540 Form 2019

What is the 540 Form

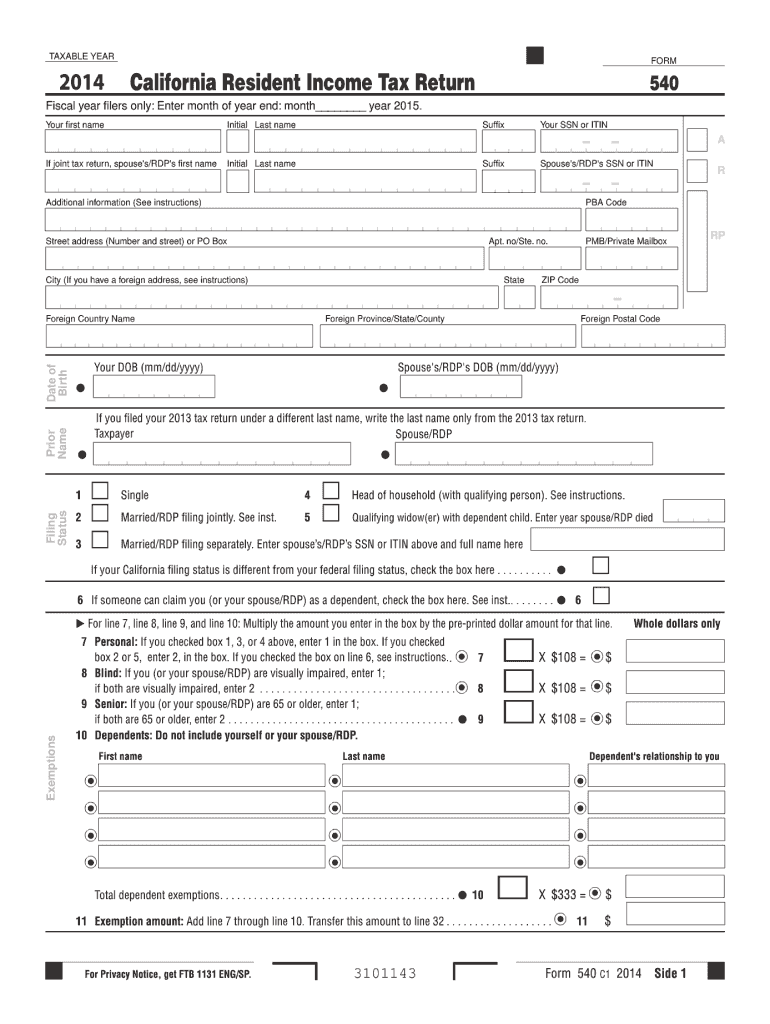

The 540 Form is a state income tax return used by residents of California to report their income and calculate their tax liability. This form is essential for individuals and families who earn income in California, as it helps determine the amount of tax owed or the refund due. The 540 Form is specifically designed for residents, while non-residents and part-year residents use different variations of the form.

How to use the 540 Form

Using the 540 Form involves several steps to ensure accurate reporting of income and deductions. Taxpayers should start by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Once the relevant information is collected, individuals can fill out the form by entering their personal information, income details, and applicable deductions. After completing the form, it should be reviewed for accuracy before submission to the California Franchise Tax Board.

Steps to complete the 540 Form

Completing the 540 Form involves a systematic approach to ensure all information is accurately reported. Here are the steps to follow:

- Gather all necessary documents, including income statements and deduction records.

- Fill in personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any eligible deductions, such as mortgage interest or property taxes.

- Calculate the total tax owed or refund due based on the provided information.

- Review the form for any errors or omissions before submission.

Legal use of the 540 Form

The 540 Form is legally binding when completed and submitted according to California tax laws. It is crucial to ensure that all information is accurate and truthful, as providing false information may lead to penalties or legal consequences. The form must be signed and dated by the taxpayer or authorized representative to validate its submission. Compliance with state tax regulations is essential to avoid issues with the California Franchise Tax Board.

Filing Deadlines / Important Dates

Filing deadlines for the 540 Form are typically aligned with the federal tax deadlines. Taxpayers must file their California state income tax return by April 15 each year unless an extension is requested. It is important to keep track of any changes in deadlines, especially in cases of natural disasters or other events that may affect filing dates. Late submissions may incur penalties and interest on any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The 540 Form can be submitted through various methods to accommodate different preferences. Taxpayers can file online using the California Franchise Tax Board's e-file system, which offers a convenient and quick way to submit returns. Alternatively, the form can be mailed to the appropriate address provided by the Franchise Tax Board. In-person submissions are also accepted at designated tax offices, allowing for direct assistance if needed.

Quick guide on how to complete 2014 540 form

Effortlessly Prepare 540 Form on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle 540 Form on any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Modify and eSign 540 Form with Ease

- Find 540 Form and click on Get Form to begin.

- Use the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign 540 Form to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 540 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 540 form

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is a 540 Form and how is it used?

The 540 Form is a tax form used by California residents to report their income and calculate their state tax liability. Using the 540 Form helps taxpayers ensure they report their income accurately and claim any eligible credits or deductions. By utilizing airSlate SignNow, you can easily eSign and manage your 540 Form, saving time and reducing paperwork.

-

How does airSlate SignNow simplify the process of filling out the 540 Form?

airSlate SignNow streamlines the 540 Form process by allowing users to fill out, eSign, and send documents electronically. This eliminates the hassle of printing, signing, and scanning physical forms. With its user-friendly interface, airSlate SignNow ensures that you can complete your 540 Form efficiently and securely.

-

Are there any costs associated with using airSlate SignNow for the 540 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there is a cost associated with the service, the investment can lead to signNow time and resource savings, especially when processing critical documents like the 540 Form. The pricing is transparent, with options to start with a free trial.

-

Can I integrate airSlate SignNow with other software for managing the 540 Form?

Absolutely! airSlate SignNow integrates seamlessly with various productivity and document management tools, allowing you to incorporate the 540 Form into your existing workflow. Whether it's a CRM, cloud storage, or project management software, these integrations enhance your efficiency and streamline document processes.

-

What features does airSlate SignNow offer for the 540 Form?

airSlate SignNow provides a range of features designed to make handling the 540 Form easy and efficient. These include customizable templates, advanced security options, and automated reminders to ensure you never miss a filing deadline. Additionally, the platform supports team collaboration for those who need to work together on their 540 Form submissions.

-

How secure is my information when using airSlate SignNow for the 540 Form?

Security is a top priority for airSlate SignNow. The platform employs bank-level encryption and secure cloud storage to protect your sensitive information while you complete your 540 Form. You can confidently manage and send your documents, knowing that your data is well-protected.

-

Is support available if I encounter issues with my 540 Form in airSlate SignNow?

Yes, airSlate SignNow offers dedicated customer support to assist you with any issues you may face while completing your 540 Form. Whether you have questions during the eSigning process or need help with document management, their support team is available via various channels to ensure a smooth experience.

Get more for 540 Form

Find out other 540 Form

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement