Fiduciary Income Tax Virginia Tax 2022-2026

Understanding the Fiduciary Income Tax in West Virginia

The Fiduciary Income Tax in West Virginia applies to estates and trusts that generate income. This tax is essential for managing the financial obligations of a trust or estate, ensuring compliance with state tax laws. The tax is calculated based on the income generated by the trust or estate, and it is the responsibility of the fiduciary, typically the trustee or executor, to file the necessary forms and pay the tax owed.

Steps to Complete the Fiduciary Income Tax in West Virginia

Completing the Fiduciary Income Tax involves several key steps:

- Gather all necessary financial documents related to the trust or estate, including income statements, deductions, and prior tax returns.

- Determine the total income generated by the trust or estate for the tax year.

- Calculate any allowable deductions, such as administrative expenses or distributions to beneficiaries.

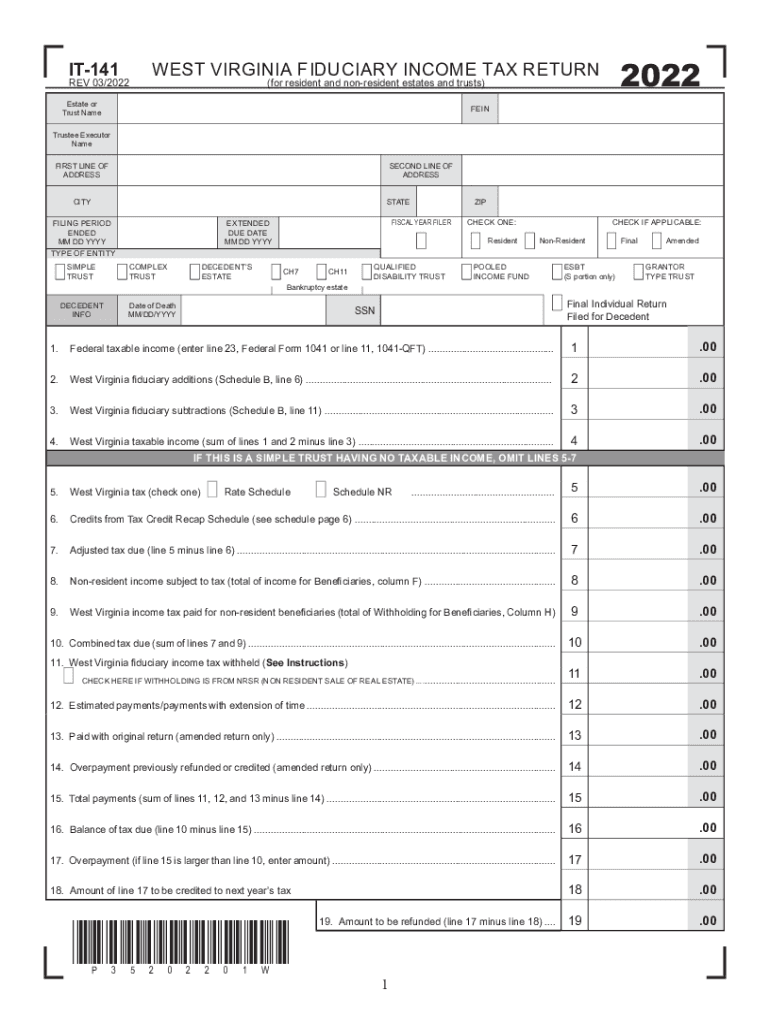

- Complete the appropriate tax form, typically the West Virginia Form IT-141, ensuring all information is accurate and complete.

- File the completed form with the West Virginia State Tax Department by the designated deadline.

Required Documents for the Fiduciary Income Tax in West Virginia

When filing the Fiduciary Income Tax, specific documents are necessary to ensure accurate reporting. These include:

- Income statements for the trust or estate, such as bank statements and investment income reports.

- Records of any deductions claimed, including receipts for administrative expenses.

- Prior year tax returns, if applicable, to provide a basis for comparison.

- Documentation of distributions made to beneficiaries during the tax year.

Filing Deadlines for the Fiduciary Income Tax in West Virginia

It is crucial to adhere to filing deadlines to avoid penalties. The Fiduciary Income Tax returns are typically due on the fifteenth day of the fourth month following the end of the tax year. For most estates and trusts, this means the deadline is April 15. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day.

Penalties for Non-Compliance with the Fiduciary Income Tax

Failure to comply with the Fiduciary Income Tax regulations can result in significant penalties. These may include:

- Late filing penalties, which can accumulate based on the amount of tax owed.

- Interest on unpaid taxes, which accrues from the due date until payment is made.

- Potential legal consequences for the fiduciary, including personal liability for unpaid taxes.

Who Issues the Fiduciary Income Tax Form in West Virginia

The West Virginia State Tax Department is responsible for issuing the Fiduciary Income Tax forms, including Form IT-141. This department provides guidance on the completion of the forms and the filing process, ensuring that fiduciaries understand their obligations under state law.

Quick guide on how to complete fiduciary income tax virginia tax

Complete Fiduciary Income Tax Virginia Tax effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can find the required form and securely save it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and efficiently. Manage Fiduciary Income Tax Virginia Tax on any device with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to edit and eSign Fiduciary Income Tax Virginia Tax without hassle

- Obtain Fiduciary Income Tax Virginia Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal weight as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Choose how you want to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Fiduciary Income Tax Virginia Tax and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fiduciary income tax virginia tax

Create this form in 5 minutes!

How to create an eSignature for the fiduciary income tax virginia tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the wv form it 141?

The wv form it 141 is a state-specific form used in West Virginia for tax-related submissions. It is essential for individuals and businesses to understand its requirements to ensure compliance with state regulations. Using airSlate SignNow can simplify the process of completing and submitting the wv form it 141.

-

How can airSlate SignNow help with the wv form it 141?

airSlate SignNow streamlines the process of filling out and signing the wv form it 141. With its user-friendly interface, businesses can easily create, edit, and eSign the document without any hassle. This ensures a fast and efficient submission process while keeping all legal requirements in check.

-

Is there a cost associated with using airSlate SignNow for the wv form it 141?

Yes, airSlate SignNow offers various pricing plans depending on the features you need. These plans are designed to be cost-effective and provide value for businesses managing documents like the wv form it 141. You can select a plan that best fits your organization's needs and budget.

-

Can I integrate airSlate SignNow with other software when working with the wv form it 141?

Absolutely! airSlate SignNow offers a range of integrations with popular software applications. This means you can seamlessly work with your existing tools while managing the wv form it 141, enhancing your workflow and productivity.

-

What features does airSlate SignNow offer for handling the wv form it 141?

airSlate SignNow provides a variety of features specifically designed to handle documents like the wv form it 141. Key features include eSignature capabilities, document templates, and secure storage, making it easy to manage all your signing needs in one place.

-

How secure is airSlate SignNow when using the wv form it 141?

Security is a top priority for airSlate SignNow. When handling the wv form it 141, your data is protected with industry-standard encryption and compliance with various security regulations. You can trust that your sensitive information remains safe throughout the signing process.

-

Is airSlate SignNow suitable for small businesses submitting the wv form it 141?

Yes, airSlate SignNow is ideal for small businesses looking to manage the wv form it 141 efficiently. Its user-friendly platform combined with cost-effective pricing makes it accessible for organizations of all sizes. Small businesses can greatly benefit from streamlined document management that airSlate SignNow offers.

Get more for Fiduciary Income Tax Virginia Tax

- Mutual wills package with last wills and testaments for married couple with no children tennessee form

- Tennessee wills last testaments form

- Tennessee last will form

- Legal last will and testament form for a married person with no children tennessee

- Tn married form

- Codicil to will form for amending your will will changes or amendments tennessee

- Legal last will and testament form for married person with adult and minor children from prior marriage tennessee

- Legal last will and testament form for married person with adult and minor children tennessee

Find out other Fiduciary Income Tax Virginia Tax

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract