Wisconsin Wt 7 Tax Form 2020

What is the Wisconsin WT-7 Tax Form

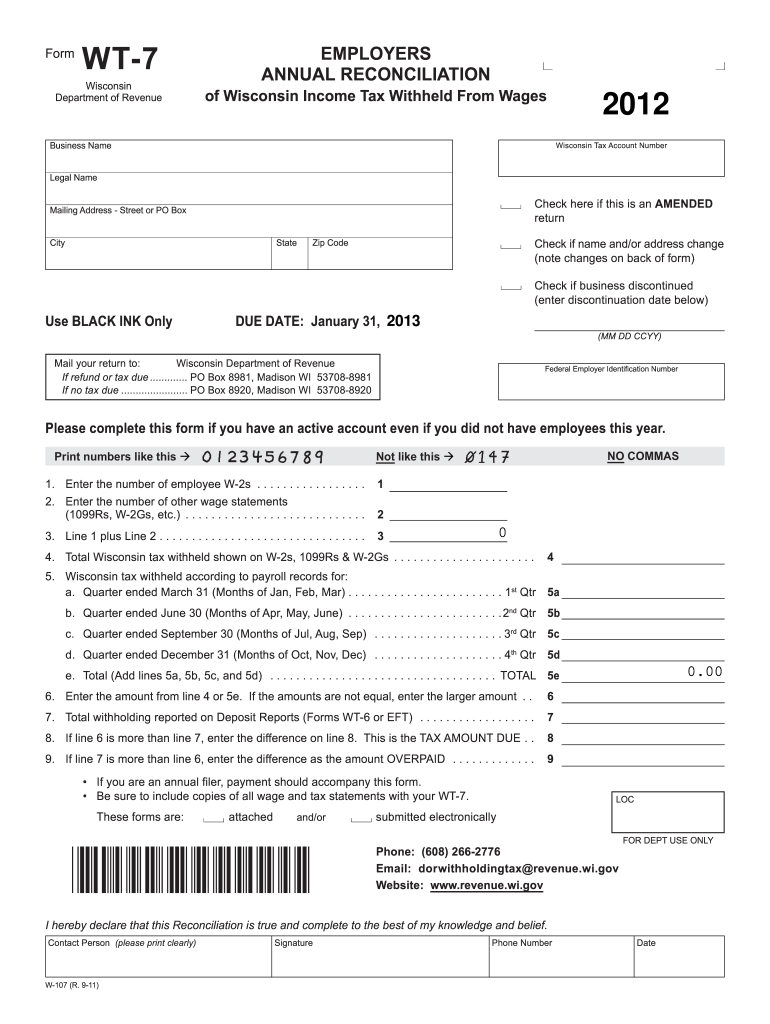

The Wisconsin WT-7 Tax Form is a state-specific document used for withholding tax purposes. It is primarily utilized by employers to report and remit state income tax withheld from employees' wages. This form is essential for ensuring compliance with Wisconsin tax regulations and helps maintain accurate records of withholding amounts. Employers must complete this form accurately to avoid potential penalties and ensure proper tax collection.

How to use the Wisconsin WT-7 Tax Form

To use the Wisconsin WT-7 Tax Form effectively, employers should first gather all necessary employee information, including Social Security numbers and wage details. The form requires specific data about the employer and the employees for whom taxes are being withheld. After filling out the required fields, employers must submit the form to the Wisconsin Department of Revenue along with the payment of any withheld taxes. It is crucial to keep copies of the completed form for record-keeping and future reference.

Steps to complete the Wisconsin WT-7 Tax Form

Completing the Wisconsin WT-7 Tax Form involves several key steps:

- Gather employee information, including names, addresses, and Social Security numbers.

- Determine the total amount of state income tax withheld from each employee's wages.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the Wisconsin Department of Revenue along with the payment for withheld taxes.

Legal use of the Wisconsin WT-7 Tax Form

The Wisconsin WT-7 Tax Form is legally required for employers to report state income tax withholding. Its proper use ensures compliance with Wisconsin tax laws and helps avoid penalties for non-compliance. Employers must adhere to the guidelines set forth by the Wisconsin Department of Revenue, including timely submission and accurate reporting of withheld amounts. Failure to comply with these legal requirements can result in fines and other legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin WT-7 Tax Form are critical for compliance. Employers must submit this form along with any tax payments by specific deadlines to avoid penalties. Typically, the form is due on a quarterly basis, with the exact dates varying depending on the employer's reporting schedule. It is essential for employers to stay informed about these deadlines to ensure timely filing and payment.

Form Submission Methods (Online / Mail / In-Person)

The Wisconsin WT-7 Tax Form can be submitted through various methods, providing flexibility for employers. Options include:

- Online submission through the Wisconsin Department of Revenue's e-filing system.

- Mailing the completed form to the designated address provided by the Department of Revenue.

- In-person submission at local Department of Revenue offices, if preferred.

Who Issues the Form

The Wisconsin WT-7 Tax Form is issued by the Wisconsin Department of Revenue. This state agency oversees the administration of tax laws and ensures compliance with state tax regulations. Employers can obtain the form directly from the Department of Revenue's website or through their local offices. It is important for employers to use the most current version of the form to ensure compliance with any updates or changes in tax law.

Quick guide on how to complete wisconsin wt 7 tax form 2011

Complete Wisconsin Wt 7 Tax Form seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Wisconsin Wt 7 Tax Form on any platform using airSlate SignNow’s Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and electronically sign Wisconsin Wt 7 Tax Form with ease

- Obtain Wisconsin Wt 7 Tax Form and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Wisconsin Wt 7 Tax Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin wt 7 tax form 2011

Create this form in 5 minutes!

How to create an eSignature for the wisconsin wt 7 tax form 2011

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the Wisconsin Wt 7 Tax Form and who needs to file it?

The Wisconsin Wt 7 Tax Form is an important document required for employers to report employee wages and withholding tax. Businesses operating in Wisconsin must file this form to ensure compliance with state tax regulations. It's essential for employers to keep accurate records and submit this form timely to avoid penalties.

-

How can airSlate SignNow assist with the Wisconsin Wt 7 Tax Form?

airSlate SignNow streamlines the process of preparing and eSigning the Wisconsin Wt 7 Tax Form, making sure you meet all compliance requirements. The platform allows for easy document sharing and secure signatures, ensuring that your tax filing process is efficient and hassle-free. With airSlate SignNow, you can focus on running your business while we handle your documentation needs.

-

Is there a cost associated with using airSlate SignNow for the Wisconsin Wt 7 Tax Form?

Yes, using airSlate SignNow involves a subscription fee, which varies depending on the plan you choose. Each plan is designed to provide access to a range of features that enhance your document management, including support for filling out the Wisconsin Wt 7 Tax Form. Pricing is competitive, ensuring that you receive great value for a user-friendly experience.

-

What features does airSlate SignNow offer for managing the Wisconsin Wt 7 Tax Form?

airSlate SignNow provides a variety of features tailored for the Wisconsin Wt 7 Tax Form, including customizable templates, secure eSigning, and document workflow automation. These features help simplify the preparation and submission process, allowing you to focus on other important tasks. The intuitive interface makes it easy for users to navigate and leverage all available tools.

-

Can I integrate airSlate SignNow with other software I use for payroll and tax management?

Absolutely! airSlate SignNow offers integrations with popular software used for payroll and tax management systems. This means you can easily synchronize data and documents related to the Wisconsin Wt 7 Tax Form with your existing tools, improving efficiency and reducing errors in your tax filings.

-

What security measures does airSlate SignNow implement for the Wisconsin Wt 7 Tax Form?

airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your documents, including the Wisconsin Wt 7 Tax Form. We also adhere to compliance standards to ensure that all user data is handled securely. This commitment to security ensures that your sensitive tax information remains confidential and protected.

-

How does airSlate SignNow improve the speed of filing the Wisconsin Wt 7 Tax Form?

With features like eSigning and automated document workflows, airSlate SignNow signNowly speeds up the filing process for the Wisconsin Wt 7 Tax Form. You can instantly send, sign, and store documents without the delays associated with traditional mailing methods. This efficiency helps you meet deadlines more easily and minimizes stress during tax season.

Get more for Wisconsin Wt 7 Tax Form

Find out other Wisconsin Wt 7 Tax Form

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement