Form 941n 2020

What is the Form 941n

The Form 941n is a tax document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is specifically designed for employers who are required to file quarterly payroll tax returns. It provides the Internal Revenue Service (IRS) with essential information regarding the taxes owed and the amounts that have been withheld from employees' paychecks.

How to use the Form 941n

Using the Form 941n involves a few straightforward steps. Employers must first gather the necessary payroll information for the quarter, including total wages paid, the amount of taxes withheld, and any adjustments for prior periods. Once this information is compiled, it can be entered into the appropriate fields on the form. After completing the form, employers should review it for accuracy before submitting it to the IRS by the specified deadline.

Steps to complete the Form 941n

Completing the Form 941n requires careful attention to detail. Here are the steps to follow:

- Gather payroll records for the quarter.

- Calculate total wages paid to employees.

- Determine the amount of federal income tax withheld.

- Calculate Social Security and Medicare taxes owed.

- Fill out the form with the gathered information.

- Review the form for accuracy.

- Submit the completed form to the IRS by the deadline.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Form 941n to avoid penalties. The form is typically due on the last day of the month following the end of each quarter. For example, the deadlines are:

- First Quarter (January - March): Due by April 30.

- Second Quarter (April - June): Due by July 31.

- Third Quarter (July - September): Due by October 31.

- Fourth Quarter (October - December): Due by January 31 of the following year.

Legal use of the Form 941n

The Form 941n must be completed accurately to ensure compliance with federal tax laws. It serves as a legal document that reports an employer's tax obligations to the IRS. Failure to file the form correctly or on time can lead to penalties, including fines and interest on unpaid taxes. Employers are encouraged to maintain records of their submissions and any correspondence with the IRS regarding the form.

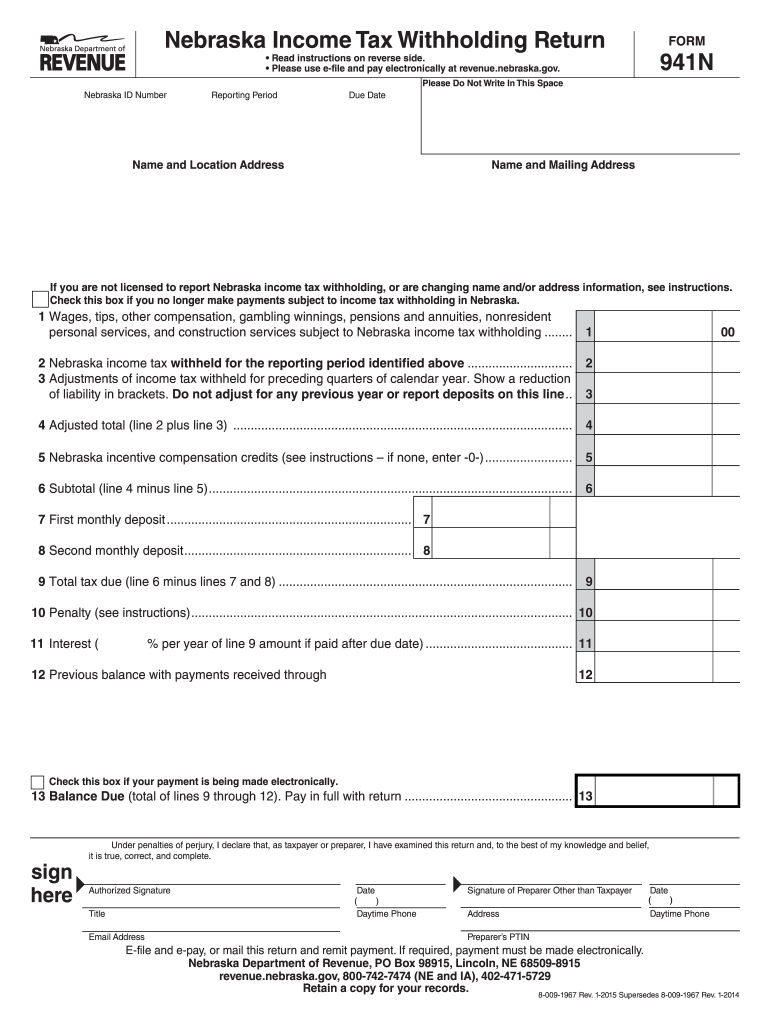

Key elements of the Form 941n

Several key elements must be included when filling out the Form 941n:

- Employer identification information, including name and address.

- Quarterly payroll totals, including wages paid and taxes withheld.

- Adjustments for any prior period errors.

- Signature of the employer or authorized representative.

Quick guide on how to complete form 941n 2013

Complete Form 941n effortlessly on any device

Web-based document management has become increasingly popular with businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed materials, as you can easily locate the right document and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your papers quickly and smoothly. Manage Form 941n on any device using airSlate SignNow's Android or iOS applications and streamline any document-driven procedure today.

The easiest way to edit and eSign Form 941n without hassle

- Obtain Form 941n and click Get Form to begin.

- Utilize the available tools to fill out your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your document, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that require the printing of new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 941n and ensure effective communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941n 2013

Create this form in 5 minutes!

How to create an eSignature for the form 941n 2013

The best way to make an eSignature for your PDF document online

The best way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 941n and how is it used?

Form 941n is a tax form used by employers to report income taxes withheld from employees’ paychecks. This form is essential for compliance with federal employment tax laws. Utilizing airSlate SignNow simplifies the submission process, ensuring your Form 941n is filed accurately and on time.

-

How can airSlate SignNow help with filing Form 941n?

airSlate SignNow offers a streamlined platform for creating, signing, and managing your Form 941n electronically. With features like e-signatures and automated workflows, you can reduce the time and effort required to file. This not only enhances accuracy but also improves compliance with IRS regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose from various subscription models based on your needs, ensuring you get the best value for managing documents like Form 941n. Additionally, there are no hidden fees, making budgeting easier.

-

Does airSlate SignNow support integrations with accounting software?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage documents like Form 941n. This allows for automatic data transfer, reducing the risk of errors and saving time. Integration with software like QuickBooks enhances overall workflow efficiency.

-

Is airSlate SignNow secure for handling Form 941n?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption technologies to protect sensitive data, including Form 941n. This ensures that your information is safe while being shared and stored, giving you peace of mind.

-

Can I access Form 941n templates within airSlate SignNow?

Absolutely! airSlate SignNow provides customizable templates for Form 941n, allowing you to create and modify documents to fit your specific needs. This feature saves time and ensures that your forms are always compliant with the latest regulations.

-

How user-friendly is airSlate SignNow for new users?

airSlate SignNow is designed with user experience in mind, making it intuitive and easy to use for new users. With a simple interface and helpful tutorials, you can quickly learn how to manage documents like Form 941n without requiring extensive training.

Get more for Form 941n

Find out other Form 941n

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer