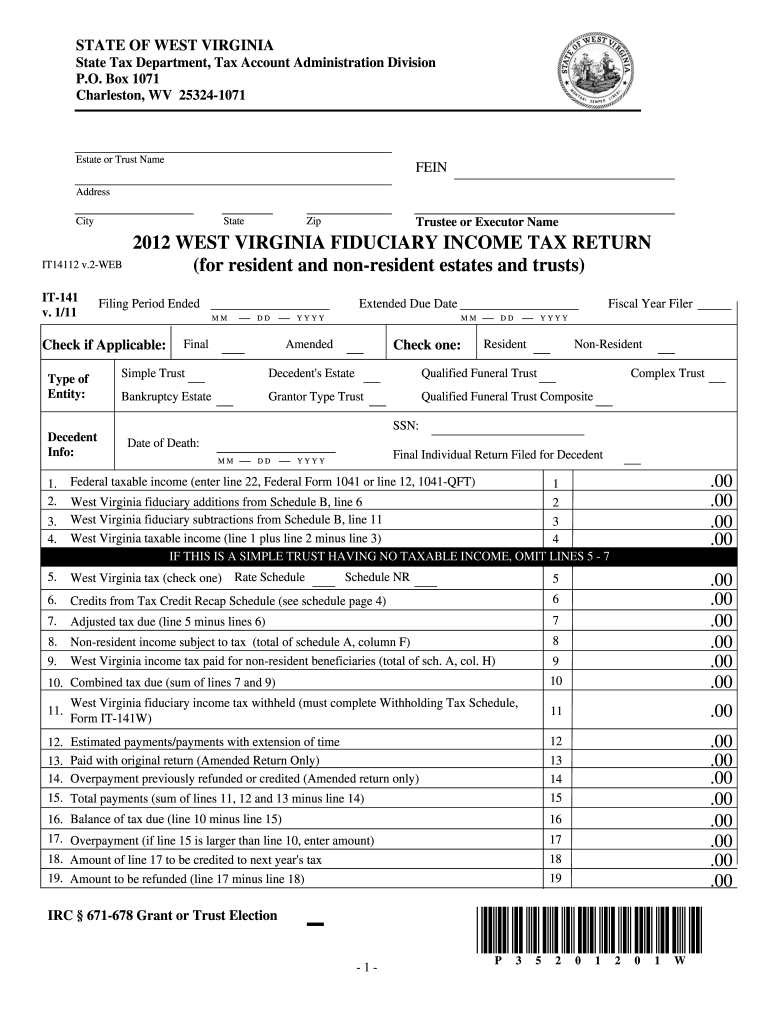

West Virginia Fiduciary Income Tax Return Form 2012

What is the West Virginia Fiduciary Income Tax Return Form

The West Virginia Fiduciary Income Tax Return Form is a specific tax document used by estates and trusts to report income earned during the tax year. This form is essential for fiduciaries, who are responsible for managing the assets of an estate or trust, ensuring that all income is accurately reported to the state tax authority. The form captures various types of income, deductions, and credits applicable to the fiduciary entity, and it must be filed annually to comply with state tax regulations.

How to use the West Virginia Fiduciary Income Tax Return Form

Using the West Virginia Fiduciary Income Tax Return Form involves several key steps. First, gather all necessary financial documents related to the estate or trust, including income statements, deduction records, and any relevant tax credits. Next, fill out the form accurately, ensuring that all income sources are reported and that deductions are correctly applied. Once completed, the form can be submitted electronically or via mail, depending on the preferences of the fiduciary. It is crucial to review the form for accuracy before submission to prevent any potential issues with the state tax authority.

Steps to complete the West Virginia Fiduciary Income Tax Return Form

Completing the West Virginia Fiduciary Income Tax Return Form involves a systematic approach:

- Gather all necessary financial documents, including income statements and deduction records.

- Begin filling out the form, starting with the basic information about the estate or trust.

- Report all sources of income, including interest, dividends, and capital gains.

- Apply any relevant deductions and credits available to the fiduciary entity.

- Double-check all entries for accuracy and completeness.

- Sign the form electronically or by hand, depending on the submission method chosen.

- Submit the completed form by the designated deadline.

Filing Deadlines / Important Dates

Filing deadlines for the West Virginia Fiduciary Income Tax Return Form are typically aligned with federal tax deadlines. The form is generally due on the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this means the form is due by April 15. It is important to stay informed about any changes to deadlines, especially in light of potential extensions or adjustments made by the state tax authority.

Required Documents

To successfully complete the West Virginia Fiduciary Income Tax Return Form, certain documents are required:

- Income statements from all sources, including bank interest and dividends.

- Records of any capital gains or losses.

- Documentation for deductions, such as expenses related to the administration of the estate or trust.

- Any applicable tax credit information.

Form Submission Methods (Online / Mail / In-Person)

The West Virginia Fiduciary Income Tax Return Form can be submitted through various methods to accommodate different preferences:

- Online Submission: Many fiduciaries opt to file electronically through authorized e-filing services, which streamline the process and ensure quicker processing times.

- Mail: The form can be printed and mailed to the appropriate state tax office. Ensure that it is postmarked by the filing deadline.

- In-Person: Some individuals may choose to deliver the form directly to their local tax office, which can provide immediate confirmation of receipt.

Quick guide on how to complete 2012 west virginia fiduciary income tax return form

Your assistance manual on how to prepare your West Virginia Fiduciary Income Tax Return Form

If you’re curious about how to create and submit your West Virginia Fiduciary Income Tax Return Form, here are some brief guidelines on how to simplify tax reporting.

To start, you simply need to set up your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to edit, create, and finalize your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and go back to modify responses as necessary. Optimize your tax handling with enhanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your West Virginia Fiduciary Income Tax Return Form in just a few minutes:

- Create your account and begin working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through variants and schedules.

- Click Get form to access your West Virginia Fiduciary Income Tax Return Form in our editor.

- Fill in the necessary fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Use this manual to file your taxes electronically with airSlate SignNow. Please be aware that paper filing can lead to return errors and delay reimbursements. Of course, before e-filing your taxes, check the IRS website for reporting regulations applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2012 west virginia fiduciary income tax return form

FAQs

-

Can I fill out an income tax return for FY 2012-2013?

According to section 139 (1) of the Income Tax Act, 1961:Every person —

Create this form in 5 minutes!

How to create an eSignature for the 2012 west virginia fiduciary income tax return form

How to make an electronic signature for your 2012 West Virginia Fiduciary Income Tax Return Form online

How to make an electronic signature for the 2012 West Virginia Fiduciary Income Tax Return Form in Google Chrome

How to create an electronic signature for putting it on the 2012 West Virginia Fiduciary Income Tax Return Form in Gmail

How to generate an electronic signature for the 2012 West Virginia Fiduciary Income Tax Return Form right from your mobile device

How to create an eSignature for the 2012 West Virginia Fiduciary Income Tax Return Form on iOS devices

How to generate an electronic signature for the 2012 West Virginia Fiduciary Income Tax Return Form on Android OS

People also ask

-

What is the West Virginia Fiduciary Income Tax Return Form?

The West Virginia Fiduciary Income Tax Return Form is a document required by the West Virginia Department of Revenue for estates and trusts to report income received. This form ensures that fiduciaries fulfill their tax obligations while managing assets on behalf of beneficiaries. Understanding this form is essential for accurate tax filing.

-

How can airSlate SignNow help with the West Virginia Fiduciary Income Tax Return Form?

airSlate SignNow simplifies the process of sending and eSigning the West Virginia Fiduciary Income Tax Return Form. With an easy-to-use interface, users can quickly prepare and obtain the necessary signatures for their tax returns. This streamlines tax submission and ensures compliance with state regulations.

-

What are the costs associated with using airSlate SignNow for the West Virginia Fiduciary Income Tax Return Form?

airSlate SignNow offers cost-effective pricing plans that cater to various business needs when processing the West Virginia Fiduciary Income Tax Return Form. Users can choose from different subscription options that provide scalability and flexibility. This makes it an economical choice for businesses and fiduciaries alike.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes several features that are beneficial for managing the West Virginia Fiduciary Income Tax Return Form. These features include secure eSigning, document templates, and real-time tracking of document status. These capabilities ensure efficient handling of tax documents while maintaining security and compliance.

-

Is airSlate SignNow compliant with legal requirements for the West Virginia Fiduciary Income Tax Return Form?

Yes, airSlate SignNow is designed to be compliant with legal requirements for electronic signatures, ensuring that your West Virginia Fiduciary Income Tax Return Form is legally binding. This compliance helps reduce the risk of rejections from tax authorities. Trust in airSlate SignNow to ensure adherence to all legal standards.

-

Can I integrate airSlate SignNow with other platforms for filing the West Virginia Fiduciary Income Tax Return Form?

Absolutely! airSlate SignNow offers integrations with various platforms, making it easy to file the West Virginia Fiduciary Income Tax Return Form alongside your existing software. This seamless integration enhances the workflow and efficiency of your tax preparation. Users can streamline processes and minimize data entry errors.

-

What are the benefits of using airSlate SignNow for the West Virginia Fiduciary Income Tax Return Form?

Using airSlate SignNow provides numerous benefits for handling the West Virginia Fiduciary Income Tax Return Form, including convenience and time savings. The platform allows for quick document preparation and eSigning, which expedites the tax submission process. Additionally, its user-friendly interface reduces the learning curve for new users.

Get more for West Virginia Fiduciary Income Tax Return Form

Find out other West Virginia Fiduciary Income Tax Return Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT