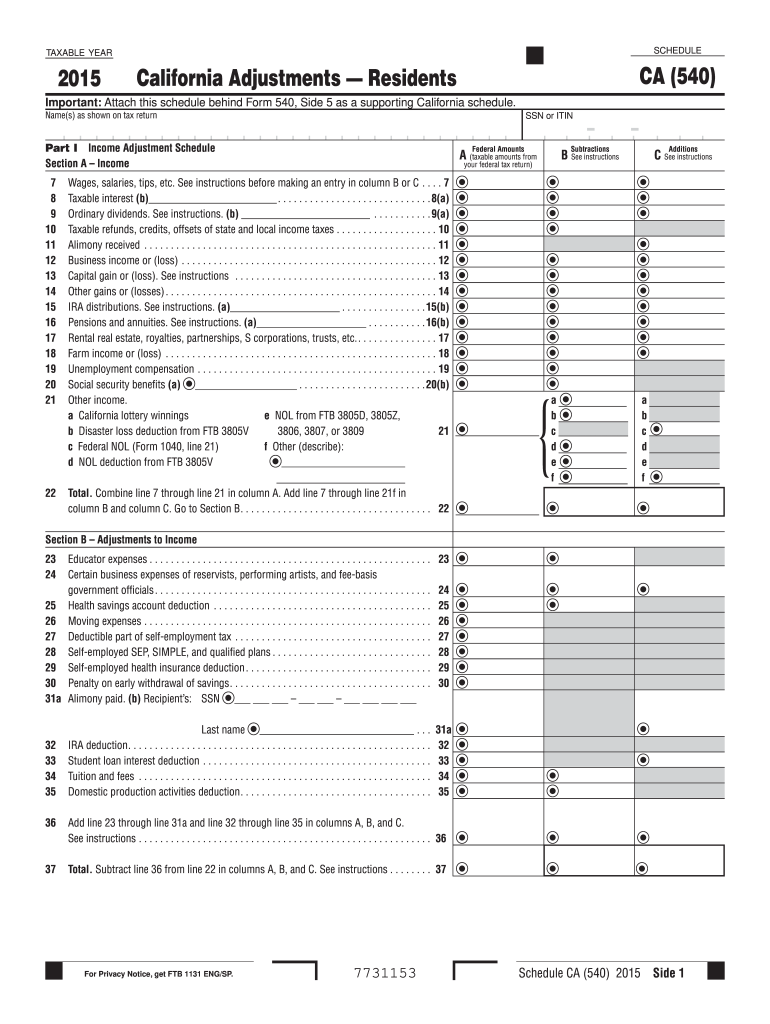

The Schedule Ca 540 Form is a tax document used by California residents to report adjustments to their income when filing their state tax returns. This form allows taxpayers to make necessary modifications to their federal adjusted gross income, ensuring that their state tax liability is accurately calculated. It is essential for individuals who need to account for specific deductions, credits, or other adjustments that differ from federal tax regulations.

How to use the Schedule Ca 540 Form

Using the Schedule Ca 540 Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including your federal tax return and any supporting documents for deductions or credits. Next, fill out the form by entering your federal adjusted gross income and making any required adjustments based on California tax laws. After completing the form, review it thoroughly to ensure all information is correct before submitting it with your California tax return.

Steps to complete the Schedule Ca 540 Form

Completing the Schedule Ca 540 Form requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report your federal adjusted gross income as shown on your federal tax return.

- Make adjustments for California-specific deductions or credits, such as those for mortgage interest or state taxes paid.

- Calculate your total income after adjustments and ensure that all figures are accurate.

- Sign and date the form before submitting it along with your California tax return.

Legal use of the Schedule Ca 540 Form

The Schedule Ca 540 Form is legally recognized as a valid document for reporting income adjustments in California. To ensure its legal standing, it must be completed accurately and submitted by the designated filing deadline. Compliance with state tax laws is crucial, as improper use of the form can lead to penalties or audits. It is advisable to retain a copy of the completed form and any supporting documentation for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule Ca 540 Form align with general California state tax deadlines. Typically, the form must be submitted by April 15 of each year, coinciding with the federal tax filing deadline. However, if April 15 falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions or changes announced by the California Franchise Tax Board, particularly during extraordinary circumstances.

Required Documents

To complete the Schedule Ca 540 Form, several documents are necessary to ensure accurate reporting. These include:

- Your federal tax return, which provides the basis for your federal adjusted gross income.

- W-2 forms from employers, detailing income earned and taxes withheld.

- 1099 forms for any additional income, such as freelance work or interest earned.

- Documentation for any deductions or credits claimed, such as mortgage statements or receipts for charitable contributions.

Quick guide on how to complete 2015 schedule ca 540 form

Complete Schedule Ca 540 Form seamlessly on any device

Online document management has become favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the right form and secure it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule Ca 540 Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to adjust and electronically sign Schedule Ca 540 Form effortlessly

- Obtain Schedule Ca 540 Form and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device of your choosing. Modify and eSign Schedule Ca 540 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 schedule ca 540 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 schedule ca 540 form

The best way to make an eSignature for a PDF document online

The best way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Schedule Ca 540 Form, and why is it important?

The Schedule Ca 540 Form is a tax form used by California residents to report their income and calculate their state taxes. It is an essential document for complying with California tax laws and ensuring proper reporting of deductions and credits. Understanding how to accurately complete this form can help in maximizing your tax benefits.

-

How can airSlate SignNow help me with the Schedule Ca 540 Form?

airSlate SignNow provides an easy-to-use platform to eSign and manage your Schedule Ca 540 Form electronically. Our solution streamlines the document signing process, allowing you to sign and send your tax forms quickly and securely. This efficiency can save you time and reduce stress during tax season.

-

Is airSlate SignNow a cost-effective solution for handling the Schedule Ca 540 Form?

Yes, airSlate SignNow offers competitive pricing plans that are designed to be cost-effective for individuals and businesses. By minimizing the need for paper documents and physical signatures, you can save on postage and printing costs while ensuring a professional handling of your Schedule Ca 540 Form.

-

Can I integrate airSlate SignNow with other software for the Schedule Ca 540 Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive and Dropbox, allowing you to manage your Schedule Ca 540 Form alongside other documents. This integration ensures a streamlined workflow and makes it easier to access and organize your tax-related forms.

-

What features does airSlate SignNow offer for the Schedule Ca 540 Form?

airSlate SignNow includes features such as customizable templates, in-app signing, and document tracking, all tailored to streamline the process of handling the Schedule Ca 540 Form. These features ensure that you can fill out, sign, and share the form with ease, making the tax filing process more efficient.

-

How secure is it to use airSlate SignNow for my Schedule Ca 540 Form?

Security is a top priority for airSlate SignNow. We utilize state-of-the-art encryption and comply with data protection regulations to ensure your sensitive information, including your Schedule Ca 540 Form, is safeguarded. You can eSign and store your documents with confidence knowing that they are protected.

-

What benefits will I gain from using airSlate SignNow for my tax documents?

Using airSlate SignNow for your tax documents, including the Schedule Ca 540 Form, provides numerous benefits such as increased efficiency, reduced paperwork, and improved organization. Additionally, our user-friendly interface makes it easy to navigate and complete your forms, enhancing your overall tax filing experience.

Get more for Schedule Ca 540 Form

Find out other Schedule Ca 540 Form

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy