S Corporation Form M8 Instructions Minnesota Department of Revenue State Mn 2020

Understanding the S Corporation Form M8 Instructions

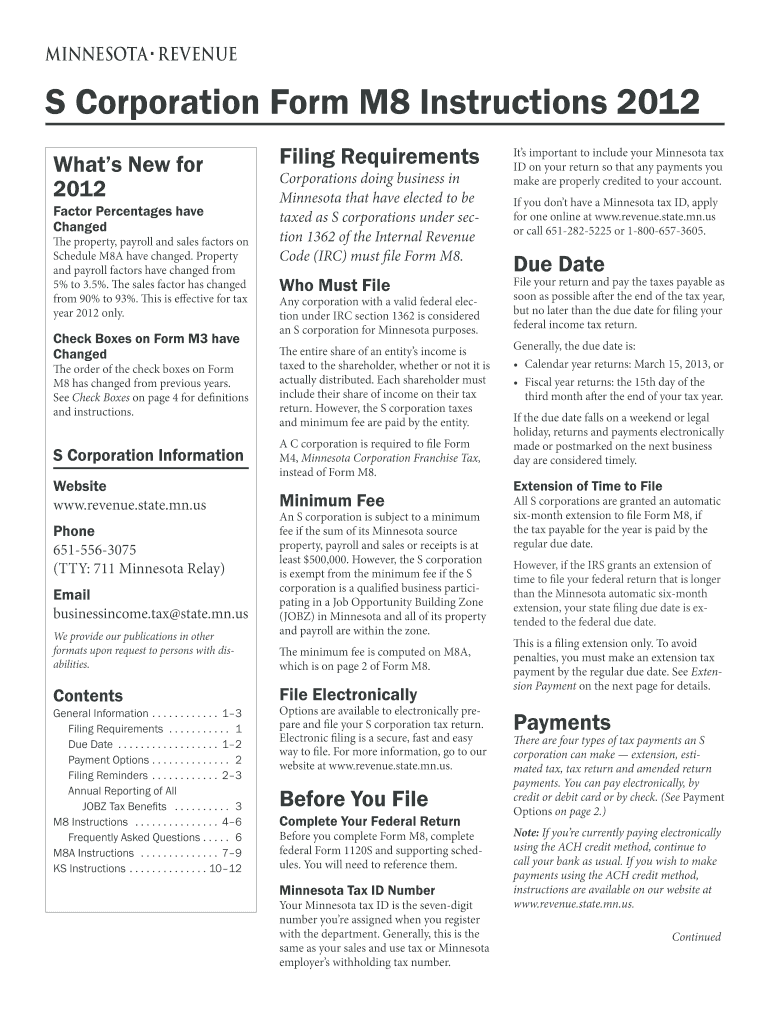

The S Corporation Form M8 instructions are essential for businesses operating as S corporations in Minnesota. This form is used to report income, deductions, and credits for S corporations, ensuring compliance with state tax regulations. It is crucial for maintaining the legal status of an S corporation and for fulfilling state tax obligations. The instructions provide detailed guidance on how to accurately complete the form, including specific requirements unique to Minnesota.

Steps to Complete the S Corporation Form M8 Instructions

Completing the S Corporation Form M8 requires careful attention to detail. Here are the key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the form with accurate information regarding the corporation's income, deductions, and credits.

- Ensure that all calculations are correct to avoid penalties.

- Review the form for completeness before submission.

- Submit the form by the specified deadline to avoid late filing penalties.

Legal Use of the S Corporation Form M8 Instructions

The S Corporation Form M8 instructions are legally binding when completed and submitted according to Minnesota state laws. To ensure the form's validity, it must be signed by an authorized individual within the corporation. Additionally, the form must comply with the standards set forth by the Minnesota Department of Revenue, including accurate reporting of all financial information. Utilizing a reliable eSignature solution can enhance the legal standing of the submitted documents.

State-Specific Rules for the S Corporation Form M8 Instructions

Each state has its own regulations regarding S corporations, and Minnesota is no exception. The S Corporation Form M8 instructions outline specific rules that businesses must follow, including:

- Filing deadlines unique to Minnesota.

- Requirements for reporting state-specific credits and deductions.

- Guidelines for maintaining compliance with state tax laws.

Filing Deadlines and Important Dates

Timely filing of the S Corporation Form M8 is crucial to avoid penalties. The form typically has a set deadline aligned with the federal tax filing dates. It is important for businesses to be aware of these dates and plan accordingly to ensure all documentation is submitted on time. Keeping track of these deadlines helps maintain good standing with the Minnesota Department of Revenue.

Form Submission Methods

The S Corporation Form M8 can be submitted through various methods, including online filing, mailing, or in-person submission. Each method has its own advantages:

- Online filing: Fast and efficient, with immediate confirmation of receipt.

- Mail: Allows for physical documentation, but may take longer for processing.

- In-person: Provides a direct way to submit and ask questions, but may require scheduling an appointment.

Quick guide on how to complete s corporation form m8 instructions 2012 minnesota department of revenue state mn

Prepare S Corporation Form M8 Instructions Minnesota Department Of Revenue State Mn effortlessly on any gadget

Digital document management has gained increased popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage S Corporation Form M8 Instructions Minnesota Department Of Revenue State Mn on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign S Corporation Form M8 Instructions Minnesota Department Of Revenue State Mn with ease

- Obtain S Corporation Form M8 Instructions Minnesota Department Of Revenue State Mn and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or blackout confidential information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your requirements in document management in just a few clicks from any device you prefer. Modify and eSign S Corporation Form M8 Instructions Minnesota Department Of Revenue State Mn and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct s corporation form m8 instructions 2012 minnesota department of revenue state mn

Create this form in 5 minutes!

How to create an eSignature for the s corporation form m8 instructions 2012 minnesota department of revenue state mn

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to Minnesota M8 instructions 2022?

airSlate SignNow offers a variety of features that assist users in managing their documents effectively. The Minnesota M8 instructions 2022 can be easily integrated into our platform, allowing for seamless eSigning and document tracking. Users can customize their workflows to suit the specific requirements outlined in the Minnesota M8 instructions.

-

How does airSlate SignNow ensure compliance with Minnesota M8 instructions 2022?

Compliance with Minnesota M8 instructions 2022 is a priority at airSlate SignNow. Our platform utilizes secure encryption and provides audit trails for all signed documents, ensuring that your transactions meet all legal requirements specified in the Minnesota guidelines. Additionally, our team continuously updates the software to align with regulatory changes.

-

What is the pricing structure for using airSlate SignNow with Minnesota M8 instructions 2022?

airSlate SignNow offers competitive pricing plans that cater to various business needs while ensuring ease of use with Minnesota M8 instructions 2022. Our plans include a range of features from basic eSigning to advanced integrations, allowing users to choose a package that fits their budget and requirements. You can check our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other applications while following Minnesota M8 instructions 2022?

Yes, airSlate SignNow supports multiple integrations with popular applications to enhance your workflow while adhering to Minnesota M8 instructions 2022. Whether you need to connect with CRM systems, storage solutions, or other document management tools, our platform is designed to accommodate various integrations that simplify your processes.

-

What benefits does airSlate SignNow provide for users of Minnesota M8 instructions 2022?

Using airSlate SignNow fulfills the needs of users following Minnesota M8 instructions 2022 by delivering a streamlined and efficient document signing experience. Benefits include reduced turnaround time for document approvals, enhanced security for sensitive information, and the ability to manage all documents in one user-friendly platform. This leads to improved productivity and business efficiency.

-

Is customer support available for queries regarding Minnesota M8 instructions 2022?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any questions or concerns regarding the Minnesota M8 instructions 2022. Our support team is available through various channels, ensuring you get the help you need quickly to utilize our platform effectively in accordance with the instructions.

-

How can airSlate SignNow help businesses comply with Minnesota M8 instructions 2022 in practice?

airSlate SignNow simplifies compliance with Minnesota M8 instructions 2022 by automating the document signing process. Our software provides templates and customizable workflows that align with the guidelines, ensuring that all necessary steps are followed. This practical approach not only saves time but also minimizes the risk of non-compliance.

Get more for S Corporation Form M8 Instructions Minnesota Department Of Revenue State Mn

- Liheap louisiana online application form

- 6 month asq pdf form

- Real estate assistant training pdf form

- Prolia order form

- Printable fillable treasurer report forms

- 3200 form

- Acceptance of service sca fc 105 west virginia judiciary courtswv form

- Support needs assessment form sna for grade r onlysupport needs assessment form sna for grade r onlysupport needs assessment

Find out other S Corporation Form M8 Instructions Minnesota Department Of Revenue State Mn

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document