Tax Form 149 2019

What is the Tax Form 149

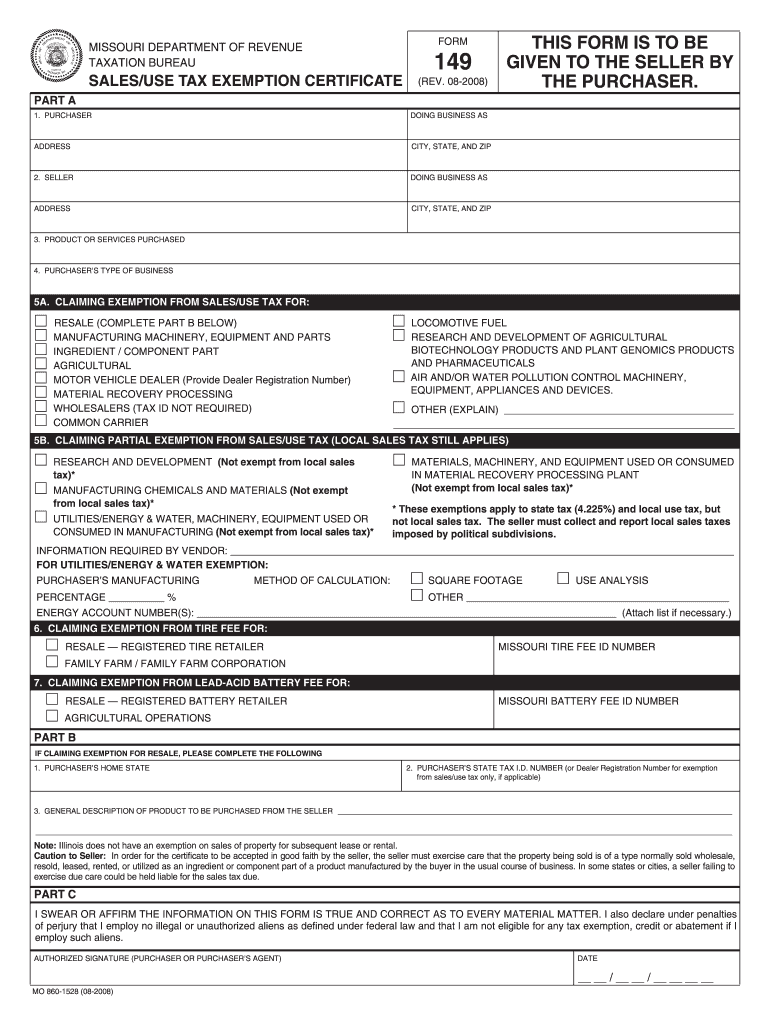

The Tax Form 149 is a specific document used for reporting certain tax-related information to the Internal Revenue Service (IRS) in the United States. This form is essential for individuals and businesses that need to disclose specific financial details for tax purposes. Understanding the purpose and requirements of Tax Form 149 is crucial for compliance with federal tax regulations.

How to use the Tax Form 149

Using the Tax Form 149 involves several steps to ensure accurate and complete reporting. First, gather all necessary financial documents that pertain to the information required on the form. Next, carefully fill out each section of the form, ensuring that all details are correct and complete. After completing the form, review it for any errors before submission. It is advisable to keep a copy of the completed form for your records.

Steps to complete the Tax Form 149

Completing the Tax Form 149 can be straightforward if you follow these steps:

- Gather all relevant financial documents, such as income statements and expense records.

- Fill out the form with your personal and financial information, ensuring accuracy.

- Double-check all entries for correctness to avoid potential issues with the IRS.

- Sign and date the form to validate your submission.

- Submit the form either electronically or via mail, depending on your preference and the IRS guidelines.

Legal use of the Tax Form 149

The legal use of the Tax Form 149 is governed by IRS regulations, which stipulate how and when the form should be used. It is important to ensure that the information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. Utilizing a reliable electronic signature solution can enhance the legal validity of the form when submitted online.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Form 149 may vary depending on the specific tax year and individual circumstances. Generally, it is advisable to submit the form by the tax filing deadline, which is typically April 15 for most taxpayers. Keeping track of these important dates ensures compliance and helps avoid late fees or penalties.

Who Issues the Form

The Tax Form 149 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and updates regarding the use of this form, ensuring that taxpayers have the necessary information to complete it correctly.

Quick guide on how to complete tax form 149 2008

Complete Tax Form 149 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents promptly without holdups. Manage Tax Form 149 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Tax Form 149 with ease

- Obtain Tax Form 149 and then select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Form 149 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax form 149 2008

Create this form in 5 minutes!

How to create an eSignature for the tax form 149 2008

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is Tax Form 149 and why is it important?

Tax Form 149 is essential for businesses as it provides crucial information regarding tax obligations. Properly completing and submitting Tax Form 149 ensures compliance with tax regulations, helping you avoid penalties and maintain good standing with tax authorities.

-

How can airSlate SignNow assist in completing Tax Form 149?

airSlate SignNow simplifies the process of completing Tax Form 149 by allowing users to eSign and manage documents online. With its intuitive interface, you can easily fill out, sign, and share Tax Form 149, streamlining the entire process.

-

Is there a fee to use airSlate SignNow for Tax Form 149?

AirSlate SignNow offers various pricing plans that accommodate businesses of all sizes. Whether you need to handle multiple Tax Form 149 submissions or just a few, there are cost-effective solutions available to meet your specific needs.

-

What features does airSlate SignNow offer for managing Tax Form 149?

airSlate SignNow provides features like document templates, eSignature capabilities, and secure cloud storage, ensuring a seamless experience for managing Tax Form 149. These tools help enhance productivity and ensure accuracy during the signing process.

-

Can I integrate airSlate SignNow with other software for Tax Form 149?

Yes, airSlate SignNow offers integrations with popular software applications, enabling you to streamline your workflow for managing Tax Form 149. You can connect it with your accounting or project management tools for enhanced efficiency.

-

What are the benefits of using airSlate SignNow for Tax Form 149?

Using airSlate SignNow for Tax Form 149 brings numerous benefits, including increased accuracy, reduced processing time, and enhanced collaboration. Its user-friendly platform ensures that your Tax Form 149 is processed efficiently and submitted on time.

-

Is airSlate SignNow secure for handling sensitive Tax Form 149 information?

Absolutely. airSlate SignNow utilizes industry-standard security protocols to protect your sensitive data, such as Tax Form 149. You can have peace of mind knowing that your information is secure during the signing and submission process.

Get more for Tax Form 149

Find out other Tax Form 149

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure