502 FORM MARYLAND RESIDENT INCOME TAX RETURN 2019

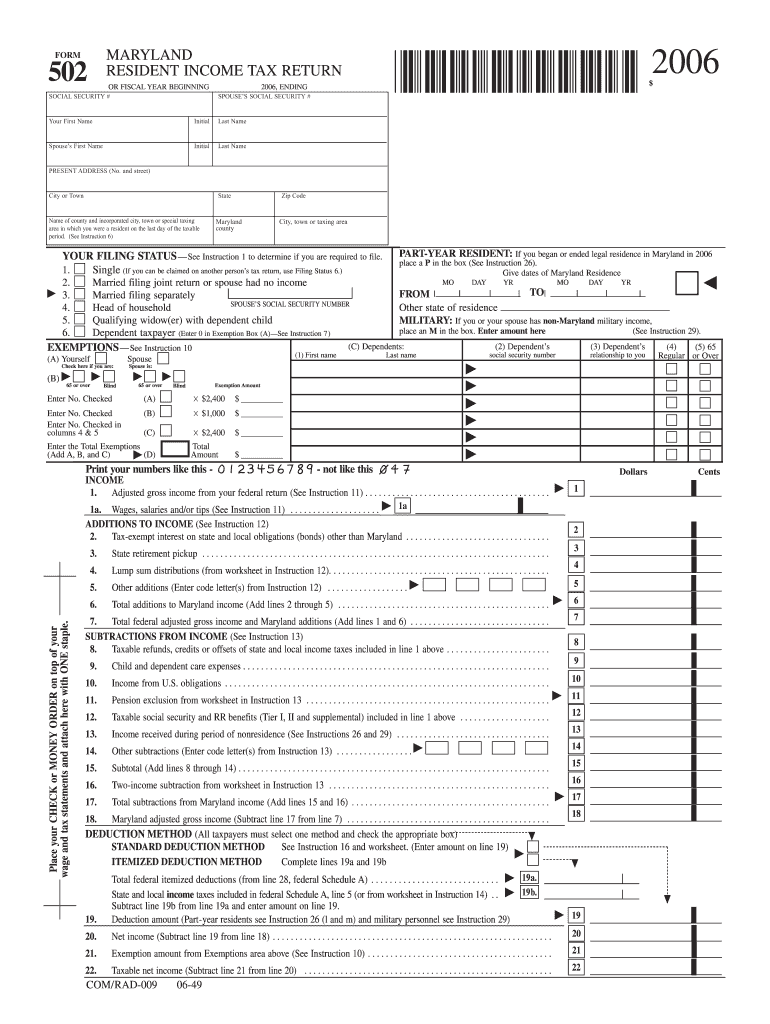

What is the Maryland Form 502 Resident Income Tax Return?

The Maryland Form 502 is the official document used by residents of Maryland to file their state income tax returns. This form allows individuals to report their income, claim deductions, and determine their tax liability for the year. It is essential for ensuring compliance with Maryland tax laws and is typically required for all residents earning income within the state. The form captures various types of income, including wages, dividends, and capital gains, and provides a structured way to calculate the total tax owed or refund due.

Steps to Complete the Maryland Form 502

Completing the Maryland Form 502 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out personal information at the top of the form, including your name, address, and Social Security number. Then, report your total income on the designated lines, followed by any applicable deductions and credits. Finally, calculate your tax liability and determine whether you owe money or are due a refund. It is advisable to double-check all entries for accuracy before submission.

How to Obtain the Maryland Form 502

The Maryland Form 502 can be obtained through several methods. The most convenient way is to download it directly from the Maryland Comptroller's website, where it is available in PDF format. Additionally, physical copies can often be found at local tax offices, public libraries, and government buildings. For those who prefer digital solutions, many tax preparation software programs also include the form, allowing users to complete and file it electronically.

Legal Use of the Maryland Form 502

The Maryland Form 502 is legally binding once it is completed and submitted according to state regulations. To ensure its legality, the form must be signed and dated by the taxpayer. Electronic submissions are also valid, provided they meet the requirements established by Maryland law. It is important to retain copies of the completed form and any supporting documents in case of future audits or inquiries from the state tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form 502 typically align with federal tax deadlines. For most taxpayers, the deadline is April 15 of the following year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers may also request an extension, allowing them to file up to six months later, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To successfully complete the Maryland Form 502, several key documents are required. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Previous year’s tax return for reference

- Any additional documentation supporting income or deductions

Having these documents ready will streamline the filing process and help ensure that all income is accurately reported.

Form Submission Methods

The Maryland Form 502 can be submitted through various methods to accommodate different preferences. Taxpayers can file electronically using approved tax software, which often simplifies the process and allows for faster refunds. Alternatively, the form can be mailed to the appropriate state address, or submitted in person at local tax offices. Each method has its benefits, and taxpayers should choose the one that best suits their needs.

Quick guide on how to complete 502 form maryland resident income tax return 2006

Complete 502 FORM MARYLAND RESIDENT INCOME TAX RETURN effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage 502 FORM MARYLAND RESIDENT INCOME TAX RETURN on any device using airSlate SignNow mobile applications for Android or iOS and streamline any document-centric workflow today.

The easiest way to modify and eSign 502 FORM MARYLAND RESIDENT INCOME TAX RETURN without hassle

- Obtain 502 FORM MARYLAND RESIDENT INCOME TAX RETURN and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your papers or conceal sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which only takes a few seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate issues with lost or forgotten files, laborious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign 502 FORM MARYLAND RESIDENT INCOME TAX RETURN to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 502 form maryland resident income tax return 2006

Create this form in 5 minutes!

How to create an eSignature for the 502 form maryland resident income tax return 2006

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the md 502 feature in airSlate SignNow?

The md 502 feature in airSlate SignNow offers a streamlined document management solution, allowing users to send and eSign documents efficiently. This feature is designed to enhance user experience and simplify the eSigning process, making it an essential tool for businesses.

-

How much does airSlate SignNow with md 502 cost?

Pricing for airSlate SignNow featuring md 502 is competitive and varies based on the chosen plan. Each plan includes access to the md 502 feature, ensuring that businesses get excellent value for their investment in digital document management.

-

What are the main benefits of using md 502 in airSlate SignNow?

The md 502 feature in airSlate SignNow improves efficiency, reduces paper waste, and accelerates the document signing process. By utilizing this feature, businesses can streamline workflows and enhance productivity while ensuring compliance with legal standards.

-

Can I integrate md 502 with other tools or platforms?

Yes, airSlate SignNow's md 502 feature supports integration with various third-party applications and platforms. This flexibility allows businesses to incorporate the eSigning process seamlessly into their existing workflows, enhancing overall operational efficiency.

-

Is the md 502 feature user-friendly for those unfamiliar with digital tools?

Absolutely! The md 502 feature in airSlate SignNow is designed with user experience in mind, making it intuitive for users of all skill levels. Comprehensive support and tutorials are provided to help users quickly adapt and fully utilize the capabilities of the md 502 feature.

-

What types of documents can be signed using md 502?

With the md 502 feature, airSlate SignNow allows users to sign a wide variety of documents, including contracts, agreements, and forms. This versatility makes it suitable for industries ranging from real estate to finance, catering to diverse document signing needs.

-

How secure is the md 502 feature for signing documents?

The md 502 feature in airSlate SignNow employs top-notch encryption and security protocols to safeguard sensitive information during the document signing process. Businesses can trust that their documents are protected, which is crucial in maintaining confidentiality and compliance.

Get more for 502 FORM MARYLAND RESIDENT INCOME TAX RETURN

Find out other 502 FORM MARYLAND RESIDENT INCOME TAX RETURN

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now