Forms & Instructions State of West Virginia 2020

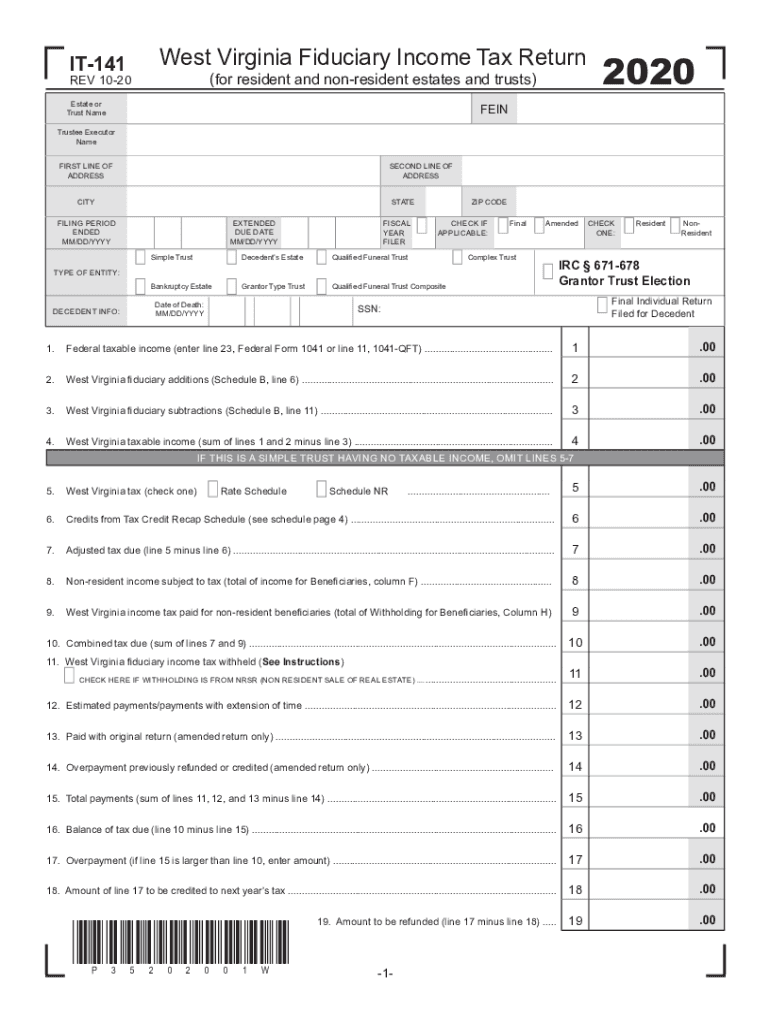

What is the Form IT-141?

The Form IT-141, also known as the West Virginia Fiduciary Income Tax Return, is a tax form used by fiduciaries to report income and calculate tax liabilities for estates and trusts in West Virginia. This form is essential for ensuring compliance with state tax laws and is specifically designed to capture the income generated by the assets held in trust or estate. It includes various sections for reporting different types of income, deductions, and credits applicable to fiduciaries.

Steps to Complete the Form IT-141

Completing the Form IT-141 involves several key steps that ensure accuracy and compliance with West Virginia tax regulations. First, gather all necessary financial documents related to the estate or trust, including income statements, expense records, and previous tax returns. Next, fill out the identification section of the form, providing details such as the fiduciary's name, address, and taxpayer identification number. Following this, report the income earned by the estate or trust, including dividends, interest, and rental income. Be sure to include any applicable deductions and credits, as these can significantly affect the overall tax liability. Finally, review the completed form for accuracy before submitting it to the West Virginia State Tax Department.

Legal Use of the Form IT-141

The Form IT-141 is legally binding when completed and submitted according to West Virginia tax laws. To ensure its validity, the fiduciary must sign the form, affirming that the information provided is accurate and complete. The form must be filed by the due date to avoid penalties. Additionally, it is important to maintain records of all supporting documents for at least three years, as these may be required for audit purposes. Compliance with the legal requirements surrounding the use of Form IT-141 helps protect the fiduciary from potential legal issues and ensures proper tax reporting.

Filing Deadlines for Form IT-141

The filing deadline for the Form IT-141 typically aligns with the federal tax return deadlines. For estates and trusts, the form is generally due on the fifteenth day of the fourth month following the close of the taxable year. For example, if the taxable year ends on December 31, the form must be filed by April 15 of the following year. It is crucial for fiduciaries to be aware of these deadlines to avoid late filing penalties and interest on any taxes owed.

Form Submission Methods

The Form IT-141 can be submitted to the West Virginia State Tax Department through various methods. Fiduciaries have the option to file the form electronically, which is often the most efficient method, allowing for quicker processing and confirmation of receipt. Alternatively, the form can be printed and mailed to the appropriate tax office. When mailing, it is advisable to use a secure method, such as certified mail, to ensure that the form is received by the deadline.

Required Documents for Form IT-141

When completing the Form IT-141, fiduciaries must have several documents on hand to ensure accurate reporting. These documents typically include income statements for the estate or trust, such as bank statements, brokerage statements, and any other records of income received. Additionally, records of expenses related to the management of the estate or trust, such as legal fees and administrative costs, should be collected. Having these documents readily available will facilitate the completion of the form and help ensure compliance with tax regulations.

Quick guide on how to complete forms ampampamp instructions state of west virginia

Complete Forms & Instructions State Of West Virginia effortlessly on any device

Online document management has become popular among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the right template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Forms & Instructions State Of West Virginia on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The easiest way to modify and eSign Forms & Instructions State Of West Virginia seamlessly

- Locate Forms & Instructions State Of West Virginia and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Forms & Instructions State Of West Virginia and ensure excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct forms ampampamp instructions state of west virginia

Create this form in 5 minutes!

How to create an eSignature for the forms ampampamp instructions state of west virginia

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is Formit 141 and how does it relate to airSlate SignNow?

Formit 141 is a specific form type utilized within the airSlate SignNow platform. It allows users to easily manage and streamline their document signing and management processes. By integrating Formit 141, businesses can enhance their efficiency and accuracy in handling electronic documents.

-

How can I integrate Formit 141 into my existing workflows with airSlate SignNow?

Integrating Formit 141 into your existing workflows is straightforward with airSlate SignNow. The platform offers user-friendly tools and templates that allow for seamless document incorporation. You can customize Formit 141 to fit your specific needs and quickly incorporate it into your operations.

-

What are the pricing options for using Formit 141 with airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to Formit 141 features. Pricing is competitive and tailored to cater to businesses of all sizes, ensuring that you find an option that fits your budget. Additionally, you can access a free trial to explore how Formit 141 can benefit your organization.

-

What features does airSlate SignNow provide for Formit 141 users?

airSlate SignNow provides a comprehensive set of features for Formit 141 users, including document templates, eSignature capabilities, and automated workflows. These features help streamline the process of completing and managing Formit 141 documents efficiently. You can also track document status in real time.

-

What are the benefits of using Formit 141 with airSlate SignNow?

Using Formit 141 with airSlate SignNow offers numerous benefits, such as reduced paperwork, enhanced collaboration, and improved document security. This enables organizations to complete transactions faster while minimizing errors associated with manual processes. Overall, Formit 141 enhances productivity and operational efficiency.

-

Can I customize Formit 141 templates in airSlate SignNow?

Yes, you can easily customize Formit 141 templates in airSlate SignNow to meet your specific needs. The platform allows you to modify layout, fields, and branding elements to ensure that the form aligns with your business identity. This flexibility enhances the user experience and compliance.

-

Does airSlate SignNow integrate with other platforms when using Formit 141?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, allowing users to connect Formit 141 with tools they already use. This enables you to automate processes and enhance workflow efficiency, making it easier to manage documents without disruption.

Get more for Forms & Instructions State Of West Virginia

Find out other Forms & Instructions State Of West Virginia

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement