MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 2020

What is the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00

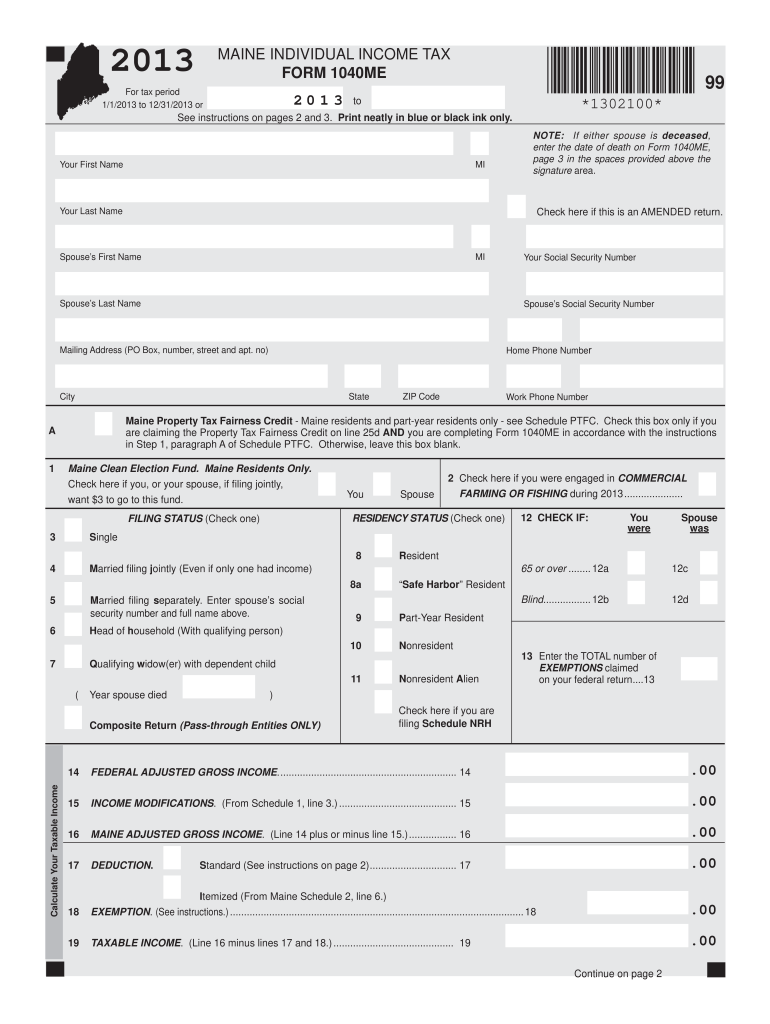

The MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 is a tax form used by residents of Maine to report their individual income to the state. This form is essential for calculating the amount of state income tax owed based on the taxpayer's income, deductions, and credits. It is part of the annual process of filing taxes and ensures compliance with state tax laws. Understanding this form is crucial for accurate tax reporting and avoiding penalties.

How to use the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00

Using the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and any applicable deductions or credits. After completing the form, review it carefully to ensure accuracy. Finally, submit the form according to the preferred submission method, whether electronically or by mail.

Steps to complete the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00

Completing the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 involves a systematic approach:

- Gather all relevant tax documents, including income statements and receipts for deductions.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Calculate adjustments to income, if applicable.

- Claim any deductions and credits you qualify for to reduce your taxable income.

- Review the completed form for any errors or omissions.

- Submit the form via your chosen method, ensuring it is sent by the filing deadline.

Legal use of the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00

The legal use of the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 is governed by state tax regulations. When completed accurately and submitted on time, the form serves as a legally binding document for reporting income and calculating tax liability. It is essential to adhere to all legal requirements, including the use of e-signatures if filing electronically, to ensure the form is accepted by the state tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 typically align with the federal tax deadline. For most taxpayers, this is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines or additional filing requirements that may arise.

Form Submission Methods (Online / Mail / In-Person)

The MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 can be submitted through various methods:

- Online: Many taxpayers choose to file electronically using tax preparation software or through the Maine Revenue Services website.

- Mail: The completed form can be printed and mailed to the designated state tax office.

- In-Person: Taxpayers may also have the option to submit their forms in person at local tax offices, although this is less common.

Quick guide on how to complete maine individual income tax form 1040me 1302100 00

Effortlessly Prepare MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly solution to traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without any holdups. Handle MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

Editing and Electronically Signing MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 with Ease

- Locate MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 and select Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and electronically sign MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maine individual income tax form 1040me 1302100 00

Create this form in 5 minutes!

How to create an eSignature for the maine individual income tax form 1040me 1302100 00

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00?

The MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 is the official tax form used by residents of Maine to report their individual income for tax purposes. This form helps individuals accurately declare their earnings and calculate their tax liability, ensuring compliance with state regulations.

-

How can I obtain the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00?

You can easily obtain the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 through the Maine Revenue Services website or directly from local tax offices. Additionally, many online tax preparation services can help you access and complete this form as part of their offerings.

-

Is there a fee associated with filing the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00?

Filing the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 itself typically does not incur a direct fee if you're submitting it on your own. However, if you choose to use a tax preparation service, there may be associated costs depending on the service's pricing structure.

-

What features does airSlate SignNow offer for filing the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00?

airSlate SignNow provides an easy-to-use platform for eSigning and sending the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00. With features like customizable templates and secure document storage, businesses can seamlessly manage their tax documents through our service.

-

How does airSlate SignNow ensure the security of the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00?

airSlate SignNow prioritizes the security of your documents, including the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00, by utilizing advanced encryption and secure storage solutions. Our compliance with industry standards helps protect sensitive tax information throughout the signing process.

-

Can I integrate airSlate SignNow with other software for handling the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00?

Yes, airSlate SignNow easily integrates with various accounting and tax software, making it convenient for businesses to manage the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 alongside their other financial documents. This seamless integration streamlines workflows and increases efficiency.

-

What are the benefits of using airSlate SignNow for the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00?

Utilizing airSlate SignNow for the MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00 offers several benefits, including time-saving features, enhanced document security, and the ability to eSign anytime, anywhere. This cost-effective solution simplifies the filing process for individuals and businesses alike.

Get more for MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00

Find out other MAINE INDIVIDUAL INCOME TAX FORM 1040ME *1302100* 00

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online