Wv State Tax Department Fiduciary Estate Tax Return Forms 2019

What is the Wv State Tax Department Fiduciary Estate Tax Return Forms

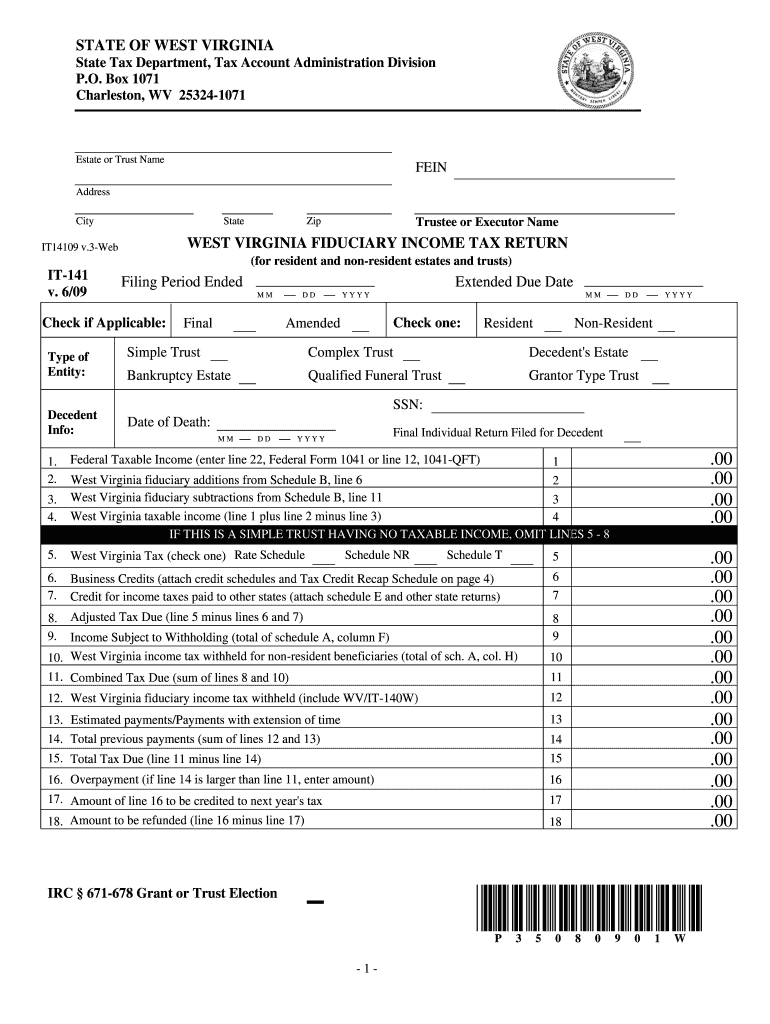

The Wv State Tax Department Fiduciary Estate Tax Return Forms are essential documents required for reporting the income and assets of a deceased individual's estate. These forms help ensure that the estate complies with state tax laws and regulations. The fiduciary, often an executor or administrator, is responsible for accurately completing and submitting these forms to the West Virginia State Tax Department. This process is crucial for settling the estate and distributing assets to beneficiaries.

How to use the Wv State Tax Department Fiduciary Estate Tax Return Forms

Using the Wv State Tax Department Fiduciary Estate Tax Return Forms involves several steps. First, gather all necessary financial information related to the estate, including income, assets, and liabilities. Next, carefully complete the forms, ensuring all details are accurate and comprehensive. The fiduciary must sign the forms, affirming their correctness. Once completed, submit the forms to the appropriate state tax authority, either electronically or by mail, depending on the submission options available.

Steps to complete the Wv State Tax Department Fiduciary Estate Tax Return Forms

Completing the Wv State Tax Department Fiduciary Estate Tax Return Forms requires a systematic approach:

- Collect all relevant financial documents related to the estate.

- Fill out the forms with accurate information regarding income, assets, and expenses.

- Review the completed forms for any errors or omissions.

- Sign the forms as the fiduciary, confirming the accuracy of the information provided.

- Submit the forms to the West Virginia State Tax Department by the specified deadline.

Legal use of the Wv State Tax Department Fiduciary Estate Tax Return Forms

The legal use of the Wv State Tax Department Fiduciary Estate Tax Return Forms is crucial for compliance with state tax laws. These forms serve as an official record of the estate's financial activities and must be completed accurately to avoid legal complications. Failure to file the forms or providing incorrect information may result in penalties, interest, and potential legal action against the fiduciary.

Required Documents

When preparing the Wv State Tax Department Fiduciary Estate Tax Return Forms, several documents are typically required:

- Death certificate of the deceased.

- Will or trust documents, if applicable.

- Financial statements, including bank statements and investment accounts.

- Records of any debts or liabilities of the estate.

- Previous tax returns of the deceased, if available.

Form Submission Methods

The Wv State Tax Department Fiduciary Estate Tax Return Forms can be submitted through various methods. The preferred method is electronic submission, which allows for quicker processing and confirmation. Alternatively, forms can be mailed directly to the West Virginia State Tax Department. In some cases, in-person submission may also be an option, depending on the specific requirements and circumstances of the estate.

Quick guide on how to complete wv state tax department fiduciary estate tax return forms 2009

Complete Wv State Tax Department Fiduciary Estate Tax Return Forms effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, enabling you to access the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Wv State Tax Department Fiduciary Estate Tax Return Forms on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

How to modify and electronically sign Wv State Tax Department Fiduciary Estate Tax Return Forms with ease

- Obtain Wv State Tax Department Fiduciary Estate Tax Return Forms and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or censor sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, frustrating form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Wv State Tax Department Fiduciary Estate Tax Return Forms to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wv state tax department fiduciary estate tax return forms 2009

Create this form in 5 minutes!

How to create an eSignature for the wv state tax department fiduciary estate tax return forms 2009

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What are the Wv State Tax Department Fiduciary Estate Tax Return Forms?

The Wv State Tax Department Fiduciary Estate Tax Return Forms are necessary documents for reporting estate income and calculating tax liabilities for estates in West Virginia. These forms ensure compliance with state tax regulations and are crucial for fiduciaries managing estate assets.

-

How can airSlate SignNow help with Wv State Tax Department Fiduciary Estate Tax Return Forms?

airSlate SignNow offers an efficient platform for sending and eSigning Wv State Tax Department Fiduciary Estate Tax Return Forms. With our user-friendly interface, you can quickly prepare and execute these forms, ensuring quick submission and compliance with the State Tax Department.

-

Are there costs associated with using airSlate SignNow for Wv State Tax Department Fiduciary Estate Tax Return Forms?

Yes, while airSlate SignNow is a cost-effective solution, there may be subscription fees based on the features you choose. Our pricing plans cater to various business needs, ensuring you find a perfect fit for managing your Wv State Tax Department Fiduciary Estate Tax Return Forms.

-

What features does airSlate SignNow provide for managing estate tax return forms?

airSlate SignNow provides numerous features such as customizable templates, automated workflows, and secure cloud storage. These tools streamline the process of filling out and submitting Wv State Tax Department Fiduciary Estate Tax Return Forms, saving you time and reducing errors.

-

Can I integrate airSlate SignNow with other software for managing Wv State Tax Department Fiduciary Estate Tax Return Forms?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing you to coordinate your estate tax management process. By connecting to tools like accounting software, you can enhance the efficiency of managing your Wv State Tax Department Fiduciary Estate Tax Return Forms.

-

What are the benefits of using airSlate SignNow for estate tax documents?

Using airSlate SignNow for your estate tax documents, like the Wv State Tax Department Fiduciary Estate Tax Return Forms, offers greater flexibility and speed. You can easily eSign documents, track the status of submissions, and ensure secure handling of sensitive information.

-

Is airSlate SignNow secure for handling Wv State Tax Department Fiduciary Estate Tax Return Forms?

Absolutely, airSlate SignNow prioritizes security with encrypted eSignature technology and secure document storage. Your Wv State Tax Department Fiduciary Estate Tax Return Forms will be protected, ensuring only authorized persons have access to sensitive information.

Get more for Wv State Tax Department Fiduciary Estate Tax Return Forms

Find out other Wv State Tax Department Fiduciary Estate Tax Return Forms

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple